Global Solid Oxide Fuel Cells (SOFCs) Market - Key Trends and Drivers Summarized

Why Are Solid Oxide Fuel Cells (SOFCs) Gaining Momentum?

Solid Oxide Fuel Cells (SOFCs) have garnered significant attention in recent years due to their high efficiency and versatility in generating electricity. SOFCs operate at high temperatures, typically between 600°C and 1,000°C, allowing them to efficiently convert chemical energy from a variety of fuels into electrical energy. Unlike traditional combustion-based power generation, SOFCs produce electricity through an electrochemical reaction, resulting in lower emissions of pollutants such as nitrogen oxides (NOx) and sulfur oxides (SOx). This environmentally friendly aspect makes SOFCs an attractive option for both stationary power generation and mobile applications. Additionally, the ability to use diverse fuels, including natural gas, hydrogen, and biofuels, enhances their adaptability and potential for widespread adoption in various industries. As the world increasingly prioritizes sustainable energy solutions, SOFCs are poised to play a crucial role in the transition to cleaner energy sources.How Are Technological Advancements Impacting SOFC Development?

Technological advancements have significantly impacted the development and performance of SOFCs, driving their efficiency and reducing costs. Innovations in materials science have led to the creation of more durable and conductive electrolytes and electrodes, which are crucial for the high-temperature operation of SOFCs. Researchers are also exploring new manufacturing techniques, such as 3D printing, to produce more complex and efficient cell structures. These advancements not only enhance the performance of SOFCs but also lower production costs, making them more competitive with other power generation technologies. Furthermore, the integration of advanced control systems and real-time monitoring technologies ensures optimal performance and longevity of SOFC systems. These technological strides are essential in overcoming the challenges associated with SOFC deployment, such as high initial costs and material degradation over time. As research and development continue to advance, SOFCs are expected to become more efficient, reliable, and economically viable.What Are the Key Applications and End-Uses of SOFCs?

SOFCs have a wide range of applications, making them a versatile solution for various energy needs. One of the primary applications of SOFCs is in stationary power generation, where they are used to provide electricity for residential, commercial, and industrial buildings. Their high efficiency and low emissions make them ideal for distributed generation, reducing the need for extensive grid infrastructure. In addition to stationary applications, SOFCs are being explored for use in auxiliary power units (APUs) in vehicles, particularly in the transportation sector. These units can provide electricity for onboard systems without relying on the main engine, thus improving fuel efficiency and reducing emissions. Furthermore, SOFCs are being integrated into microgrids and hybrid energy systems, where they complement renewable energy sources such as solar and wind power by providing reliable and continuous power. The versatility of SOFCs extends to their potential use in remote and off-grid locations, where reliable power generation is critical.What Factors Are Driving the Growth in the SOFC Market?

The growth in the SOFC market is driven by several factors. Technological advancements in materials and manufacturing processes have significantly improved the efficiency and durability of SOFCs, making them more cost-competitive with other power generation technologies. The increasing demand for clean and efficient energy solutions is also propelling market growth, as SOFCs produce lower emissions compared to traditional combustion-based systems. Additionally, the growing adoption of SOFCs in various applications, such as stationary power generation, transportation, and auxiliary power units, is expanding their market potential. Government policies and incentives aimed at promoting clean energy technologies are further supporting the deployment of SOFC systems. Strategic partnerships and collaborations among key industry players are accelerating innovation and commercialization efforts. Moreover, the versatility of SOFCs in utilizing diverse fuel sources enhances their appeal in various sectors, including residential, commercial, industrial, and remote power generation. These factors collectively contribute to the robust growth and development of the SOFC market, positioning it as a key player in the future energy landscape.Report Scope

The report analyzes the Solid Oxide Fuel Cells (SOFCs) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Stationary, Transportation, Portable).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Stationary Application segment, which is expected to reach US$7.8 Billion by 2030 with a CAGR of a 34.5%. The Transportation Application segment is also set to grow at 39.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $462.5 Million in 2024, and China, forecasted to grow at an impressive 33.6% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Solid Oxide Fuel Cells (SOFCs) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Solid Oxide Fuel Cells (SOFCs) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Solid Oxide Fuel Cells (SOFCs) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adelan Ltd., Atrex Energy Inc., Bloom Energy Corporation, Ceramic Fuel Cells Limited, Ceres Power Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Solid Oxide Fuel Cells (SOFCs) market report include:

- Adelan Ltd.

- Atrex Energy Inc.

- Bloom Energy Corporation

- Ceramic Fuel Cells Limited

- Ceres Power Limited

- Convion Ltd.

- Elcogen AS

- FuelCell Energy, Inc.

- Hexis AG

- SOLIDpower S.p.A.

- Sunfire GmbH

- Ultra Electronics Holdings Plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adelan Ltd.

- Atrex Energy Inc.

- Bloom Energy Corporation

- Ceramic Fuel Cells Limited

- Ceres Power Limited

- Convion Ltd.

- Elcogen AS

- FuelCell Energy, Inc.

- Hexis AG

- SOLIDpower S.p.A.

- Sunfire GmbH

- Ultra Electronics Holdings Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

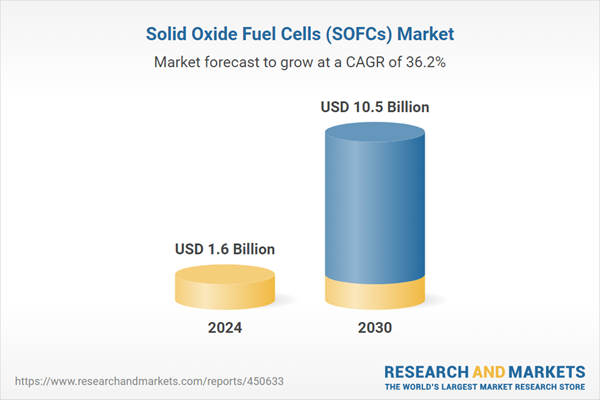

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 10.5 Billion |

| Compound Annual Growth Rate | 36.2% |

| Regions Covered | Global |