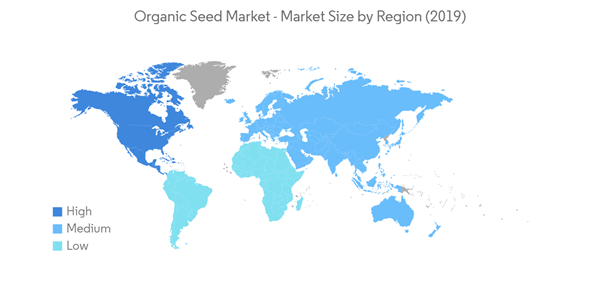

In 2019, North America was the largest geographical segment in the overall market, and it accounted for a 38.8% market share.

The growing demand for organic products,amid increasing dietary concerns and a change in consumer spending patterns, has led to a significant increase in the production of organic crops all over the world. This has enhanced the demand for organic seeds. However, the cost of seeds is becoming a significant economic barrier for farmers in a few countries, which is influencing them to choose conventional seeds over organically produced seeds.

Organic Seed Market Trends

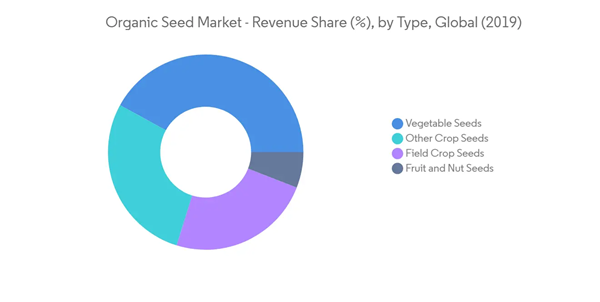

Rapidly Expanding Market for Organic Vegetable Seeds

According to the International Trade Statistics (ITS), the average organic vegetable seed production increased by 22.7%, from 2015 to 2016, in countries, like Mexico, Uganda, Tanzania, Ethiopia, and India. The Food and Agricultural Organization (FAO) estimated the total area under organic vegetable production to be 0.8% of the total area, of the overall vegetable production, globally, in 2018. The countries with the highest organic vegetable seed production are Mexico, the United States, China, Poland, and Egypt. Organic seed accessibility, lack of awareness regarding the benefits associated with organic seeds, and higher prices are a few of the challenges faced by consumer groups all over the world. However, on the upside, increasing consumption of organic vegetables, by consumers, is driving the organic vegetable seed market, which is expanding at a rapid pace. Some of the major global players for organic vegetable seed sources are - Vitalis Organic Seeds, Seeds of Change, Wild Garden Seeds, Fedco Seeds Inc., and Tamar Organics, among others.North America Dominates the Global Market

North America is the largest organic seeds market, as a result of the growing organic sales over the years. There are several factors, like the growing trend of home gardening, rising demand for healthy food, and favorable government regulations, augmenting the sales of organic seed in North America. Some of the major players in North America are High Mowing Organic Seeds, Johnny's Selected Seeds, and Southern Exposure Seed Exchange. Most of the organic sales recorded in Canada are from the field crops seed segment, holding almost 50% of the market share. However, most of the organic farmers in the United States are still relying on conventionally produced seeds, at least to some extent, considering them an economical alternative to organic seeds. This posed a threat to the market, in the country, as it may hamper the market during the forecast period.Organic Seed Industry Overview

The organic seed market is highly fragmented, with several small and medium-sized companies witnessing minimal share in the global market. The higher market shares of players are likely to be attributed to their highly diversified product portfolios and launches of various new varieties of seeds every year. Moreover, companies are focusing on expanding their business to new regions, such as Africa and Asia-Pacific, to increase their customer base and brand awareness.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Vitalis Organic Seeds

- Seeds of Change Inc.

- Seed Savers Exchange

- Southern Exposure Seed Exchange

- Johnny's Selected Seeds

- Wild Garden Seeds

- Fedco Seeds

- Fleuren

- Maas Plant

- HILD Samen

- Navdanya

- Arnica Kwekerij

- High Mowing Organic Seeds

- De Bolster

- Territorial Seed Company