Global Frozen Desserts Market - Key Trends & Drivers Summarized

Frozen desserts, encompassing a wide variety of products such as ice cream, frozen yogurt, gelato, sorbet, and frozen novelties, have become a staple in many diets around the world. These desserts are loved for their refreshing qualities and rich, diverse flavors that cater to a broad range of consumer preferences. Ice cream remains the most popular category, with traditional flavors like vanilla and chocolate being perennial favorites, while innovative flavors and inclusions continue to captivate consumers. Gelato, known for its dense texture and intense flavor, has gained popularity for its artisanal appeal. Frozen yogurt, often perceived as a healthier alternative to ice cream, attracts health-conscious consumers with its lower fat content and probiotic benefits. Sorbets and sherbets, typically made from fruit purees, provide a dairy-free option that appeals to vegans and those with lactose intolerance.Technological advancements and innovative production techniques have significantly enhanced the quality and variety of frozen desserts. Modern freezing technologies, such as continuous freezing and blast freezing, ensure a smoother texture and longer shelf life for these products. Ingredient innovation has also played a crucial role, with the introduction of plant-based and allergen-free ingredients catering to the growing demand for inclusive dietary options. The development of low-calorie sweeteners and fat replacers has enabled manufacturers to create guilt-free indulgences without compromising on taste. Additionally, the use of high-quality, natural ingredients and the trend towards clean label products have resonated well with consumers seeking transparency and authenticity in their food choices. Packaging innovations, such as resealable containers and portion-controlled packs, have further improved the convenience and appeal of frozen desserts.

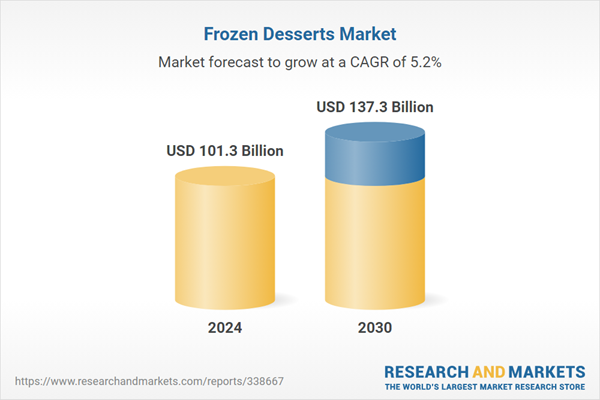

The growth in the frozen desserts market is driven by several factors. The increasing consumer demand for convenient and indulgent food options is a significant driver, as busy lifestyles make ready-to-eat desserts more appealing. The rise in health consciousness and dietary awareness has led to the proliferation of better-for-you options, including low-sugar, low-fat, and plant-based frozen desserts. Technological advancements in freezing and ingredient processing are making it easier for manufacturers to produce high-quality, diverse products that meet evolving consumer preferences. Additionally, the expansion of distribution channels, including online platforms and specialty stores, is enhancing the accessibility of these products to a broader audience. The growing influence of social media and food trends is also shaping consumer preferences and driving innovation in flavors and formats. Together, these factors are fostering a dynamic and expanding market for frozen desserts, presenting significant opportunities for continued innovation and growth.

Report Scope

The report analyzes the Frozen Desserts market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Ice Cream, Confectionary & Candies, Frozen Yogurt, Other Types); Distribution Channel (Supermarket/Hypermarket, Cafe & Bakery Shops, Online, Convenience Stores, Other Distribution Channels).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ice Cream segment, which is expected to reach US$80.2 Billion by 2030 with a CAGR of 5.5%. The Confectionary & Candies segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $32.8 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $23.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Frozen Desserts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Frozen Desserts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Frozen Desserts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Britannia Industries Ltd., Bakoma Sp. z o.o., Bakkavor Group PLC, Ambika Global Foods & Beverages PrivateLimited, Al Safi and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 1246 companies featured in this Frozen Desserts market report include:

- Britannia Industries Ltd.

- Bakoma Sp. z o.o.

- Bakkavor Group PLC

- Ambika Global Foods & Beverages PrivateLimited

- Al Safi

- Baketree Inc.

- Better Than Ice Cream, Inc. (BTIC, Inc.)

- Baixiang Foods Co., Ltd.

- Bagley Argentina SA

- 16 Handles

- Bestway Cash & Carry Limited

- A. Royale & Co.

- ALICO S.r.L.

- Bisignano

- Apricot Technologies Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Britannia Industries Ltd.

- Bakoma Sp. z o.o.

- Bakkavor Group PLC

- Ambika Global Foods & Beverages PrivateLimited

- Al Safi

- Baketree Inc.

- Better Than Ice Cream, Inc. (BTIC, Inc.)

- Baixiang Foods Co., Ltd.

- Bagley Argentina SA

- 16 Handles

- Bestway Cash & Carry Limited

- A. Royale & Co.

- ALICO S.r.L.

- Bisignano

- Apricot Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 1492 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 101.3 Billion |

| Forecasted Market Value ( USD | $ 137.3 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |