Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The new passenger car market surged by 25.3%, totaling 33,447 units, driven by robust consumer demand and favorable lending conditions. Export sales also saw significant growth, rising 31.1% to 39,477 vehicles compared to 30,123 in March 2024. Dealer sales made up 86.8% of total sales, while 7.3% went to vehicle rentals, 3.5% to government, and 2.5% to corporate fleets.

Sales of light commercial vehicles dropped by 8.4%, totaling 13,328 units, while medium and heavy truck segments saw slight declines, with 696 medium commercial vehicles and 2,022 heavy trucks and buses sold, reflecting minimal changes from the previous year. As vehicle longevity improves and used vehicle imports continue, the replacement tire cycle has become a dominant factor. Parallel to this is the rising focus on localized tire assembly and reprocessing, which is stimulating new business models and creating domestic employment opportunities. Increasing investments in tire retail chains, roadside servicing points, and mobile fitment services are also playing a pivotal role in streamlining tire availability across urban and semi-urban markets.

Market Drivers

Rising Vehicle Parc Expansion

The continuous increase in the number of vehicles on the road is a central growth driver in the Africa tire market. As vehicle ownership becomes more accessible through affordable used imports and credit-based vehicle financing, the vehicle parc steadily expands. This leads to greater demand for replacement tires, as older vehicles often require frequent maintenance, particularly tire changes due to usage and wear. The expansion in the vehicle base impacts both the passenger and commercial vehicle segments, encouraging retailers and service providers to widen their inventory across radial, bias, and tubeless categories. With more vehicles aging beyond their manufacturer’s tire life recommendations, periodic tire replacements become essential, generating recurring revenue for manufacturers and tire sellers.The lifecycle of vehicles in Africa tends to be longer due to cost-conscious consumer behavior and limited access to brand-new vehicles, especially in remote areas. This results in extended use of vehicles with multiple tire change cycles throughout their lifespan. The increasing frequency of tire replacement, combined with an expanding aftermarket network, contributes to robust demand across both premium and budget tire segments. The growing fleet of two-wheelers and three-wheelers for short-distance commuting and delivery applications further augments the overall tire demand volume. The commercial segment, particularly freight and logistics, also plays a pivotal role in this expansion.

As goods transportation and supply chains evolve, commercial fleets require consistent tire maintenance to ensure safety, performance, and fuel efficiency. Transport operators recognize tires as mission-critical assets and invest in replacement solutions regularly, thus stimulating bulk purchases. An indirect result of this vehicle parc growth is the rise of tire servicing and alignment shops across city centers and transport corridors, enhancing market accessibility. This expansion, coupled with increased consumer reliance on motorized transport, keeps the tire industry on an upward trajectory.

Key Market Challenges

Proliferation of Counterfeit and Substandard Tires

One of the most persistent threats in the Africa tire market is the widespread availability of counterfeit and substandard tires. These products not only compromise road safety but also erode consumer trust in legitimate tire brands. Many unregulated imports bypass safety checks and offer tires at drastically low prices, making them attractive to price-conscious consumers. However, their poor construction often leads to faster deterioration, accidents, and reduced fuel efficiency. Legitimate tire manufacturers and distributors suffer as substandard products undercut their pricing. Brand dilution occurs when consumers mistakenly attribute poor performance to reputable companies due to counterfeit lookalikes.The lack of robust regulatory enforcement and the ease of entry for low-quality imports exacerbate this issue. Retailers looking to maximize profit margins may unknowingly stock counterfeit tires, further perpetuating the cycle. Combating this challenge requires collaborative efforts across stakeholders, including government agencies, industry associations, and certification bodies. Public education campaigns focused on tire safety, visible labeling standards, and digital tracking systems like QR codes or blockchain identifiers can improve transparency. In the absence of a secure and monitored distribution ecosystem, counterfeit tires will continue to undermine market integrity and stifle innovation in product quality.

Key Market Trends

Digitalization of Tire Retail and Distribution

The tire industry is undergoing a digital transformation that is reshaping how tires are marketed, sold, and delivered. Online platforms, mobile apps, and e-commerce websites are becoming central to tire distribution strategies. Consumers are now able to compare prices, check compatibility, read reviews, and place orders directly from their phones or computers. This shift offers greater convenience and transparency, especially for urban consumers and fleet operators seeking efficiency. Digitalization also supports inventory management and supply chain optimization. Retailers and distributors can integrate their stock systems with digital platforms to avoid overstocking or understocking.Consumers receive real-time updates on product availability and delivery timelines. This boosts confidence in the purchase process and promotes brand loyalty through seamless service experiences. Tire manufacturers are capitalizing on this trend by offering virtual tire advisors, size-matching algorithms, and even AR-based tire visualization tools. Partnerships between e-commerce giants and tire companies are expanding the reach of premium brands into markets that were traditionally dominated by small shops or unorganized vendors. Moreover, digital platforms facilitate loyalty programs, post-sale service reminders, and warranty registrations, creating an end-to-end ecosystem for the tire customer journey. Digital tire retail also helps collect valuable consumer behavior data, which can inform product development and marketing strategies. Companies that embrace digitalization will benefit from scalable customer acquisition, reduced transaction friction, and enhanced brand differentiation in an increasingly competitive landscape.

Key Market Players

- Bridgestone Corporation

- Zhongce Rubber Group Co., Ltd

- Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries Ltd

- Shandong Linglong Tyre Co., Ltd

- Pirelli & C. S.p.A.

- Yokohama Rubber Company Limited

- Kumho Tire Co. Inc

- BFGoodrich Tyres

- Hankook Tire & Technology Co., Ltd.

Report Scope:

In this report, the Africa Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Africa Tire Market, By Vehicle Type:

- Passenger Car

- Two-Wheelers

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

Africa Tire Market, By Demand Category:

- OEM

- Aftermarket

Africa Tire Market, By Tire Construction Type:

- Radial

- Bias

Africa Tire Market, By Country:

- South Africa

- Egypt

- Morocco

- Libya

- Nigeria

- Kenya

- Angola

- Zimbabwe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Africa Tire Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Bridgestone Corporation

- Zhongce Rubber Group Co., Ltd

- Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries Ltd

- Shandong Linglong Tyre Co., Ltd

- Pirelli & C. S.p.A.

- Yokohama Rubber Company Limited

- Kumho Tire Co. Inc

- BFGoodrich Tyres

- Hankook Tire & Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | August 2025 |

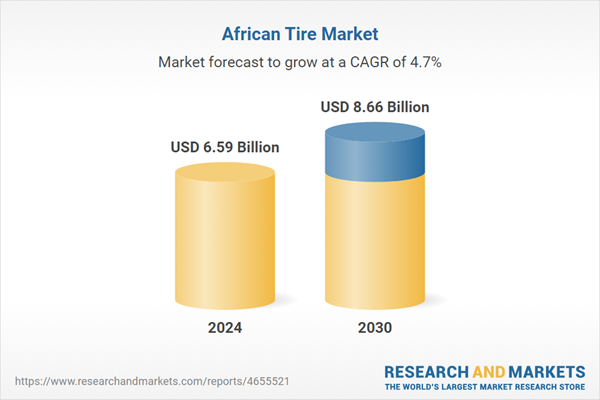

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.59 Billion |

| Forecasted Market Value ( USD | $ 8.66 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Africa |

| No. of Companies Mentioned | 10 |