Key Highlights

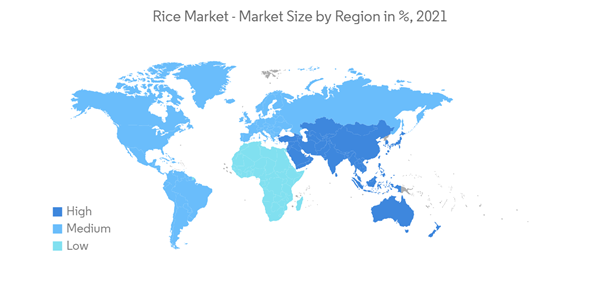

- As a cereal grain, rice is the most widely consumed staple food for most of the global human population, especially in Asia, accounting for nearly 90% of rice production and consumption. Rice is cultivated in more than 120 countries, with China and India accounting for 50% of rice production globally. It is the primary agricultural commodity with the third-highest worldwide production after maize and sugarcane. It is the staple food of more than half of the global population, with the Asian, sub-Saharan African, and South American regions being the largest consumers.

- The increasing food and restaurant sector is anticipated to promote market growth in the future. Likewise, continuous global development in rice mill machinery and attractive packaging enhance product demand in emerging economies. The rising demand for specialty rice varieties has increased the trade for long-grain rice, which in turn is driving the market growth. Additionally, constantly changing lifestyles and food habits among consumers are accelerating the fast-food industry market, which is expected to drive significant market growth during the forecast period.

- Hence, the dependency on monsoons, the heavy incidence of pests and diseases, and other factors, like shortage of land and labor, are expected to impede the market growth during the forecast period.

- Asia-Pacific is the largest rice market. This is attributable to higher per capita consumption, production, and regional population. Most of the rice is grown and consumed in the Asian region, from Japan in the east to Pakistan in the west. Rice is the second-most vital cereal crop, after wheat, in Asia. It is a crop that ensures food security in many developing countries of Southeast Asian as well as East Asia regions. Over recent years, the rice market has witnessed considerable growth due to the growing demand for rice in emerging and developing nations globally.

Rice Market Trends

Growing preference for specialty rice varieties leads to increased trade

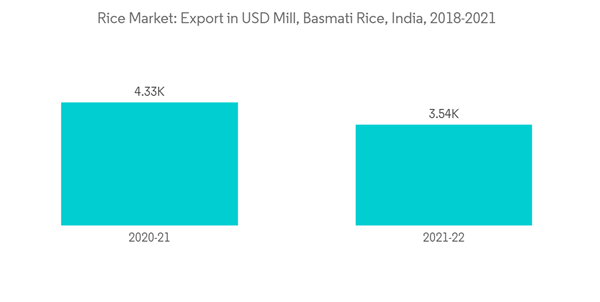

The demand for specialty rice has been gaining traction globally, bolstered by consumers' growing concerns about health and wellness. Compared with regular milled white rice, specialty rice varieties are rich in vitamins and minerals, aid good health, and are good sources of fiber. Therefore, such varieties are witnessing an immense demand among consumers.Around the world, basmati rice is one of the best types of rice. It is known for its slender, sleek, tapering grains with a unique taste, aroma, and grain elongation quality upon cooking. Exports of the premium variety from India have an 85% share in the basmati export market. The United States imports Asian aromatic rice, such as jasmine and basmati. India is the top exporter of basmati rice to the global market. According to the Agricultural and Processed Food Products Export Development Authority (APEDA), the country exported 3,948,161.03 metric ton of basmati rice to the world for the worth of INR 26,416.49 Crores ( USD 3,540.40 Million) during the year 2021-22. In 2021, Saudi Arabia, Iran, Iraq, the United States, and the United Arab Emirates were the major importers of basmati rice.

In 2021, China, the Philippines, the Kingdom of Saudi Arabia, the United States, Bangladesh, and Iraq were the major importers of rice globally. China and the Philippines account for 45% of the rice imports at the global level. India exports huge volumes of aromatic and long-grain basmati rice, which is anticipated to increase with tourism and changes in food patterns. Port handling infrastructure, the value chain development, and exploring new opportunities in countries or markets for rice exports led to a huge spike in rice exports.

In Europe, the demand for specialty and exotic varieties, such as basmati as well as jasmine rice, is growing exponentially. A significant share of imported rice consists of long-grain Indica rice and aromatic varieties (basmati and jasmine), which are popular mainly in Northern Europe. The United Kingdom dominates the imports of basmati rice, mainly from India. Therefore, the demand for special and exotic rice varieties is expected to increase during the coming year.

Asia-Pacific Dominates the Market

Rice is the staple food of Asia and part of the Pacific. According to the Food and Agriculture Organization, about 90% of the global rice is produced and consumed in Asia. India and China are the prominent producers of rice, with a production of 177.6 million metric ton and 211.4 million metric ton, respectively, in 2020.Over the ages, China has dominated production and continues to do so. All rice cultivation is highly labor-intensive. Rice farms are mainly located in Central China, accounting for about 49% of Chinese rice production (National Bureau of Statistics of China). Apart from meeting its huge domestic demand, China also exports a significant quantity of rice globally. Major importers of Chinese rice are Ivory Coast, Korea, Egypt, Turkey, and Japan. Rice production will likely remain high during the forecast period, given the high local consumption and global export demands.

Likewise, rice production in India has increased by 3.5 times in the last 60 years. According to the Rice Exporters Association, Indian rice exports touched 20 million ton in 2021, as well as 16 million ton of non-basmati rice. Rice being vital, no country-enforced restrictions on its import. Furthermore, the Indian government has been helping farmers to take up rice cultivation by providing a minimum support price (MSP). For the 2021-2022 Kharif season, the minimum selling price (MSP) was INR 1,940 per quintal compared to INR 1,868 per quintal in 2021.

After China and India, Indonesia, Bangladesh, Vietnam, and Thailand were the next largest rice producers. Thus, owing to increasing demand and government initiatives to increase rice production, the market is anticipated to grow during the coming year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.