During COVID-19, in Australia, sales of general mills declined by 3%. Food products such as gluten-free or other free-from dairy products, drinks, condiments, and sauces have taken a back seat as stores stock up on more priority and fundamental necessities, resulting in a significant drop in sales. Consumers with celiac disease or gluten sensitivity are more likely to purchase survival-based items rather than gluten-containing ones.

The market studied has undergone a radical change from specialty niche products to mainstream products. A current trend toward gluten-free product consumption has given further impetus to the gluten-free food and beverages segment. The easy availability of products in almost all grocery stores is expected to have a significant impact on market growth. Higher disposable incomes and the shifting trend toward processed foods in countries such as India and China are the factors that drive the growth of gluten-free products in Asia-Pacific.

The Asian-Pacific gluten-free foods and beverages market has undergone a radical change, from specialty niche products to mainstream products. The current trend toward gluten-free product consumption and increasing cases of celiac diseases have given further impetus to the gluten-free food and beverage segment in the region.

Key Market Trends

Rising Demand for Free-from Food

The free-from food market is also thriving in the light of medical advancements that have analyzed and provided a solid understanding of different responses from the immune system, enabling consumers to make conscious decisions in purchasing their food products. Consumer awareness regarding the labeling of allergen-free and dairy-free products claims is driving the demand for free-from food products. High levels of new product development, coupled with growing availability and accessibility of free-from foods in mainstream retail, such as mass merchandisers, are regularizing its utility among the consumers. This trend is expected to provide a greater push in driving the future sales of free-from foods.

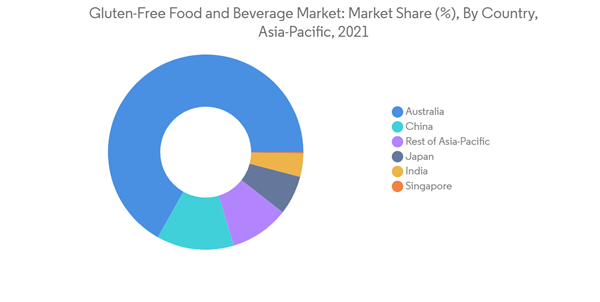

Australia Dominates the Gluten-free Food and Beverages Market

Australia is the largest gluten-free market in the Asia-Pacific region and is a significant exporter to the United States and Western Europe. An increasing number of Australians choosing to eliminate some particular food components from their diets, such as gluten, dairy, or meat, and rising consumer awareness are driving IT-based packaging innovations on gluten-free products. The Australian market for gluten-free food and beverages is undergoing a major change from being considered specialty products to becoming mainstream products. Consumers are taking gluten-free products not only to prevent adverse symptoms, such as gastrointestinal in nature (bloating, wind, and abdominal cramps) and fatigue/tiredness but also because of a general perception of maintaining better health.

Competitive Landscape

The gluten-free product market in Asia-Pacific is highly competitive and comprises numerous regional and international competitors. Some of the major players operating in the APAC gluten-free food and beverages market are The Kraft Heinz Company, Amy's Kitchen Inc., Conagra Brands (Pinnacle Foods), and General Mills. The leading players in the gluten-free product market enjoy a dominant presence across the region. These players focus on leveraging opportunities posed by emerging markets to expand their product portfolio so that they can cater to the requirements of various product categories. The key players in the market are focusing on introducing new products catering to the interests of target consumers. Innovation or new product development is the most adopted strategy among key players, like Kellogg's and Passage Foods, among other players operating in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Conagra Brands Inc.

- General Mills Inc.

- Nestle SA

- PepsiCo Inc.

- Hain Celestial Group

- Mondelez International

- The Kellogg Company

- Danone SA

- The Kraft Heinz Company

- Dr. Schar AG/SPA

- Bobs Red Mill Natural Foods Inc.

- Amy's Kitchen Inc.