PPR pipes, or polypropylene random copolymer pipes, are a type of plastic pipe extensively used in the construction industry due to their durability and robust nature. These pipes are primarily employed in the transportation of hot and cold water in residential, commercial, and industrial settings. The PPR pipes possess distinct advantages such as resistance to corrosion, high-temperature tolerance, and low thermal conductivity, which contribute to their effectiveness in providing efficient water supply systems. Moreover, these pipes are lightweight, reducing the effort and cost of transportation and installation.

The maintenance cost associated with PPR pipes is also relatively low as they are less prone to leaks and damage. In terms of environmental sustainability, PPR pipes are recyclable, making them an eco-friendlier choice. It is important to note that despite these advantages, appropriate installation procedures must be followed to ensure the maximum performance and lifespan of PPR pipes.

The growing health consciousness among the population majorly drives the market in Saudi Arabia. PPR pipes are non-corrosive and do not promote biofilm growth, ensuring the supply of cleaner and safer water. This factor is increasingly important in residential, commercial, and healthcare facilities, thereby driving the demand for PPR pipes. Consequently, the need for replacing outdated systems with corrosion-resistant, low-maintenance, and more efficient options such as PPR pipes is a major market driver.

Moreover, the replacement process is facilitated by the relative ease of installing PPR pipes and their compatibility with existing pipe systems, further enhancing the attractiveness of PPR pipes to those seeking to upgrade their infrastructure. In addition, the Saudi Arabian government's emphasis on implementing quality standards and regulations for construction materials, including PPR pipes, is another significant market driver. Moreover, continuous advancements in pipe joining techniques have simplified the installation process, reducing the time and costs are creating a positive market outlook.

Saudi Arabia PPR Pipes Market Trends/Drivers:

Rising Infrastructural Development

The escalating rate of urbanization in Saudi Arabia is driving the demand for PPR pipes. As cities expand and new residential and commercial buildings are constructed, the need for robust and efficient plumbing systems is paramount. PPR pipes, with their durability and effectiveness in transporting hot and cold water, are an optimal choice. The Saudi Arabian government's initiatives aimed at diversifying the economy and developing infrastructure further fuels this demand.This initiative includes ambitious housing projects and extensive developments in the hospitality sector, necessitating significant quantities of PPR pipes. In confluence with this, the country's commitment to building sustainable cities, including the project of NEOM, entails the use of eco-friendly materials, such as PPR pipes, which are recyclable and less harmful to the environment.

Increasing Water Conservation Efforts

Saudi Arabia, being a predominantly desert region, faces substantial challenges related to water scarcity. Along with this, the government's emphasis on water conservation leads to the demand for efficient and leak-proof piping systems. In addition, PPR pipes, with their strong joints and resistance to leakage, prove to be crucial in these water conservation efforts.Their low thermal conductivity further aids in minimizing the loss of heat in hot water lines, enhancing energy efficiency. Moreover, initiatives by the government to promote water-saving techniques and the public's growing awareness about sustainable practices push the demand for PPR pipes, as they offer a solution that is both practical and environmentally responsible.

Saudi Arabia PPR Pipes Industry Segmentation:

The research provides an analysis of the key trends in each segment of the Saudi Arabia PPR pipes market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on type and application.Breakup by Type:

- High Pressure Pipes

- Low Pressure Pipe.

High pressure pipes represent the most widely used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes high pressure pipes and low pressure pipes. According to the report, high pressure pipes represented the largest segment.High pressure PPR pipes are being increasingly demanded in the Saudi Arabian market, driven by the growing need for these pipes in industries such as oil and gas, where high pressure handling capability is essential. Saudi Arabia, being one of the world's leading oil producers, requires these pipes for efficient and safe oil transportation. Additionally, the country's aggressive water desalination projects, due to its arid climate and water scarcity, necessitate the use of high pressure pipes. These pipes are vital in the reverse osmosis process used extensively in desalination plants, handling high pressures effectively.

The construction industry, expanding rapidly due to urbanization and infrastructural development initiatives, also drives the demand. High pressure PPR pipes are preferred for high-rise buildings where the water needs to be pumped to significant heights. Moreover, the increasing focus on the use of durable and reliable pipes for long-term applications contributes to the market growth of high pressure PPR pipes.

Breakup by Application:

- Plumbing

- Chemical Industries and Labs

- Other.

Plumbing dominates the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes plumbing, chemical industries and labs, and others. According to the report, plumbing represented the largest segment.The market for PPR pipes in the plumbing application sector in Saudi Arabia is experiencing significant growth, fueled by the escalating rate of urbanization and infrastructure development in the country, including residential, commercial, and industrial properties, all of which require efficient plumbing systems. As PPR pipes offer numerous advantages such as durability, corrosion resistance, and thermal efficiency, they are increasingly being adopted in plumbing applications. Additionally, the replacement and renovation of aging infrastructure with modern, reliable, and efficient systems are promoting the use of PPR pipes in plumbing.

The country's push towards sustainable and environmentally friendly practices also favors PPR pipes, given their recyclability and low environmental impact. Furthermore, government standards and regulations requiring the use of high-quality and safe materials in construction have also enhanced the market demand for PPR pipes in plumbing applications.

Competitive Landscape:

The key players in the market are investing heavily in research and development to improve the performance characteristics of PPR pipes. They are introducing products with enhanced durability, temperature resistance, and pressure handling capabilities. Companies are also working on developing pipes that are easier and quicker to install, thereby reducing installation costs.Along with this, the growing investments in new manufacturing facilities and upgrading their existing facilities with advanced manufacturing technologies are positively influencing the market. In addition, the accelerating focus on obtaining quality certifications for their products to assure customers of their reliability and safety is significantly supporting the market.

These certifications also help companies to comply with government regulations and standards, thereby gaining a competitive advantage in the market. Apart from this, the rising emphasis on environmental sustainability in Saudi Arabia is encouraging to adopt eco-friendly practices in their operations, which is acting as another growth-inducing factor. Furthermore, the escalating number of partnerships and collaborations with local and international entities is creating a positive market outlook.

The report has provided a comprehensive analysis of the competitive landscape in the Saudi Arabia PPR pipes market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Al Koblan Thermopipe Factory Co.

- Almona Plastic Products Ltd. Co.

- MT-Plast Company

- Tahweel Pipes

- Al Munif Pip.

Key Questions Answered in This Report

- What was the size of the Saudi Arabia PPR pipes market in 2024?

- What is the expected growth rate of the Saudi Arabia PPR pipes market during 2025-2033?

- What are the key factors driving the Saudi Arabia PPR pipes market?

- What has been the impact of COVID-19 on the Saudi Arabia PPR pipes market?

- What is the breakup of the Saudi Arabia PPR pipes market based on the type?

- What is the breakup of the Saudi Arabia PPR pipes market based on application?

- Who are the key players/companies in the Saudi Arabia PPR pipes market?

Table of Contents

Companies Mentioned

- Al Koblan Thermopipe Factory Co.

- Almona Plastic Products Ltd. Co.

- MT-Plast Company

- Tahweel Pipes

- Al Munif Pipe

Table Information

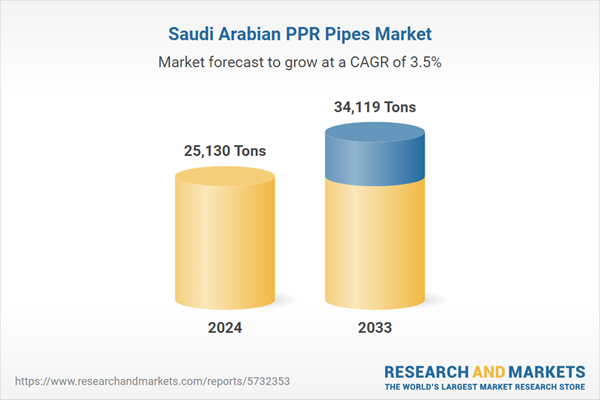

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 25130 Tons |

| Forecasted Market Value by 2033 | 34119 Tons |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 5 |