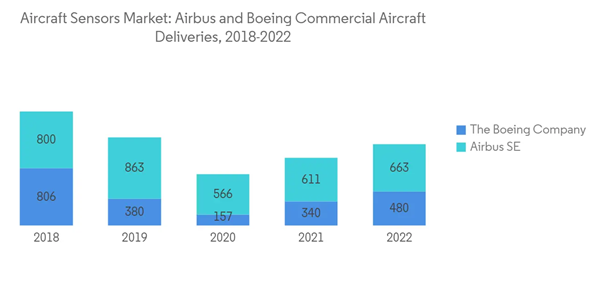

The COVID-19 pandemic severely impacted the global aviation market; flight activity was muted for more than a quarter, and multiple aircraft orders were delayed, which led to a brutal disruption of the demand trajectory of aircraft sensors. Further, 2021 was marked as the year of transition; air passenger numbers are expected to be equivalent to or even surpass the pre-COVID levels by 2023, which is expected to drive the demand for aircraft sensors over the coming years.

The innovation in safety and effective handling of aircraft would drive the aircraft sensor market. A modern aircraft integrates fly-by-computer systems, where signals from sensors monitor the various activities going on in the flight, such as thrust levels, pedals, and flight sticks. The information is then received by flight management systems that control surfaces like ailerons and flaps.

Moreover, the increasing integration of the Internet of Things (IoT) in airplanes to gain real-time statistics is raising the utilization and need for sensors to generate more accurate data, which is expected to drive the aircraft sensor market. However, the major factor impeding the growth of the market is the high R&D, manufacturing, and maintenance costs of sophisticated sensors, that raise questions on the economic viability of emerging technologies to be integrated onboard next-generation aircraft.

Aircraft Sensors Market Trends

Temperature Sensor to Account for a Significant Share

Temperature sensors are an integral part of an aircraft. They are incorporated in various parts of the aircraft, such as cabins, brakes, air ducts, inter-stage turbines, and hydraulic lines. The manufacturers have to comply with the industry standards and regulations to commercialize. For instance, in July 2018, Airbus introduced the whale-faced aircraft named BelugaXL. It is a next-generation aircraft with substantial capacity, which requires several sensors, primarily temperature sensors, to regulate the optimum required temperature in the cabin and the cargo space. This aircraft, with its high ability to transport large amounts of cargo, created a huge demand for sensors to be used for monitoring various parameters while in flight or on the ground. The Boeing Company's Dreamlifter is another major cargo carrier that significantly drove the demand for sensors to be used across the world.Also, with an increase in air passenger traffic, aircraft OEMs are expanding their manufacturing capabilities to meet the demand from end-users for new aircraft. As a result, the need for temperature sensors to be used in aircraft, especially commercial aircraft, will grow significantly due to the nehanced need to ensure air passenger safety and comfort, which is expected to propel the growth of the market.

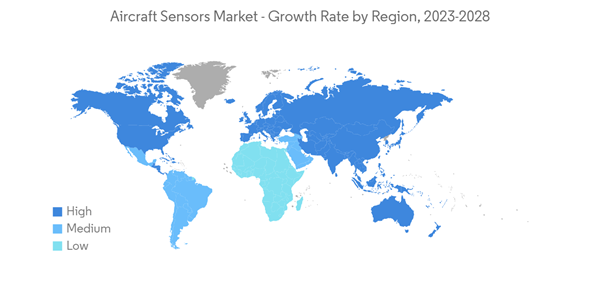

North America to Dominate the Aircraft Sensors Market

Countries in North America, especially the US, had been making constant progress in terms of demand for new aircraft in all sectors (commercial, military, and general aviation). This demand is driven by factors such as rapidly growing passenger traffic and fleet modernization initiative undertaken by the US defense forces. Moreover, the need to maintain the airworthiness of the fleet, both scheduled and unscheduled maintenance is carried out, which drives the demand from the MRO sector.Moreover, US aerospace manufacturers are very competitive internationally. In terms of export sales, the industry contributed USD 143 billion to the US economy. The inward stock of FDI into the US aerospace manufacturing industry totaled more than USD 21 billion, depicting the scope for aircraft sensor manufacturers in the region. The United States is making deals with other emerging economies or countries to sell high-end military aircraft, which is likely to boost market growth over the forecast period.

Aircraft Sensors Industry Overview

The major players in the Aircraft Sensors Market include TE Connectivity Ltd, Honeywell International Inc., The General Electric Company, Raytheon Technologies Corporation, and Safran SA, amongst others. These companies are associated with several active aircraft programs, thereby catering to a majority of the current demand generated by OEMs and MROs alike. Thus, the aircraft sensors market is rendered consolidated, with little or no scope for new market players due to high associated R&D costs and stringent regulatory and certification framework.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- TE Connectivity Ltd.

- Honeywell International Inc.

- Meggitt PLC

- Ametek Inc.

- THALES

- The General Electric Company

- Raytheon Technologies Corporation

- Curtiss-Wright Corporation

- Safran SA

- Hydra-Electric Company

- PCB Piezotronics Inc.

- Avidyne Corporation

- Precision Sensors (United Electric Controls)