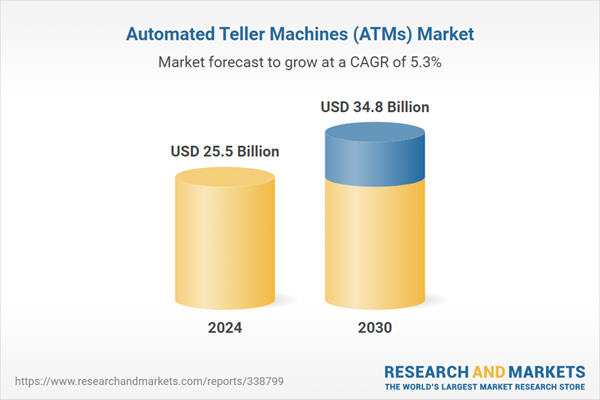

The global market for Automated Teller Machines (ATMs) was valued at US$25.5 Billion in the year 2024, is expected to reach US$34.8 Billion by 2030, growing at a CAGR of 5.3% over the analysis period 2024-2030. 15” & Below Screen Size, one of the segments analyzed in the report, is expected to record a 4.7% CAGR and reach US$23.1 Billion by the end of the analysis period. Growth in the Above 15” Screen Size segment is estimated at 6.4% CAGR over the analysis period.

The U.S. Market is valued at US$6.7 Billion While China is Forecast to Grow at 8.1% CAGR

The Automated Teller Machines (ATMs) market in the U.S. is valued at US$6.7 Billion in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$7.8 Billion by the year 2030 trailing a CAGR of 8.1% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 3.2% and 4.1% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 3.8% CAGR.Automated Teller Machines (ATMs) are electronic banking outlets that allow customers to complete basic transactions without the need for a branch representative or teller. Introduced in the 1960s, ATMs revolutionized the banking industry by providing round-the-clock access to cash withdrawals, deposits, fund transfers, and account information. Over the decades, the functionality of ATMs has expanded significantly, incorporating advanced features like bill payments, mobile top-ups, and even remote video banking. Today, ATMs are ubiquitous in urban and rural areas worldwide, serving as a critical touchpoint in the financial ecosystem for both banks and their customers.

The evolution of ATMs has been marked by technological advancements aimed at enhancing security, user experience, and operational efficiency. Modern ATMs are equipped with sophisticated software that supports biometrics, contactless transactions, and integration with mobile banking apps. Enhanced security features, such as EMV chip technology, encryption, and anti-skimming devices, have been pivotal in safeguarding against fraud and theft. Additionally, the deployment of cash recycling ATMs, which can both dispense and accept cash, has improved the cash management process, reducing operational costs for banks. The introduction of multi-functional ATMs, which offer a broader range of services, has also helped banks manage the declining number of branch visits while maintaining high customer service levels.

The growth in the ATM market is driven by several factors. Technological advancements, such as the integration of artificial intelligence and machine learning, are enabling more personalized and efficient customer interactions. The increasing demand for financial inclusion in developing regions is spurring the installation of ATMs in remote and underserved areas, bridging the gap between rural populations and banking services. Consumer behavior is also a key driver, with a sustained preference for cash transactions in many parts of the world despite the rise of digital payment methods. Furthermore, the expanding functionalities of ATMs, including services like biometric authentication and QR code payments, cater to the evolving needs of tech-savvy consumers. Lastly, regulatory support for ATM deployment and upgrades, particularly in emerging markets, is fostering a favorable environment for market expansion. As a result, the global ATM market is expected to continue its robust growth trajectory in the coming years.

Report Scope

The report analyzes the Automated Teller Machines (ATMs) market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Screen Size (15' & Below, Above 15'); Component (Deployment Solutions, Managed Services); ATM Type (Conventional / Bank, Brown Label, White Label, Cash Dispensers, Smart ATMs).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 15” & Below Screen Size segment, which is expected to reach US$23.1 Billion by 2030 with a CAGR of a 4.7%. The Above 15” Screen Size segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.7 Billion in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $7.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automated Teller Machines (ATMs) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automated Teller Machines (ATMs) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automated Teller Machines (ATMs) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGCO Corporation, Agmatix, Bayer AG, CNH Industrial N.V., Corteva Agriscience and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 292 companies featured in this Automated Teller Machines (ATMs) market report include:

- Automatia Pankkiautomaatit Oy

- Banking Automation Ltd.

- BankUnited

- Banqit AB

- Cashway Technology Co., Ltd.

- Chungho Comnet Co., Ltd.

- Diebold Nixdorf, Inc.

- Eastcom Co., Ltd.

- Euronet Worldwide, Inc.

- First Merit Bank

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Automatia Pankkiautomaatit Oy

- Banking Automation Ltd.

- BankUnited

- Banqit AB

- Cashway Technology Co., Ltd.

- Chungho Comnet Co., Ltd.

- Diebold Nixdorf, Inc.

- Eastcom Co., Ltd.

- Euronet Worldwide, Inc.

- First Merit Bank

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 524 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.5 Billion |

| Forecasted Market Value ( USD | $ 34.8 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |