A generic drug is a pharmaceutical product that is bioequivalent to a brand-name drug in terms of dosage, strength, safety, efficacy, route of administration, and intended use. It is produced and marketed after the patent protection of the original brand-name drug expires. These medications contain the same active ingredients as their brand-name counterparts and undergo rigorous testing by regulatory authorities to ensure their quality, safety, and effectiveness.

Generic drugs offer several advantages, including lower cost, increased accessibility, and greater affordability, making healthcare more affordable and accessible to a wider population. They play a crucial role in providing cost-effective alternatives to brand-name drugs, promoting competition in the pharmaceutical market, and enhancing the overall efficiency of healthcare systems in the United States.

The market in the United States is majorly driven by the easy availability and affordability of the product. In line with this, the increasing number of expired patents is significantly contributing to the market. Apart from this, with the rising cost of healthcare, including prescription medications, payers and healthcare providers seek to promote the use of generic drugs to contain expenses, thus catalyzing the market.

Moreover, numerous government initiatives encourage the use of generic drugs by providing incentives and lower reimbursement rates for generic prescriptions, thereby creating a positive outlook for the market. Besides, the aging population in the United States requires a larger volume of medications. Additionally, the expiration of patents for several blockbuster drugs creates growth opportunities for generic manufacturers.

US Generic Drug Market Trends/Drivers:

Growing demand for chronic disease management

The growing demand for chronic disease management is favorably impacting the market. Chronic diseases, such as diabetes, cardiovascular conditions, and respiratory disorders, are prevalent and require long-term medication use. As the population ages and the prevalence of chronic diseases increases, the need for cost-effective medication options becomes crucial. Furthermore, generic drugs offer an affordable alternative for managing chronic diseases. They contain the same active ingredients as their brand-name counterparts, ensuring similar therapeutic effects at a fraction of the cost. This makes them highly attractive to patients, healthcare providers, and payers.Moreover, healthcare providers often prioritize using generic drugs for chronic disease management due to their proven safety and efficacy. They may prescribe generics as a first-line treatment option or encourage patients to switch from brand-name medications to their generic equivalents to improve adherence and reduce costs. In addition, the payers, including insurance companies and government programs, recognize the cost-saving potential of generic drugs in chronic disease management. They may offer preferential coverage or lower co-pays for generic prescriptions, making them more accessible and affordable for patients. Additionally, formulary management programs may include generics as preferred options, further driving their utilization.

Increasing drug shortage across the region

The increasing drug shortage is strengthening the market across the region. Shortages of brand-name drugs can occur due to a variety of factors, including manufacturing issues, regulatory challenges, supply chain disruptions, and increased demand. These shortages can lead to increased utilization of generic alternatives. During a drug shortage, healthcare providers and pharmacies may face challenges maintaining a consistent supply of brand-name medications. As a result, they turn to generic drugs as a substitute to ensure continuity of patient care. Generic drugs offer a viable solution during these shortages as they are often readily available, produced by multiple manufacturers, and competitively priced.Furthermore, healthcare providers may proactively prescribe generic drugs as alternatives to mitigate the impact of drug shortages on patient treatment plans. In some cases, healthcare systems and hospitals may implement protocols to promote the use of generic drugs during shortages to optimize resource allocation and minimize disruptions in patient care.

Moreover, the reliance on generic drugs during drug shortages addresses immediate supply challenges and contributes to the growth of the generic drug market in the long term. This creates an opportunity for healthcare providers, patients, and payers to recognize the value and reliability of generic medications, potentially leading to increased utilization and market growth for generic drugs beyond the period of shortage.

Presence of patent cliffs

Patent cliffs refer to the expiration of patents for blockbuster brand-name drugs, opening the market for generic competitors. When a patent expires, generic manufacturers can legally produce and distribute their drug versions, often at significantly lower prices. Furthermore, patent cliffs are offering lucrative opportunities for generic drug manufacturers to enter the market and offer more affordable alternatives to brand-name drugs. As patents expire, competition increases, leading to the market growth for generic drugs. This increased competition promotes price transparency and drives down the cost of medications, benefiting patients and healthcare systems.Moreover, pharmaceutical companies and healthcare providers closely monitor patent expirations to identify cost savings opportunities and promote the usage of generics. They may proactively switch patients to generic alternatives to take advantage of the cost savings. Additionally, the presence of patent cliffs in the pharmaceutical industry expands access to more affordable medications and fosters market growth for generic drugs by creating a competitive landscape and encouraging innovation among generic manufacturers.

US Generic Drug Industry Segmentation:

The research provides an analysis of the key trends in each segment of the US generic drug market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on segment, therapy area, drug delivery, and distribution channel.Breakup by Segment:

- Unbranded

- Brande.

Unbranded dominates the market

The report has provided a detailed breakup and analysis of the market based on segment. This includes unbranded and branded generics. According to the report, unbranded generics represented the largest segment.Unbranded generics, or non-proprietary or off-patent generics, refer to generic drugs not associated with any specific brand name. These medications are typically identified by their active pharmaceutical ingredient (API) and are often marketed under their generic names. They are experiencing high acceptance and utilization among healthcare providers and patients in Europe. These medications offer cost-effective alternatives to brand-name drugs, as they are generally priced lower due to competition from multiple manufacturers.

The affordability and accessibility of unbranded generics make them a preferred choice for healthcare providers, payers, and patients looking for cost savings and value-based healthcare solutions. The market share of unbranded generics reflects a competitive generic drug market in the US. This competition fosters price transparency, encourages innovation among generic manufacturers, and drives down healthcare costs. The presence of a wide range of unbranded generics in the market promotes choice, affordability, and accessibility of medications across the US.

Breakup by Therapy Area:

- CNS

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

CNS therapy encompasses conditions targeted at depression, anxiety, and neurological disorders. The availability of generic drugs allows for cost-effective treatment options for these disorders. The affordability of generic CNS medications increases patient access to essential treatments and contributes to the growth of the generic drug market.

Furthermore, the cardiovascular segment covers medications for heart-related conditions like hypertension and heart failure. Generic drugs provide cost savings and promote adherence to treatment plans. The availability of generic cardiovascular medications allows patients and healthcare providers to manage these chronic conditions more affordably, catalyzing the market.

Moreover, dermatology includes treatments for skin conditions like acne, eczema, and psoriasis, the availability of generic medications offers cost-effective solutions. These generic alternatives make dermatological treatments more accessible, augmenting market growth by expanding patient access and reducing healthcare costs. Besides, these medications enable targeted approaches to specific medical needs. It ensures that a wide range of diseases and conditions can be effectively managed with affordable and high-quality generic medications, driving the overall market growth and improving healthcare outcomes.

Breakup by Drug Delivery:

- Oral

- Injectables

- Dermal/Topical

- Inhaler.

Oral holds the largest share of the market

A detailed breakup and analysis of the market based on drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers. According to the report, oral accounted for the largest market share.Oral drugs are widely favored by patients and healthcare providers due to their convenience and ease of administration, often requiring minimal or no medical assistance. The popularity of oral drugs stems from their ability to be self-administered, allowing patients to take their medication in the comfort of their homes without needing injections or medical procedures. This convenience factor improves patient adherence to treatment plans, ultimately improving health outcomes.

Furthermore, the availability of generic oral drugs provides cost-effective alternatives to brand-name medications in this segment. Generic oral drugs undergo rigorous testing to ensure bioequivalence with their brand-name counterparts, offering the same therapeutic benefits at a lower cost. This affordability and accessibility of generic oral drugs contribute to their market growth, as they meet the demand for convenient and self-administered medications while providing significant cost savings for patients and healthcare systems.

Breakup by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacie.

Hospital Pharmacies hold the largest share of the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies and retail pharmacies. According to the report, hospital pharmacies accounted for the largest market share.Hospital pharmacies are critical in supplying medications to patients within the healthcare system, including inpatient settings, outpatient clinics, and emergency departments. The prevalence of hospital pharmacies in the distribution of generic drugs is attributed to several factors. Hospitals require a significant volume of medications to meet the needs of their patient population. Generic drugs, known for their cost-effectiveness, are favored options for hospitals to manage medication costs while ensuring quality patient care.

Furthermore, hospital formularies often prioritize using generic drugs due to their proven efficacy and cost savings. This encourages healthcare providers within hospital settings to prescribe and administer generic drugs whenever possible. Moreover, the centralized nature of hospital pharmacies allows for efficient procurement, storage, and distribution of generic medications. Hospitals can leverage their purchasing power to negotiate favorable pricing agreements with generic drug manufacturers.

The dominance of hospital pharmacies in distributing generic drugs drives market growth by promoting the use of cost-effective alternatives within the healthcare system. The high volume of medication sales through hospital pharmacies demonstrates these institutions' significant role in the accessibility and utilization of generic drugs in the United States.

Competitive Landscape:

The top generic drug companies in the United States actively contribute to the market expansion with their extensive resources, research capabilities, and industry expertise. These companies invest heavily in research and development to bring a wide range of generic drugs. They focus on developing cost-effective alternatives to brand-name medications across various therapy areas, addressing the needs of patients and healthcare providers for affordable treatment options. Furthermore, these companies maintain strong manufacturing capabilities and efficient supply chains, ensuring a steady and reliable supply of generic medications.This enables healthcare providers to confidently prescribe and dispense generic drugs, promoting their utilization and market growth. Besides, these companies engage in strategic partnerships, collaborations, and licensing agreements to enhance their product portfolios and expand market reach. By partnering with other industry leaders, they access a broader range of products, expertise, and distribution channels, allowing for increased market penetration and growth.

Moreover, top generic drug companies engage in comprehensive marketing and promotional efforts to raise awareness among healthcare providers and patients about the benefits of generic drugs. They actively participate in educational initiatives, formulary discussions, and healthcare conferences, aiming to promote the value and cost-effectiveness of generic medications.

The report has provided a comprehensive analysis of the competitive landscape in the US generic drug market. Detailed profiles of all major companies have also been provided.

- Teva

- Mylan

- Actavis (Teva)

- Sandoz (Novartis)

- Sun Pharma

- Par Pharmaceuticals (Endo Pharmaceuticals)

- Lupin Pharmaceuticals

- Dr Reddy’s

- Hospira (Pfizer.

Recent Developments:

In 2020, Teva announced a collaboration with Amgen, a biotechnology company, to launch two biosimilar drugs in the United States. The collaboration aimed to bring more affordable and accessible treatment options to patients.In 2020, Mylan, a global pharmaceutical company, finalized its merger with Pfizer's Upjohn division to form Viatris. This merger was a significant development in the generic drugs industry, as it created one of the largest global players in the generic and biosimilar markets.

In 2020, Actavis announced a collaboration with Celltrion Healthcare, a global biopharmaceutical company, to commercialize two biosimilar products in the United States. The collaboration aimed to bring cost-effective alternatives to biologic drugs for patients in the US market.

Key Questions Answered in This Report

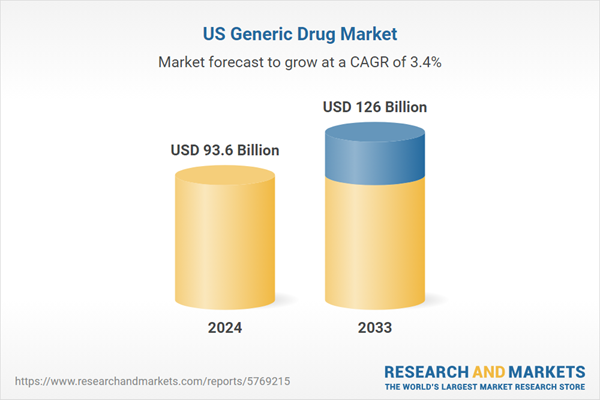

- What was the size of the US generic drug in 2024?

- What is the expected growth rate of the US generic drug during 2025-2033?

- What are the key factors driving the US generic drug market?

- What has been the impact of COVID-19 on the US generic drug market?

- What is the breakup of the US generic drug market based on the segment?

- What is the breakup of the US generic drug market based on the therapy area?

- What is the breakup of the US generic drug market based on the drug delivery?

- What is the breakup of the US generic drug market based on the distribution channel?

- Who are the key companies/players in the US generic drug market?

Table of Contents

Companies Mentioned

- Teva

- Mylan

- Actavis (Teva)

- Sandoz (Novartis)

- Sun Pharma

- Par Pharmaceuticals (Endo Pharmaceuticals)

- Lupin Pharmaceuticals

- Dr Reddy’s

- Hospira (Pfizer)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 93.6 Billion |

| Forecasted Market Value ( USD | $ 126 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 9 |