During the COVID-19 situation, where the population is generally avoiding hospital and clinic visits unless necessary, the trend of self-medication has been observed to increase exponentially. Over-the-counter (OTC) medicines are witnessing an unprecedented demand amid the COVID-19 crisis, owing to the restricted visits to hospitals and health professionals. For instance, in March 2020, Sandoz, one of the largest medicine providers, in Europe reported that it was increasing supplies of key antibiotics needed to respond to the COVID-19 crisis owing to the increased demand in the European countries.

The major factors propelling the growth of the Spain OTC drugs market include product innovation, growing distribution channels, an inclination of the pharmaceutical companies from Rx to OTC drugs, and increasing self-medication among the general population. The increasing healthcare costs demand better accessibility and affordability of healthcare services. Self-medication with non-prescription drugs has increased in the past years owing to its advantages, such as it helps improve the accessibility and cost benefits of healthcare services. Thus, there is an increase in the trend toward self-medication in European countries, including Spain.

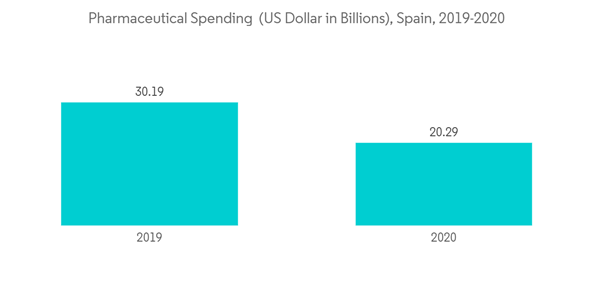

For instance, a report published in June 2020, titled "Spain Pharma Market & Regulatory Report" stated that according to the Spain's pharmaceutical market with patented drugs comprising 81% of the total in 2019 at a value of USD 24.45 billion. The generic drugs accounted for a low 14.3% of the market and over-the-counter (OTC) medicines accounted for just 4.7% of the market. The same source that, from November 1 2019, Spain’s Ministry of Health implemented a price reduction across 16,454 medicines. These price cuts will impact prescription (pharmacy and hospital setting) and OTC medicines, which are expected to reduce public expenditure on medicines by USD 129 million a year. Such intitatives by the government would support the growth of the market in upcoming period.

Thus, owing to the abovementioned factors, market is expected to show growth over the forecast period. However, incorrect self diagnosis and probability of self abuse may hinder the growth of the market.

Key Market Trends

The Cough, Cold, and Flu Products Segment is Expected to Dominate the Market over the Forecast Period

The growth of the over-the-counter (OTC) drugs in the cough/cold/flu category is driven by a rise in the number of individuals affected by these conditions. The increasing prevalence of these common diseases such as cough, cold, and flu has led patients to use OTC drugs, as these drugs are readily available and can be bought without a doctor’s prescription. For instance, in May 2021, according to the European Union’s statistics agency, Eurostat if demographic trends persist, the average age on the continent will rise to 49.1 years by 2050, a leap of four years from 2019. And in 30 years’ time, four of the European regions with the oldest populations will be in Spain. The aging population increases the market growth as old people are most prone to cough, cold, and flu.

Various studies published by institutes are another factor in the growth of the market. For instance, in January 2020, research published titled "Spain: Flu epidemic wave of the 2019-2020 season has officially begun" stated that according to Amparo Larrauri with the Carlos III Health Institute, “It is estimated that in the last two seasons of influenza, epidemics have produced between 500,000 and 700,000 cases of mild disease treated in primary care; between 35,000 and 52,000 hospitalizations with influenza, and between 2,500 and 3,000 admissions in ICU with laboratory-confirmed influenza. Such studies provide insight on the growing prevalence of disease which would increase the market growth. For these diseases, the patient generally prefers taking self-medication rather than going to the doctor to save both time and cost required to visit a physician/hospital. Consumers are dependent on OTC drugs for cough and cold medicines as the first response for quick relief from symptoms. Owing to their ease in procurement and surging market demand, the sale of OTC drugs for cough, cold, and flu is seen increasing in Spain.

Quick-relief tablets, including throat lozenges, provide quick relief from throat tickles and have the highest demand in the market, which contributes as one of the major growth factors for the segment. Aspirin is one of the most widely used drugs to provide quick relief from headaches, and it is the most commonly demanded OTC drug worldwide. Moreover, the improved quality and efficacy of OTC products for cough, cold, and flu are strongly driving the market.

Competitive Landscape

The Spain over-the-counter (OTC) drugs market is highly competitive. There are some major players that are holding the major share, along with some smaller companies holding a substantial share. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by introducing new products with fewer prices. Key players in the market are Bayer, Pfizer Inc., Sanofi SA, GlaxoSmithKline PLC, and Reckitt Benckiser Group PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.2.1 Inclination of Pharmaceutical Companies to Switch From Rx to OTC Drugs

4.2.2 Increasing Self Medication Among the General Population

4.2.3 High Penetration in Emerging Markets

4.3 Market Restraints

4.3.1 Incorrect Self Diagnosis

4.3.2 Probability of Substance Abuse

4.4 Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

5.1 By Product

5.1.1 Cough, Cold, and Flu Products

5.1.2 Analgesics

5.1.3 Dermatology Products

5.1.4 Gastrointestinal Products

5.1.5 Vitamin, Mineral, and Supplement (VMS) Products

5.1.6 Weight-loss/Dietary Products

5.1.7 Ophthalmic Products

5.1.8 Sleeping Aids

5.1.9 Other Product Types

5.2 By Distribution Channel

5.2.1 Retail Pharmacies

5.2.2 Online Pharmacies

5.2.3 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

6.1 Company Profiles

6.1.1 Astrazeneca PLC

6.1.2 Bayer

6.1.3 Bristol-Myers Squibb

6.1.4 Cardinal Health

6.1.5 GlaxoSmithKline PLC

6.1.6 Johnson and Johnson

6.1.7 Leo Pharma AS

6.1.8 Procter & Gamble ( Merck & Co.)

6.1.9 Novartis AG

6.1.10 Pfizer Inc.

6.1.11 Reckitt Benckiser Group PLC

6.1.12 Sanofi SA

6.1.13 Takeda Pharamaceutical Company Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Astrazeneca PLC

- Bayer

- Bristol-Myers Squibb

- Cardinal Health

- GlaxoSmithKline PLC

- Johnson and Johnson

- Leo Pharma AS

- Procter & Gamble ( Merck & Co.)

- Novartis AG

- Pfizer Inc.

- Reckitt Benckiser Group PLC

- Sanofi SA

- Takeda Pharamaceutical Company Ltd