COVID-19 impacted the studied market owing to the reduction in physiotherapy clinic visits and supply chain disruptions of the equipment. For instance, an article published in Work Journal in 2022 stated that out of the total surveyed physiotherapists, 62.9% suspended their services while 37% of all participanthile 37% of all participants worked without suspending their services during the pandemic. Also, clinics and home visits of physiotherapists were suspended during the pandemic. Therefore, due to the high chances of physical contact among physiotherapists, equipment, and patients, leading to COVID-19 transmission, the physiotherapy equipment market slightly declined during the pandemic. However, the market recovered in the last few years due to the increasing use of physiotherapy equipment for COVID-19, musculoskeletal, and other diseases requiring physiotherapy for movement and other daily activities.

The increasing incidence of cardiovascular, musculoskeletal, and neurological disorders and the increasing demand for rehabilitation after surgeries, chemotherapy, and radiation are expected to stimulate the demand for physiotherapy equipment worldwide.

The musculoskeletal disorder leads to restricted mobility and is a major contributor to disability. For instance, according to the article published in the Annals of Medicine and Surgery in December 2021, the prevalence of work-related musculoskeletal disorders among the surveyed participants of North West Ethiopia was 64.2%. Additionally, according to Work-Related Musculoskeletal Disorders statistics, around 470 thousand people suffered from work-related musculoskeletal disorders which were new or long-standing in Great Britain, in 2021. Therefore, the high burden of musculoskeletal disorders and arthritis is expected to increase the need for physiotherapy equipment, thereby accelerating market growth.

Furthermore, the increasing burden of neurological disorders among the population is the major factor driving the demand for physiotherapy equipment for neurology rehabilitation. For instance, an article published in July 2022 in the International Journal of Environmental Research and Public Health stated that the most used physiotherapy procedures in elderly with neurological disorders are balance and gait training, occupational therapy, classical physiotherapy, walking and treadmill training, and upper limb robot-assisted therapy. Also, according to a WHO article published in March 2023, over 55 million people have dementia worldwide currently. As per the same source, nearly 10 million new cases are diagnosed every year. The high burden of dementia and other neurological diseases is expected to boost the demand for physiotherapy equipment to promote physical activity.

The strategic initiatives adopted by market players such as product launches and acquisitions significantly contribute to market growth. For instance, in April 2021, the National Office of Thermalism and Hydrotherapy (ONTH) launched one of the first mobile applications on hydrotherapy 'Tunisia Wellness'. Such launches boost the utility of physiotherapy equipment, thereby accelerating market growth.

Therefore, owing to the aforementioned factors such as the high burden of musculoskeletal and neurological conditions and rising product launches and acquisitions by market players, the studied market is anticipated to witness growth over the analysis period. However, the lack of trained and skilled personnel and inadequate reimbursement policies is estimated to restrain the market growth.

Physiotherapy Equipment Market Trends

The Musculoskeletal Segment is Expected to Witness Healthy Growth During the Forecast Period

The musculoskeletal segment is projected to witness significant growth in the market over the forecast period owing to the rising geriatric population, the increasing prevalence of musculoskeletal disorders, technological advancements, and product launches.According to a WHO article updated in July 2022, approximately 1.71 billion people have musculoskeletal conditions worldwide. Additionally, as per Versus Arthritis 2022 article, 20.3 million people had a musculoskeletal condition such as arthritis or back pain in the United Kingdom in 2021. Therefore, the high burden of musculoskeletal disorders is expected to boost the demand for innovative physiotherapy equipment for treating such movement disorders. Furthermore, common musculoskeletal disorders, like lower back pain are the most common reasons for patients visiting physiotherapists, which is expected to drive market growth.

Furthermore, rising launches and partnerships among market players to strategically introduce new technologies into the market also support market expansion. For instance, in September 2021, IncludeHealth launched MSK-OS, a new musculoskeletal operating system that emphasizes virtual physical therapy. The latest release is a result of a partnership between Google and ProMedica Health Systems. Also, in March 2022, CSP worked with other professionals on the new toolkit's creation. It offers best-practice clinical guidelines to promote service recovery and transformation opportunities for patients with shoulder pain, sciatica, hip and knee osteoarthritis, spinal pain, and all other MSK pathway conditions in primary and community care settings.

Moreover, in August 2022, The Assam Down Town University (AdtU) inaugurated new physiotherapy program labs, including Gait Lab, an Electromyography studies lab, and a Pulmonary function test lab with spirometers. Electromyography labs will provide diagnostics to rule out any musculoskeletal complications. Such developments ultimately expand the segment's growth during the forecast period.

Thus, the aforementioned factors such as the high burden of musculoskeletal disorders and rising launches and partnerships among the market players are expected to boost the segment growth over the forecast period.

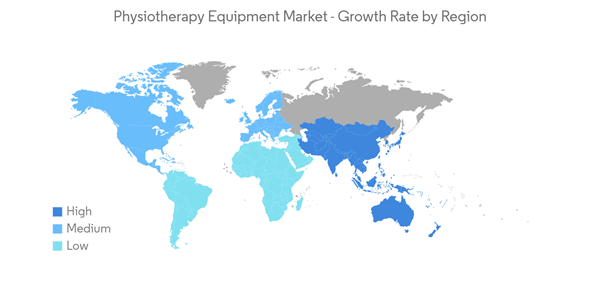

North America is Expected to Hold a Significant Share in the Physiotherapy Equipment Market During the Forecast Period

North America is expected to dominate the market owing to factors such as the rising burden of cardiovascular and musculoskeletal diseases, increasing research activities, product launches, partnerships, and acquisitions along with the high concentration of market players in the region.The high burden of cardiovascular diseases and arthritis in the region, coupled with the rising number of patients with neurological and musculoskeletal diseases have driven the market for physiotherapy equipment. For instance, according to the National Center for Health Statistics, 2022 update, the percentage of coronary heart disease among adults aged 18 years and over in the United States increased to 4.9% in 2021 as compared to 4.6% in the previous years. Also, according to the report published by SingleCare in January 2022, rheumatoid arthritis affects more than 1.36 million adults in the United States every year. Therefore, the high burden of such diseases is likely to create demand for physiotherapy equipment for the management of such diseases.

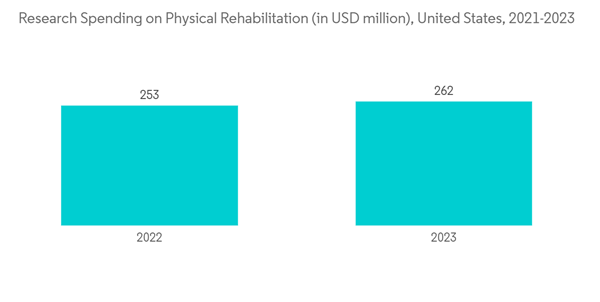

Besides, the rising research activities in the region for the development of advanced physiotherapy equipment are expected to accelerate the market during the upcoming years. For instance, in an article published in the journal Science Advances in February 2023, researchers at Northwestern University developed an 'e-bandage' that accelerated healing by 30% through the delivery of electrotherapy to the wound site in diabetic patients.

The acquisitions, partnerships, and launches by the major players to strengthen their market position in physiotherapy equipment further contribute to the market growth. For instance, in September 2022, Hyperice, a high-performance wellness brand, launched two new products within their heat therapy category, Venom Go and Venom 2, alongside HyperHeat technology for the fastest, most consistent, and even distribution of heat to relieve sore, stiff muscles and promote wellness. Such advanced launches are anticipated to boost the market growth in the region during the forecast period.

Therefore, owing to the above-mentioned factors such as the high burden of cardiovascular diseases, rising research activities, and product launches by market players, the growth of the studied market is anticipated in the North America Region.

Physiotherapy Equipment Industry Overview

The physiotherapy equipment market is moderately competitive with few major players. The development of equipment with enhanced capabilities and partnerships with local distributors for geographical expansion is a strategy of the market players. Furthermore, there is an ongoing trend of rapid consolidation, with several major players being involved in merger and acquisition activities. The major players in the market include BTL Industries, DJO Global, EMS Physio, Zynex Medical Inc., Enraf-Nonius BV, and Patterson Medical, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BTL Industries

- DJO Global Inc.

- Dynatronics Corporation

- EMS Physio

- Enraf-Nonius BV

- Life Care Systems

- Patterson Medical

- Zynex Medical Inc.

- HMS Medical Systems

- SEERS Medical Ltd