Global Animal Feed Additives Market - Key Trends & Drivers Summarized

What Are Animal Feed Additives and Why Are They Essential?

Animal feed additives are substances added to livestock feed to improve the nutritional value, enhance growth, ensure animal health, and increase the overall efficiency of food production. These additives include vitamins, amino acids, enzymes, minerals, and probiotics, which play critical roles in the dietary management of farm animals. The primary objective of using feed additives is to promote optimal growth and development, improve feed conversion ratios, and prevent nutritional deficiencies. Additives like antibiotics, which were historically used to prevent disease and promote growth, have seen reduced usage due to rising concerns about antibiotic resistance, leading to the development of alternative solutions like probiotics and prebiotics.How Are Technological Advances Shaping the Use of Feed Additives?

Technological advancements are significantly impacting the animal feed additives industry, driving innovation and enhancing the effectiveness of these products. One key development is the precision formulation of additives, tailored to meet the specific nutritional needs of different animal species and stages of growth. Advanced techniques in biotechnology have led to the creation of enzymes that improve the digestibility of feed ingredients, allowing animals to absorb more nutrients efficiently. Furthermore, the use of nanotechnology in feed additives is being explored to enhance the delivery and bioavailability of nutrients at a cellular level. These innovations ensure that livestock receive optimal nutrition, which in turn supports sustainable farming practices and improves the quality of meat, dairy, and other animal products.What Are the Emerging Trends in the Animal Feed Additives Market?

The animal feed additives market is witnessing several emerging trends that are shaping its future. One significant trend is the shift towards natural and organic additives, driven by consumer demand for organic and non-GMO animal products. This trend has led to increased use of plant-based additives and essential oils, which serve as natural growth promoters and health enhancers. Another trend is the growing emphasis on gut health, with probiotics and prebiotics becoming integral components of animal feed to promote a healthy microbiome and improve immune function. Sustainability is also a key focus, with additives being developed to reduce the environmental impact of livestock farming, such as feed additives that reduce methane emissions in ruminants. Additionally, the rise of functional additives that provide additional benefits, like stress reduction and enhanced reproductive performance, reflects the evolving needs of the industry.What Drives the Growth in the Animal Feed Additives Market?

The growth in the animal feed additives market is driven by several factors, including technological advancements, increasing demand for high-quality animal protein, and regulatory pressures for safer and more sustainable farming practices. Technological innovations, such as the development of precision nutrition and advanced biotechnological applications, are enhancing the effectiveness and efficiency of feed additives. The rising global population and increasing income levels are driving the demand for high-quality meat, dairy, and other animal products, which in turn boosts the need for effective feed additives to ensure optimal livestock productivity. Regulatory bodies are also pushing for reduced antibiotic use in animal farming, promoting the adoption of alternative additives like probiotics and enzymes. Additionally, consumer awareness about animal welfare and sustainability is encouraging the use of natural and organic feed additives. These factors collectively contribute to the robust growth of the animal feed additives market, ensuring it remains a vital component of the global agricultural sector.Report Scope

The report analyzes the Animal Feed Additives market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Amino Acids, Antibiotics / Antibacterials, Vitamins, Other Product Segments); Livestock (Poultry, Swine, Cattle, Other Livestock).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Amino Acids segment, which is expected to reach US$20.7 Billion by 2030 with a CAGR of 5.9%. The Antibiotics / Antibacterials segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.4 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $12.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Animal Feed Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Animal Feed Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Animal Feed Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADDCON GmbH, Adisseo France SAS, Ajinomoto Health & Nutrition North America, Inc., Alltech Inc., Anitox Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 310 companies featured in this Animal Feed Additives market report include:

- ADDCON GmbH

- Adisseo France SAS

- Ajinomoto Health & Nutrition North America, Inc.

- Alltech Inc.

- Anitox Corp.

- Archer Daniels Midland Company

- BASF SE

- Cargill, Inc.

- Chr. Hansen A/S

- CJ CheilJedang Corp.

- DSM-firmenich Animal Nutrition & Health

- Eastman Chemical Company

- Elanco Animal Health

- Evonik Industries AG

- Kemin Industries, Inc.

- Lonza Group Ltd.

- METEX NØØVISTAGO

- Novus International, Inc.

- Nutreco N.V.

- Phibro Animal Health Corporation

- Provimi B.V.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADDCON GmbH

- Adisseo France SAS

- Ajinomoto Health & Nutrition North America, Inc.

- Alltech Inc.

- Anitox Corp.

- Archer Daniels Midland Company

- BASF SE

- Cargill, Inc.

- Chr. Hansen A/S

- CJ CheilJedang Corp.

- DSM-firmenich Animal Nutrition & Health

- Eastman Chemical Company

- Elanco Animal Health

- Evonik Industries AG

- Kemin Industries, Inc.

- Lonza Group Ltd.

- METEX NØØVISTAGO

- Novus International, Inc.

- Nutreco N.V.

- Phibro Animal Health Corporation

- Provimi B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 514 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

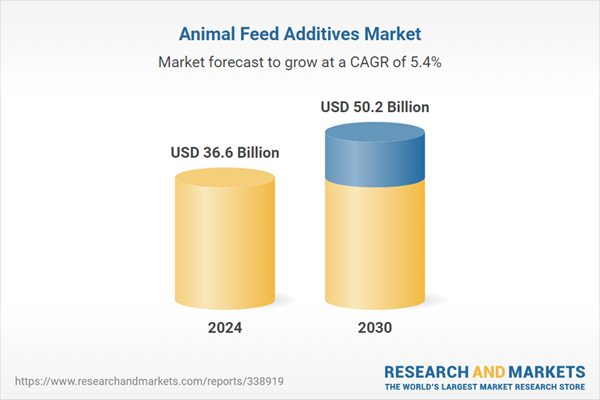

| Estimated Market Value ( USD | $ 36.6 Billion |

| Forecasted Market Value ( USD | $ 50.2 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |