Key Highlights

- The COVID-19 pandemic not only had an impact on the entire pharmaceutical supply chain but, more specifically, it disrupted the supply chain across the globe, which led to an increase in the cost of many prescription medications as well as the shortage of essential drugs in the countries. For instance, according to the article published in PubMed in April 2021, USFDA stated that the supply chain of active pharmaceutical ingredients was highly reliant on China and India during the pandemic. Though the expansion in the production of domestic pharmaceuticals was proposed, the idea was not realistic to relocate all pharmaceutical production. Thus, the heavy reliance on the supply chain of the United States for APIs from China and India was severely impacted during the pandemic.

- However, the increasing government initiatives to increase the production of active pharmaceutical ingredients are expected to boost market growth over the forecast period. For instance, in March 2022, the government of India announced that the manufacturing of 35 different active pharmaceutical ingredients (APIs) has started in India under the production-linked scheme for the pharmaceuticals sector. These 35 active pharmaceutical ingredients (APIs) are among the 53 APIs for which India had 90 percent import dependence before the pandemic hit and the supply chain was disrupted. The 35 APIs are being manufactured from 32 different manufacturing plants in India. Thus, the studied market has witnessed significant growth and is expected to grow over the forecast period.

- Factors such as the increasing prevalence of infectious, genetic, cardiovascular, and other chronic disorders, increasing adoption of biologics and biosimilars, as well as rising prevalence of cancer and increasing sophistication in oncology drug research, are expected to boost the market growth over the forecast period.

- The increasing prevalence and burden of chronic diseases, infectious diseases, and genetic disorders worldwide are driving the demand for effective and safe drugs, which in turn increases the demand for active pharmaceutical ingredients across the globe. For instance, according to the 2022 statistics published by the International Diabetes Federation (IDF), about 537 million people were living with diabetes globally in 2021, and this number is projected to reach 643 million and 784 million by 2030 and 2045, respectively. Therefore, high blood sugar caused by diabetes can damage the nerves that control the heart and blood vessels, leading to a variety of cardiovascular diseases like coronary artery disease and stroke, which can narrow the arteries and necessitate the administration of drugs, propelling the growth of the API market.

- Additionally, the increasing development and clinical trials of biosimilar and biologics drugs for new therapeutic classes urge the companies to adopt strategic initiatives for the manufacturing and development of APIs, which is expected to contribute to market growth. For instance, in September 2022, CuraTeQ Biologics, a wholly owned subsidiary of Aurobindo Pharma, invested approximately INR 300 (USD 3.82) crore in the capacity expansion of biologics manufacturing facilities. In addition, the company received approval for entering contract manufacturing operations for biologicals. Similarly, in September 2022, Novartis invested USD 300 million to increase its production and development capabilities for biological drugs. Such investments in increasing biologic manufacturing and rising biologic approvals are anticipated to increase its adoption, which in turn is expected to increase the demand for APIs for developing drugs globally.

- Therefore, owing to the high burden of diabetes among the population and growing company activities to increase the development of biologics and biosimilar drugs, the studied market is expected to grow over the forecast period. However, the drug price control policies across various countries, high competition between API manufacturers, and stringent regulation are expected to impede the growth of the active pharmaceutical ingredients market over the forecast period.

Active Pharmaceutical Ingredients (API) Market Trends

Oncology Segment is Expected to Register Significant Growth Over the Forecast Period

- The growing burden of cancer cases across the globe is one of the crucial health concerns witnessed by many countries. The incidence of cancer rises dramatically with age, which raises the demand for effective therapeutics.

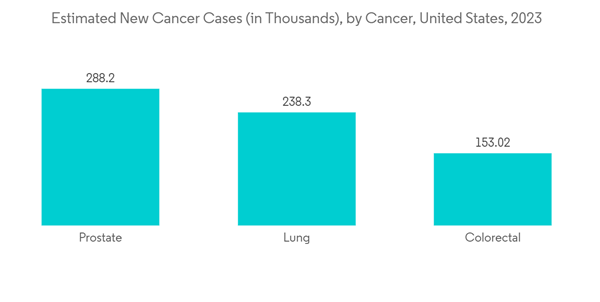

- The oncology segment is expected to witness significant growth in the active pharmaceutical ingredients market over the forecast period owing to factors such as the rising burden of cancer cases and raising awareness towards the treatment of the early-onset cancer epidemic. For instance, as per 2023 data published by the American Cancer Society, about 1,958,310 new cancer cases are expected to be diagnosed in the United States in 2023, as compared to 1,918,030 new cancer cases in 2022. This data shows a rapid increase in the incidence of cancer cases in the country, and over the forecast period, the incidence of cancer will further increase, thus raising the demand for oncology drugs that need API for drug formulation. Hence, the market is expecting a significant impact over the forecast period.

- Furthermore, the increasing focus of companies to adopt key strategic activities such as collaborations, agreements, and partnerships is expected to accelerate the development of novel cancer drugs. For instance, in October 2022, Mendus AB entered an agreement to enable the technology transfer for manufacturing of the company's lead development program DCP-001 with Minaris Regenerative Medicine GmbH. DCP-001 is being evaluated in the ADVANCE II Phase 2 clinical trial to prevent cases of tumor recurrence in Acute Myeloid Leukemia (AML) and in the ALISON Phase 1 clinical trial in ovarian cancer.

- Similarly, in October 2022, GenScript ProBio, a global CDMO, and GeneCraft entered a strategic partnership MOU concerning the development and production of new drugs needed for RX001. GenScript ProBio and GeneCraft are in the process of signing a contract for plasmid and AAV development and production of new drug candidate Pan-KRAS non-small cell lung cancer anti-cancer gene therapy (RX001).

- Moreover, the increasing investments to accelerate the production of APIs are also expected to contribute to segment growth over the forecast period. For instance, in July 2022, NovasepPharmaZell Group invested EUR 7.3 (USD 7.6) million for its Mourenx site (southwestern France). This new industrial tool will support the growth of the Mourenx site and sustain the growing demand to produce active pharmaceutical ingredients (APIs), particularly the highly potent drugs (HPAPIs) used to treat cancer.

- Hence, owing to the growing incidence of cancer and its risk factors, new company initiatives toward cancer drugs, and new investments in the area of research and development activities, the studied segment is expected to grow over the forecast period.

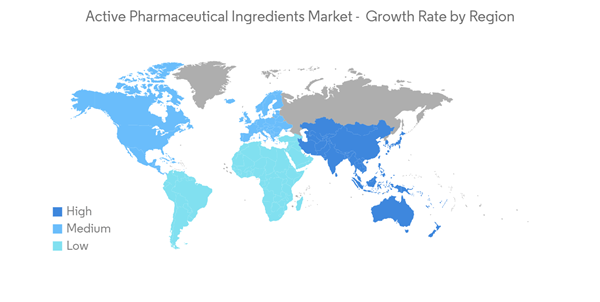

North America is Expected to Hold Significant Market Share Over the Forecast Period

- North America is anticipated to hold a significant market share over the forecast period owing to factors such as the prevalence of chronic diseases such as cancer, diabetes, cardiovascular and neurological diseases coupled with the geriatric population. In addition, the high healthcare expenditures and the presence of key market players in the region are also anticipated to boost market growth over the forecast period.

- The rising burden of chronic diseases is the key factor driving the demand for effective drugs for treatment, hence expected to fuel the market growth. For instance, according to 2023 statistics published by the American Cancer Society, about 1,958,310 new cancer cases are expected to be diagnosed in the United States in 2023, including 348,840 digestive system cancer, 300,590 breast cancer, and 256,290 respiratory-related cancer.

- Similarly, as per the Canadian Institute for Health Information data published in July 2022, about 2.4 million Canadians have heart disease in 2022. This fuels the demand for APIs for manufacturing cancer and cardiovascular drugs, which in turn is anticipated to propel the market growth in the North America region.

- Furthermore, in February 2023, the Government of Canada issued Good manufacturing practices guidelines for active pharmaceutical ingredients (GUI-0104) for people who work with Active Pharmaceutical Ingredients (APIs) and their intermediates to understand and comply with Part C, Division 2 of the Food and Drug Regulations (the Regulations), which is about Good Manufacturing Practices (GMP). This guide applies to the fabricators, packagers/labelers (including re-packagers/re-labelers), testers, importers, distributors, and wholesalers. Such a government initiative is expected to increase the requirement for finished products and hence is expected to boost the API market over the forecast period.

- Moreover, increasing company activities to increase API production by expanding manufacturing facilities is also expected to bolster market growth. For instance, in January 2023, Eurofins announced that it relocated and expanded its API development laboratories by moving to a new space in Ontario, Canada. Similarly, in May 2022, Piramal Pharma announced that a new active pharmaceutical ingredient (API) plant at the company's site in Aurora, Ontario, has come online and completed its initial production runs.

- Therefore, owing to the rising prevalence of cancer and cardiovascular diseases, increasing government initiatives, and growing company manufacturing facility expansion activities, the studied market is expected to grow over the forecast period.

Active Pharmaceutical Ingredients (API) Industry Overview

The active pharmaceutical ingredients (API) market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold market shares and are well-known, including Pfizer Inc., BASF SE, Viatris Inc., Merck KGaA, and Teva Pharmaceutical Industries Ltd., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aurobindo Pharma

- Teva Pharmaceutical Industries Ltd

- Pfizer Inc.

- Novartis AG

- BASF SE

- Merck KGaA

- Dr. Reddy's Laboratories Ltd

- Lupin Ltd

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd