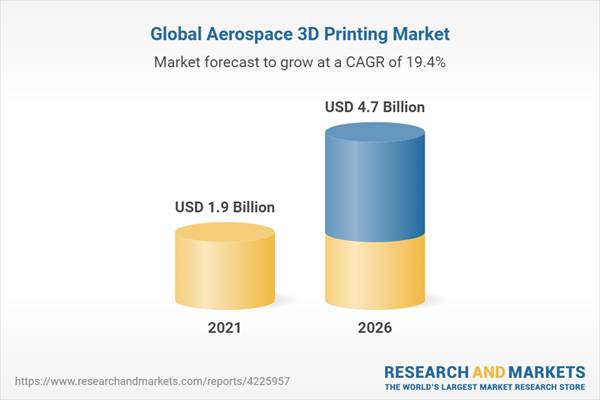

The global market for aerospace 3D printing is estimated to be USD 1.9 billion in 2021 and is projected to reach USD 4.7 billion by 2026, at a CAGR of 19.4% during the forecast period. The demand for aerospace 3D printing is projected to be driven by the low volume production of aircraft components in the aerospace industry, rising demand for lightweight components, the need to reduce the production time of components, and the requirement for cost-efficient and sustainable products. The requirement for rapid prototyping is expected to fuel the growth of the aerospace 3D printing market during the forecast period.

COVID-19 has affected almost every industry, especially aerospace. The immediate drop in the demand to manufacture aircraft and disruptions in raw materials have adversely affected the industry. Limitations in cross-border movements, disruptions in manufacturing and transportation, constrained supply chains triggering supply delays, and massive slowdowns in production over the first quarter of 2020 have also affected the industry.

In commercial aviation, companies are experiencing disruptions in production and a slump in demand due to the lack of laborers, less travel by passengers, and customers postponing the delivery of new aircraft. Demand for spare parts is also down as less maintenance is required. According to the Boeing 2019 Q2 report, the revenues for the first half (H1) 2019 vs. H1 2018 were down 19% and commercial aircraft deliveries for the same time were down 37%.

The printer segment is expected to dominate the segment in the initial years of the forecasted period. The service segment is expected to lead the market by 2026 over the printer segment. The need for cost-efficient custom printing and manufacturing would be one of the factors leading to the growth of the segment. Most companies would outsource additively manufactured parts to 3D printing companies and need extensive after-sales service once the demand for 3D printed parts increases. These factors would lead to the growth of the service segment in the market.

The Material Extrusion or Fusion Deposition Modeling (FDM) segment is projected to witness the highest CAGR during the forecast period.

Based on technology, the Material Extrusion or Fusion Deposition Modeling (FDM) segment is expected to dominate the aerospace 3D printing market. The extrusion process is fast and efficient at producing large volumes of continuous shapes in varying lengths with minimum wastage. The ability to manufacture complex shapes with varying thickness, textures, and colors is a major advantage of this process.

The Aircraft Segment is projected to witness the highest CAGR during the forecast period.

Based on platform, The aircraft segment is projected to dominate the aerospace 3D printing market, by platform, during the forecast period. The maximum number of developments would occur on an aircraft. The need for lightweight, cost-efficient aircraft and the need for fast manufacturing of complex parts would drive the adoption of 3D printers in aircraft manufacturing.

The engine component segment is projected to witness the highest market share during the forecast period

Based on the end products, the engine components segment is witnessing the highest market share for the aerospace 3D printing market during the forecast period. Ease of designing, improved strength, lightweight, and durability of the components manufactured, as well as their cost-effectiveness, contribute to the growth of end products

The functional parts is projected to witness the highest CAGR during the forecast period

Based on application, The prototyping segment is projected to lead the aerospace 3D printing market from 2021 to 2026. However, the functional parts segment is expected to grow at the largest CAGR during the forecast period. The growth of the functional parts segment can be attributed to the advancements in 3D printing technology and the increasing adoption of 3D printers into manufacturing processes across industries.

The North American market is projected to contribute the largest share from 2021 to 2026

The North American region is estimated to account for the largest share of 47.7% of the global aerospace 3D printing market in 2021. It is projected to record a CAGR of 18.6% during the forecast period, driven by the increasing adoption of 3D printing technology for manufacturing complex 3D components that are light in weight. Moreover, manufacturers of aircraft components and aircraft are switching to 3D printing technology to produce low-volume parts, thus fueling the growth of the aerospace 3D printing market.

Breakdown of primaries The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs.

The break-up of the primaries is as follows:

- By Company Type: Tier 1-49%; Tier 2-37%; and Tier 3-14%

- By Designation: C Level-55%; Directors-27%; and Others-18%

- By Region: North America-55%; Europe-27%; Asia Pacific-9%; and Rest of the World-9%

The aerospace 3D printing market is dominated by a few globally established players such as Stratasys Ltd. (U.S.), 3D Systems Corporation (U.S.), EOS GmbH (Germany), Norsk Titanium AS (Norway), Ultimaker B.V. (Netherlands), and EnvisionTec GmbH (Germany), Research Coverage

The study covers the aerospace 3D printing market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on offerings, technology, platform, end user, end product, application, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Aerospace 3D Printing Market and its segments. This study is also expected to provide region wise information about the end use, and wherein Aerospace 3D printers are used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

Figure 1 Aerospace 3D Printing Market Segmentation

1.4 Inclusions and Exclusions

Table 1 Inclusions and Exclusions in Aerospace 3D Printing Market

1.5 Years Considered for the Study

1.6 Currency & Pricing

1.7 Limitations

1.8 Market Stakeholders

1.9 Summary of Changes

Figure 2 Aerospace 3D Printing Market to Grow Faster Than Previous Estimates

2 Research Methodology

2.1 Research Data

Figure 3 Report Process Flow

Figure 4 Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Primary Insights

2.2 Market Size Estimation

2.2.1 Segments and Subsegments

2.3 Research Approach & Methodology

2.3.1 Bottom-Up Approach

2.3.1.1 Market Size Estimation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach (Demand Side & Supply Side)

2.3.2 Top-Down Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

2.4 Triangulation & Validation

Figure 7 Data Triangulation

2.4.1 Triangulation Through Primary and Secondary Research

2.5 Growth Rate Factors

2.6 Risks

2.7 Research Assumptions

3 Executive Summary

Figure 8 Printers Segment to Dominate Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Figure 9 Fdm Segment to Lead Aerospace 3D Printing Market, by Technology, 2021-2026 (USD Million)

Figure 10 Aircraft Segment to Command Largest Share, by Platform, 2021-2026 (USD Million)

Figure 11 North America to Lead Aerospace 3D Printing Market, 2021-2026

4 Premium Insights

4.1 Attractive Growth Opportunities in the Aerospace 3D Printing Market

Figure 12 Faster Manufacturing of Complex Designs and Low Wastage Drive Market, 2O21-2026

4.2 Aerospace 3D Printing Market, by Offering

Figure 13 Service Segment Projected to Lead Market, 2021-2026

4.3 Aerospace 3D Printing Market, by Application

Figure 14 Functional Parts to Dominate Market, 2021-2026

4.4 Aerospace 3D Printing Market, by End Product

Figure 15 Engine Components to Lead Product Market, 2021-2026

4.5 Aerospace 3D Printing Market, by End-user

Figure 16 Oem Segment Projected to Dominate Market, 2021-2026

4.6 Aerospace 3D Printing Market, by Top Countries

Figure 17 Highest CAGR Projected in Japanese Aerospace 3D Printing Market, 2021-2026

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 18 Aerospace 3D Printing Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Short Supply Chain of Aerospace Components

5.2.1.2 Demand for Lightweight Parts and Components from Aerospace Industry

5.2.1.3 Aerospace 3D Printing Technologies to Manufacture Complex Aerospace Parts

5.2.1.4 Need for Low Volume Production from Aerospace Industry

5.2.2 Restraints

5.2.2.1 Limited Types of Raw Materials for 3D Printing

5.2.2.2 Stringent Industry Certifications

5.2.3 Opportunities

5.2.3.1 Development of Advanced 3D Printing Technologies Requiring Less Production Time

Figure 19 Clip Vs. Other 3D Printing Technologies

5.2.3.2 3D Printing as a Service

5.2.4 Challenges

5.2.4.1 High Volume Production of Aerospace Components is Slower as Compared to Traditional Manufacturing

5.2.4.2 Ensuring Product Quality

5.2.4.3 Threat of Copyright Infringement

5.3 Impact of COVID 19 on Aerospace 3D Printing

5.4 Range and Scenarios

5.5 Technology Trends

5.5.1 Shift Toward Service Providers for Functional Parts

5.5.2 Entry of Printing Giants into the Aerospace 3D Printing Market

5.5.3 Large Scale Aerospace 3D Printing

5.6 Aerospace 3D Printing Market Ecosystem

5.6.1 Prominent Companies

5.6.2 Private and Small Enterprises

5.6.3 End-users

5.6.4 After Sale Service Providers

Figure 20 Aerospace 3D Printing Market Ecosystem

Table 2 Aerospace 3D Printing Market Ecosystem

5.7 Disruption Impacting Customer Businesses

Figure 21 Aerospace 3D Printing Market Ecosystem

5.8 Value Chain Analysis

Figure 22 Value Chain Analysis of Aerospace 3D Printing Ecosystem

5.8.1 Research & Development

5.8.2 Material & Software Players

5.8.3 Manufacturing

5.8.4 Service Provider

5.8.5 End-users

5.8.6 After-Sale Service

5.9 Case Study Analysis

5.9.1 Boom Supersonic Uses 3D Printed Parts in Its Commercial Aircraft

5.9.2 Trumpf Uses 3D Printing for Satellite & Aircraft Production

5.9.3 Utc Aerospace 3D Printing

5.9.4 Dlr (German Space Agency) Incorporating Additive Manufacturing to Optimize Fluid Dynamics

5.9.5 Astrobotic Uses 3D Printing for Lunar and Space Applications

5.10 Trade Data Analysis

Table 3 Imports Data for Hs Code 8443, by Country, 2016-2020 (USD Billion)

Table 4 Exports Data for Hs Code 8443, by Country, 2016-2020 (USD Billion)

5.11 Porter's Five Forces Analysis

Figure 23 Porter's Five Forces Analysis

Table 5 Porter's Five Forces Impact on the Aerospace 3D Printing Market

5.11.1 Threat of New Entrants

5.11.2 Threat of Substitutes

5.11.3 Bargaining Power of Suppliers

5.11.4 Bargaining Power of Buyers

5.11.5 Competitive Rivalry in Industry

5.12 Tariff and Regulatory Landscape

5.12.1 Sae Standards

6 Industry Trends

6.1 Introduction

6.2 Emerging Trends

6.2.1 3D Printing in Space Exploration Missions

6.2.2 Innovations in Materials Used for 3D Printing

6.2.3 Innovation in 3D Printing Technologies

6.2.4 4D Printing

6.2.5 Artificial Intelligence

6.3 Innovations & Patent Registrations

Table 6 Innovations & Patent Registrations

6.4 Impact of Megatrends

7 Aerospace 3D Printing Market, by Offering

7.1 Introduction

Figure 24 Services Segment Projected to Lead Market During Forecast Period

Table 7 Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 8 Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

7.2 Printers

Figure 25 Desktop Printer Segment Projected to Grow at Higher CAGR During Forecast Period

Table 9 Aerospace 3D Printer Market, by Type, 2017-2020 (USD Million)

Table 10 Aerospace 3D Printer Market, by Type, 2021-2026 (USD Million)

7.2.1 Desktop Printers

7.2.1.1 Increased Use in Designing and Prototyping in Aerospace Industry Will Drive this Segment

7.2.2 Industrial Printers

7.2.2.1 Industrial Printers are Used to Generate Concept Models, Precision and Functional Prototypes, Master Patterns and Molds for Tooling, and Real End-Use Parts

7.3 Materials

Figure 26 Plastic Segment Projected to Grow at Highest CAGR During Forecast Period

Table 11 Aerospace 3D Printing Materials Market, by Type, 2017-2020 (USD Million)

Table 12 Aerospace 3D Printing Materials Market, by Type, 2021-2026 (USD Million)

7.3.1 Titanium

7.3.1.1 Titanium Powder is Sintered Together by a Laser to Produce End-Use Metal Parts That are as Good as Machined Models

7.3.2 Steel

7.3.2.1 Steel Provides a Significant Level of Strengthening to the 3D Printed Model

7.3.3 Aluminum

7.3.3.1 Alumide is Commonly Used to Build Complex, Small Series, and Functional Models

7.3.4 Nickel

7.3.4.1 Growth is Driven by the Rising Adoption of 3D Printing in the Aerospace & Defense Industry

7.3.5 Plastic

7.3.5.1 Plastics are Used Either in Powdered or Filament Forms for Prototyping and Printing

7.3.6 Ceramic

7.3.6.1 Versatile Physical Properties of Ceramics Allow Them to be Used Across Applications

7.3.7 Others

7.3.7.1 Ability to Withstand Heat and Corrosion Along with the Capability of Creating Complex Designs to Drive the Segment

7.4 Software

Figure 27 Printing Segment Projected to Lead Market for Aerospace 3D Printing Software During Forecast Period

Table 13 Aerospace 3D Printing Software Market, by Type, 2017-2020 (USD Million)

Table 14 Aerospace 3D Printing Software Market, by Type, 2021-2026 (USD Million)

7.4.1 Design

7.4.1.1 Design Software is Used to Create Drawings of Parts and Assemblies

7.4.2 Inspection

7.4.2.1 Inspection Software is Developed to Inspect Prototypes to Ensure Their Compliance with Required Specifications

7.4.3 Printing

7.4.3.1 Printing Software Includes Tools to Ensure Precision with the Functioning of Printers

7.4.4 Scanning

7.4.4.1 Scanning Software Allows Users to Scan Physical Objects and Create Digital Models or Designs

7.5 Services

Figure 28 Custom Design & Manufacturing Segment Projected to Lead Market for Aerospace 3D Printing Services During Forecast Period

Table 15 Aerospace 3D Printing Services Market, by Type, 2017-2020 (USD Million)

Table 16 Aerospace 3D Printing Services Market, by Type, 2021-2026 (USD Million)

7.5.1 Custom Design & Manufacturing

7.5.1.1 Requirements for Complex Custom Designs to Drive this Segment

7.5.2 After-Sales

7.5.2.1 Increasing Demand for 3D Printers to Drive the Need for Aftersales Services

8 Aerospace 3D Printing Market, by Technology

8.1 Introduction

Figure 29 Material Extrusion Segment is Projected to Lead Market During Forecast Period

Table 17 Aerospace 3D Printing Market, by Technology, 2017-2020 (USD Million)

Table 18 Aerospace 3D Printing Market, by Technology, 2021-2026 (USD Million)

8.2 Polymerization

8.2.1 High-Quality Surface Finish Makes Polymerization Ideal for Concept Models, Form and Fit Studies, and Investment Casting Patterns

8.3 Powder Bed Fusion

8.3.1 Use of Powder Bed Fusion Does Not Require Support for Materials and Produce High-Density Parts with Relatively Good Mechanical Properties

8.4 Material Extrusion

8.4.1 a Clean, Simple-To-Use, and Office-Friendly 3D Printing Technology

8.5 Others

8.5.1 Other Technologies are Used to Develop Highly Accurate Models with Intricate Details and Complex Geometries

9 Aerospace 3D Printing Market, by Platform

9.1 Introduction

Figure 30 Aircraft Segment Projected to Lead Aerospace 3D Printing Market During Forecast Period

Table 19 Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 20 Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

9.2 Aircraft

9.2.1 Usage of 3D Printing to Manufacture Aircraft Parts Results in Shorter Production Time, Elimination of Additional Tools, and Higher Cost-Efficiency

9.3 Uavs

9.3.1 Use of 3D Printing Capabilities Makes It Possible to Manufacture Uavs for Beyond Military Use

9.4 Spacecraft

9.4.1 Aerospace 3D Printing Used to Manufacture Rocket Components

10 Aerospace 3D Printing Market, by End Product

10.1 Introduction

Figure 31 Engine Components Segment Projected to Lead Aerospace 3D Printing Market During Forecast Period

Table 21 Aerospace 3D Printing Market, by End Product, 2017-2020 (USD Million)

Table 22 Aerospace 3D Printing Market, by End Product, 2021-2026 (USD Million)

10.2 Engine Components

10.2.1 3D Printed Engine Components are Increasingly Used for Efficiency and Reduce Weight

10.3 Structural Components

10.3.1 Use of Advanced Materials in Structural Components Reduces Their Cost and Weight

10.4 Others

10.4.1 Increasing Usage of 3D Printed Components in Spacecraft and Hypersonics Will Drive this Segment

11 Aerospace 3D Printing Market, by Application

11.1 Introduction

Figure 32 Functional Parts Segment Expected to Grow at Highest CAGR During Forecast Period

Table 23 Aerospace 3D Printing Market, by Application, 2017-2020 (USD Million)

Table 24 Aerospace 3D Printing Market, by Application, 2021-2026 (USD Million)

11.2 Prototyping

11.2.1 Increasing Usage of 3D Printing for Prototyping as It Enables Quick Production and Cost-Effective Prototypes

11.3 Tooling

11.3.1 Increasing Use of 3D Printing for Creating Comlex Design Tool Molds to Help the Mass Production of These Tools Through Conventional Manufacturing

11.4 Functional Parts

11.4.1 Increasing Use of 3D Printers to Manufacture Functional Parts as They Have the Ability to Produce Complex Design and Defined Aerodynamic Properties

12 Aerospace 3D Printing Market, by End-user

12.1 Introduction

Figure 33 Oem Segment Projected to Lead Aerospace 3D Printing Market During Forecast Period

Table 25 Aerospace 3D Printing Market, by End-user, 2017-2020 (USD Million)

Table 26 Aerospace 3D Printing Market, by End-user, 2021-2026 (USD Million)

12.2 Oem

12.2.1 Oems Adopts 3D Printing to Achieve Lightweight High Complex Designs, Reduce Lead Time & Increase Aircraft's Efficiency

12.3 Mro

12.3.1 3D Printing Used in Large Military Aircraft Parts, Turbine Blades, and Other Equipment Will Drive this Segment

13 Regional Analysis

13.1 Introduction

Figure 34 North America Estimated to Hold Largest Share of Aerospace 3D Printing Market in 2021

Table 27 Aerospace 3D Printing Market, by Region, 2017-2020 (USD Million)

Table 28 Aerospace 3D Printing Market, by Region, 2021-2026 (USD Million)

13.2 North America

Figure 35 North America Aerospace 3D Printing Market Snapshot

13.2.1 PESTLE Analysis: North America

Table 29 North America: Aerospace 3D Printing Market, by Country, 2017-2020 (USD Million)

Table 30 North America: Aerospace 3D Printing Market, by Country, 2021-2026 (USD Million)

Table 31 North America: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 32 North America: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 33 North America: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 34 North America: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.2.2 US

13.2.2.1 Presence of Major Players Drive Market in the US

Table 35 US: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 36 US: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 37 US: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 38 US: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.2.3 Canada

13.2.3.1 Increased Developments in 3D Printing Undertaken by Players Expected to Fuel Market

Table 39 Canada: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 40 Canada: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 41 Canada: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 42 Canada: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.3 Europe

Figure 36 Europe Aerospace 3D Printing Market Snapshot

13.3.1 PESTLE Analysis: Europe

Table 43 Europe: Aerospace 3D Printing Market, by Country, 2017-2020 (USD Million)

Table 44 Europe: Aerospace 3D Printing Market, by Country, 2021-2026 (USD Million)

Table 45 Europe Aerospace 3D Printing Market Size, by Offering, 2017-2020 (USD Million)

Table 46 Europe: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 47 Europe: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 48 Europe Aerospace 3D Printing Market Size, by Platform, 2021-2026 (USD Million)

13.3.2 Germany

13.3.2.1 Supplying and Manufacturing Engine Parts for Aerospace Companies

Table 49 Germany: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 50 Germany: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 51 Germany: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 52 Germany: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.3.3 UK

13.3.3.1 Acquaintances and Collaborations for Aerospace 3D Printed Parts

Table 53 UK: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 54 UK: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 55 UK: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 56 UK: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.3.4 France

13.3.4.1 Oems Such as Airbus and Safran Investing in Advanced 3D Printing Solutions Propel the Market in France

Table 57 France: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 58 France: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 59 France: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 60 France: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.3.5 Italy

13.3.5.1 Developments Undertaken by Players Operating in Italy to Drive the Market

Table 61 Italy: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 62 Italy: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

Table 63 Italy: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 64 Italy: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

13.3.6 Russia

13.3.6.1 Increasing Government Investments into 3D Printing Technologies Fueling Growth of the Market

Table 65 Russia: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 66 Russia: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 67 Russia: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 68 Russia: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.3.7 Rest of Europe

13.3.7.1 Increasing Adoption of 3D Printing Solutions in Military Applications and Mro Services Drive the Market in this Region

Table 69 Rest of Europe: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 70 Rest of Europe: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 71 Rest of Europe: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 72 Rest of Europe: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.4 Asia-Pacific (Apac)

Figure 37 APAC Aerospace 3D Printing Market Snapshot

13.4.1 PESTLE Analysis: Asia-Pacific

Table 73 APAC: Aerospace 3D Printing Market, by Country, 2017-2020 (USD Million)

Table 74 APAC: Aerospace 3D Printing Market, by Country, 2021-2026 (USD Million)

Table 75 APAC: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 76 APAC: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

Table 77 APAC: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 78 APAC: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

13.4.2 China

13.4.2.1 Advancements in 3D Printing Technology Will Fuel the Market

Table 79 China: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 80 China Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 81 China: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 82 China: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.4.3 Japan

13.4.3.1 Increased Use of 3D Printing to Manufacture Satellite Engines Will Drive the Market

Table 83 Japan: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 84 Japan: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 85 Japan Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 86 Japan: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.4.4 India

13.4.4.1 Strategic Collaborations Between 3D Printing Service Providers in the Country to Drive Market

Table 87 India: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 88 India: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 89 India: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 90 India: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.4.5 South Korea

13.4.5.1 Advancements in 3D Printing Propel the Market

Table 91 South Korea: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 92 South Korea: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 93 South Korea: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 94 South Korea: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.4.6 Australia

13.4.6.1 Increased Investments to Adopt 3D Printing Solutions for Aerospace Applications Fuel the Market

Table 95 Australia: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 96 Australia: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 97 Australia Aerospace 3D Printing Market Size, by Platform, 2017-2020 (USD Million)

Table 98 Australia: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.4.7 Rest of APAC

13.4.7.1 Emergence of Startups is Boosting the Aerospace 3D Printing Market in the Region

Table 99 Rest of APAC: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 100 Rest of APAC: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 101 Rest of APAC: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 102 Rest of APAC: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.5 Rest of the World (Row)

Figure 38 RoW: Aerospace 3D Printing Market Snapshot

Table 103 RoW: Aerospace 3D Printing Market, by Region, 2017-2020 (USD Million)

Table 104 RoW: Aerospace 3D Printing Market, by Region, 2021-2026 (USD Million)

Table 105 RoW: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 106 RoW: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 107 RoW: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 108 RoW: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.5.1 Latin America

13.5.1.1 Increasing Use of 3D Printing in Space and Military Applications Will Drive the Market

Table 109 Latin America: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 110 Latin America: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 111 Latin America: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 112 Latin America: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.5.2 Middle East

13.5.2.1 Presence of Key Aerospace 3D Printing Solution Providers to Drive the Market in this Region

Table 113 Middle East: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 114 Middle East: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 115 Middle East: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 116 Middle East: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

13.5.3 Africa

13.5.3.1 Increasing Investments in 3D Printing Technology Propel the Market in this Region

Table 117 Africa: Aerospace 3D Printing Market, by Offering, 2017-2020 (USD Million)

Table 118 Africa: Aerospace 3D Printing Market, by Offering, 2021-2026 (USD Million)

Table 119 Africa: Aerospace 3D Printing Market, by Platform, 2017-2020 (USD Million)

Table 120 Africa: Aerospace 3D Printing Market, by Platform, 2021-2026 (USD Million)

14 Competitive Landscape

14.1 Introduction

14.2 Market Share Analysis, 2020

Table 121 Degree of Competition

Figure 39 Market Share of Top Players in the Aerospace 3D Printing Market, 2020 (%)

14.3 Revenue Analysis of Top 5 Market Players, 2020

14.4 Company Evaluation Quadrant

14.4.1 Star

14.4.2 Emerging Leaders

14.4.3 Pervasive

14.4.4 Participant

Figure 40 Aerospace 3D Printing Market Competitive Leadership Mapping, 2020

14.5 Startup Evaluation Quadrant

14.5.1 Progressive Companies

14.5.2 Responsive Companies

14.5.3 Dynamic Companies

14.5.4 Starting Blocks

Figure 41 Aerospace 3D Printing Market Startups/Sme Competitive Leadership Mapping, 2020

Table 122 Company Product Footprint

Table 123 Company Footprint by Offerings

Table 124 Company Footprint by Platform

Table 125 Company Region Footprint

14.6 Competitive Scenario

14.6.1 Deals

Table 126 Deals, 2017-2021

14.6.2 Product Launches

Table 127 Product Launches, 2017-2021

14.6.3 Others

Table 128 Others, 2017-2021

15 Company Profiles

(Business Overview, Products Offered, Recent Developments, Analyst's View Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats) *

15.1 Key Players

15.1.1 Stratasys Ltd.

Table 129 Stratasys Ltd.: Business Overview

Figure 42 Stratasys Ltd.: Company Snapshot

Table 130 Stratasys Ltd.: Products/Solutions/Services Offered

Table 131 Stratasys: Product Launches

Table 132 Stratasys: Deals

15.1.2 3D Systems, Inc.

Table 133 3D Systems, Inc.: Business Overview

Figure 43 3D Systems, Inc.: Company Snapshot

Table 134 3D Systems, Inc.: Products/Solutions/Services Offered

Table 135 3D Systems, Inc.: New Product Developments

Table 136 3D Systems, Inc.: Deals

15.1.3 GE Additive

Table 137 GE Additive: Business Overview

Table 138 GE Additive: Products/Solutions/Services Offered

Table 139 GE Additive: Product Launches

Table 140 GE Additive: Deals

Table 141 GE Additive: Others

15.1.4 Eos GmbH

Table 142 Eos GmbH: Business Overview

Figure 44 Eos GmbH: Company Snapshot

Table 143 Eos GmbH: Product/Solutions/Services Offerings

15.1.5 Materialise Nv

Table 144 Materialise Nv: Business Overview

Figure 45 Materialise Nv: Company Snapshot

Table 145 Embraer Sa: Products/Solutions/Services Offered

Table 146 Materialise Nv: Deals

15.1.6 Renishaw plc

Table 147 Renishaw plc: Business Overview

Figure 46 Renishaw plc: Company Snapshot

Table 148 Renishaw plc: Products/Solutions/Services Offered

15.1.7 Trumpf

Table 149 Trumpf: Business Overview

Figure 47 Trumpf: Company Snapshot

Table 150 Trumpf: Products/Solutions/Services Offered

15.1.8 Norsk Titanium

Table 151 Norsk Titanium: Business Overview

Figure 48 Norsk Titanium: Company Snapshot

Table 152 Norsk Titanium: Products/Solutions/Services Offered

Table 153 Norsk Titanium: Deals

15.1.9 Oc Oerlikon Management Ag

Table 154 Oc Oerlikon Management AG : Business Overview

Figure 49 Oc Oerlikon Management Ag: Company Snapshot

Table 155 Oc Oerlikon Management Ag: Products/Solutions/Services Offered

Table 156 Oc Oerlikon Management Ag: Deals

15.1.10 Ultimaker Bv

Table 157 Ultimaker Bv: Business Overview

Table 158 Ultimaker Bv: Products/Solutions/Services Offered

Table 159 Ultimaker Bv: Deals

15.1.11 Höganäs Ab

Table 160 Höganäs Ab: Business Overview

Table 161 Höganäs Ab: Products/Solutions/Services Offered

15.1.12 Markforged

Table 162 Markforged: Business Overview

Table 163 Markforged: Products/Solutions/Services Offered

Table 164 Markforged: Deals

15.1.13 Slm Solutions

Table 165 Slm Solutions Business Overview

Figure 50 Slm Solutions: Company Snapshot

Table 166 Slm Solutions: Products/Solutions/Services Offered

15.1.14 Voxeljet

Table 167 Voxeljet: Business Overview

Figure 51 Voxeljet: Company Snapshot

Table 168 Voxeljet: Products/Solutions/Services Offered

15.1.15 Prodways

Table 169 Prodways: Business Overview

Figure 52 Prodways : Company Snapshot

Table 170 Prodways: Products/Solutions/Services Offered

Table 171 Prodways: Deals

15.1.16 Nano Dimension

Table 172 Nano Dimension: Business Overview

Figure 53 Nano Dimension: Company Snapshot

Table 173 Vertical Aerospace Group Ltd.: Products/Solutions/Services Offered

15.2 Other Players

15.2.1 Moog Inc

Table 174 Moog Inc: Company Overview

15.2.2 Protolabs

Table 175 Protolabs: Company Overview

15.2.3 Shapeways

Table 176 Shapeways: Company Overview

15.2.4 St Engineering

Table 177 Delorean Aerospace: Company Overview

15.2.5 Fit Ag

Table 178 Fit Ag: Company Overview

15.2.6 Zortrax

Table 179 Zortrax: Company Overview

15.2.7 Javelin Technologies

Table 180 Javelin Technologies: Company Overview

15.2.8 Envisiontec, Inc.

Table 181 Envisiontec, Inc.: Company Overview

15.2.9 Essentium, Inc.

Table 182 Essentium, Inc. Company Overview

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies.

16 Appendix

16.1 Discussion Guide

16.2 Knowledgestore: The Subscription Portal

16.3 Available Customization

Companies Mentioned

- Stratasys Ltd.

- 3D Systems, Inc.

- GE Additive

- Eos GmbH

- Materialise Nv

- Renishaw plc

- Trumpf

- Norsk Titanium

- Oc Oerlikon Management Ag

- Ultimaker Bv

- Höganäs Ab

- Markforged

- Slm Solutions

- Voxeljet

- Prodways

- Nano Dimension

- Moog Inc

- Protolabs

- Shapeways

- St Engineering

- Fit Ag

- Zortrax

- Javelin Technologies

- Envisiontec, Inc.

- Essentium, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 226 |

| Published | November 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 19.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |