Global Functional Foods and Drinks Market - Key Trends & Drivers Summarized

Functional foods and drinks are designed to provide additional health benefits beyond basic nutrition, often containing ingredients that promote specific physiological functions or reduce the risk of disease. These products include fortified foods, dietary supplements, probiotics, prebiotics, and beverages enriched with vitamins, minerals, antioxidants, and other bioactive compounds. Examples of functional foods and drinks include probiotic yogurt, which supports digestive health; fortified cereals with added vitamins and minerals; and beverages infused with herbs like turmeric or ginseng, known for their anti-inflammatory and immune-boosting properties. The concept of functional foods and drinks has gained significant traction as consumers become more health-conscious and seek to prevent health issues through diet rather than just treating them with medications.The growth in the functional foods and drinks market is driven by several factors. Rising health awareness among consumers is a primary driver, as more people seek to improve their overall well-being and prevent chronic diseases through diet. The increasing prevalence of lifestyle-related health issues, such as obesity, diabetes, and cardiovascular diseases, has also spurred demand for functional products that offer specific health benefits. The aging population is another significant factor, with older adults looking for ways to maintain health and vitality. Additionally, the expanding research into the gut microbiome and its impact on health has highlighted the importance of probiotics and prebiotics, boosting their inclusion in functional foods and drinks. Regulatory support and favorable policies promoting health and wellness have encouraged the development and marketing of these products. Furthermore, the rise of e-commerce and digital marketing has made functional foods and drinks more accessible to a broader audience, contributing to the market's robust growth. These factors collectively underscore the dynamic and expanding nature of the functional foods and drinks market, reflecting its critical role in contemporary health and nutrition strategies.

Technological advancements and scientific research have significantly contributed to the development and popularity of functional foods and drinks. Enhanced processing techniques, such as microencapsulation, ensure the stability and bioavailability of active ingredients, allowing them to retain their efficacy until consumed. Biotechnology has enabled the fortification of foods with essential nutrients and the enhancement of naturally occurring compounds, improving their health benefits. Additionally, advancements in packaging technology have extended the shelf life of functional foods and drinks, maintaining their nutritional value over time. Scientific studies and clinical trials have provided evidence supporting the health claims of these products, further boosting consumer confidence and market growth. Moreover, personalized nutrition, driven by genetic testing and biomarkers, is emerging as a significant trend, allowing for the customization of functional foods and drinks to meet individual health needs.

Report Scope

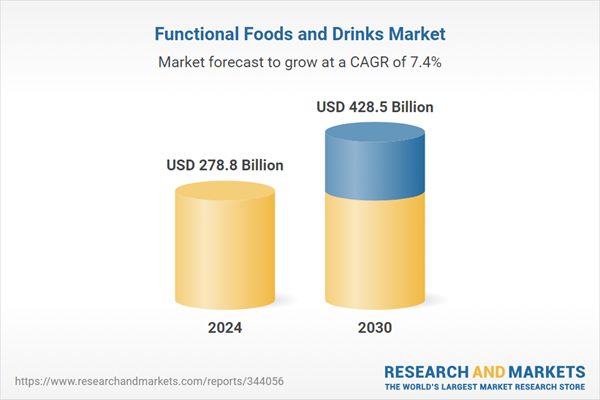

The report analyzes the Functional Foods and Drinks market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Beverages, Dairy Products, Cereals & Grains, Snacks, Other Types); Ingredient (Dietary Fibers, Vitamins, Minerals, Carotenoids, Fatty Acids, Prebiotics & Probiotics, Other Ingredients).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Functional Beverages segment, which is expected to reach US$180.3 Billion by 2030 with a CAGR of 8.2%. The Functional Dairy Products segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $84.9 Billion in 2024, and China, forecasted to grow at an impressive 9.5% CAGR to reach $62.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Functional Foods and Drinks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Functional Foods and Drinks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Functional Foods and Drinks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Nutrition, ABF Ingredients, Amway Corporation, Archer Daniels Midland Company, Arla Foods amba and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 306 companies featured in this Functional Foods and Drinks market report include:

- Abbott Nutrition

- ABF Ingredients

- Amway Corporation

- Archer Daniels Midland Company

- Arla Foods amba

- BASF SE

- Ceapro, Inc.

- Celsius Holdings, Inc.

- Coca-Cola Co.

- Dali Foods Group Co., Ltd.

- Danone SA

- Del Monte Pacific Limited (DMPL)

- Dymatize Enterprises, LLC

- General Mills, Inc.

- Glanbia Nutritionals Limited

- Glanbia Plc

- GNC Holdings, LLC

- Herbalife International, Inc.

- Kellogg Company

- Keurig Dr Pepper

- MaxiNutrition

- Meiji Holdings Co., Ltd.

- Monster Beverage Corporation

- Natural Products, Inc.

- Nestlé S.A.

- Novozymes A/S

- Otsuka Pharmaceutical Co., Ltd.

- PepsiCo Inc.

- Post Holdings, Inc.

- Rockstar Inc.

- Royal FrieslandCampina N.V.

- Suntory Holdings Limited

- TC Pharmaceutical Industries Co., Ltd.

- The Hain Celestial Group, Inc.

- The Quaker Oats Company, Inc.

- Unilever plc

- Valio Ltd.

- Yakult Honsha Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Nutrition

- ABF Ingredients

- Amway Corporation

- Archer Daniels Midland Company

- Arla Foods amba

- BASF SE

- Ceapro, Inc.

- Celsius Holdings, Inc.

- Coca-Cola Co.

- Dali Foods Group Co., Ltd.

- Danone SA

- Del Monte Pacific Limited (DMPL)

- Dymatize Enterprises, LLC

- General Mills, Inc.

- Glanbia Nutritionals Limited

- Glanbia Plc

- GNC Holdings, LLC

- Herbalife International, Inc.

- Kellogg Company

- Keurig Dr Pepper

- MaxiNutrition

- Meiji Holdings Co., Ltd.

- Monster Beverage Corporation

- Natural Products, Inc.

- Nestlé S.A.

- Novozymes A/S

- Otsuka Pharmaceutical Co., Ltd.

- PepsiCo Inc.

- Post Holdings, Inc.

- Rockstar Inc.

- Royal FrieslandCampina N.V.

- Suntory Holdings Limited

- TC Pharmaceutical Industries Co., Ltd.

- The Hain Celestial Group, Inc.

- The Quaker Oats Company, Inc.

- Unilever plc

- Valio Ltd.

- Yakult Honsha Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 768 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 278.8 Billion |

| Forecasted Market Value ( USD | $ 428.5 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |