Global Modular Laboratory Automation Market - Key Trends & Drivers Summarized

Modular laboratory automation represents a transformative approach in the realm of scientific research and diagnostic testing, offering tailored solutions that significantly enhance efficiency and flexibility in laboratory processes. This system integrates various automated laboratory instruments, software, and methodologies into a cohesive framework that can be easily customized or scaled according to the specific needs of a laboratory. By adopting modular components, labs can optimize their workflows for high-throughput screening, genetic sequencing, drug development, and clinical diagnostics. The modular nature of this technology allows for the incremental addition or removal of modules to accommodate changing research demands or technological advancements. This adaptability not only maximizes resource utilization but also reduces the downtime typically associated with reconfiguring entire systems, thereby streamlining operations and cutting costs.The integration of modular automation systems in laboratories has been further propelled by advancements in digital technology, particularly in areas such as artificial intelligence (AI) and machine learning. These technologies enhance the capabilities of modular systems, enabling more sophisticated data analysis and decision-making processes. AI algorithms can predict equipment failures, optimize resource allocation, and automate complex decision trees in experimental procedures, thus reducing human error and enhancing reproducibility. Additionally, the use of cloud-based platforms for data management in modular systems allows for seamless integration and accessibility of data across multiple modules and geographic locations. This connectivity not only facilitates remote monitoring and control of laboratory processes but also supports collaborative research efforts across different fields and institutions, fostering innovation and speeding up the development of new scientific breakthroughs.

The growth in the modular laboratory automation market is driven by several factors, including the increasing demand for precision and reproducibility in research outputs, the need for cost-effective lab operations, and the rising prevalence of complex biological and chemical research requiring versatile analytical approaches. Economic pressures and competition within the pharmaceutical and biotechnology sectors encourage labs to adopt modular systems to enhance productivity and maintain competitiveness. Consumer behavior, particularly the demand for faster and more reliable test results in medical diagnostics, also propels the adoption of these systems. Furthermore, the push for personalized medicine and the expansion of genomics and proteomics necessitate automation solutions that can adapt quickly to evolving scientific research requirements. As such, the continual advancements in related technologies, coupled with growing industry requirements for efficient, scalable, and precise laboratory operations, drive the sustained expansion of the modular laboratory automation market.

Report Scope

The report analyzes the Modular Laboratory Automation market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Equipment and Software (Automated Liquid Handlers, Automated Plate Handlers, Robotic Arms, Automated Storage & Retrieval Systems (ASRS), Software, Analyzers); and End-Use (Hospitals & Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, and Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automated Liquid Handlers segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of 6.7%. The Automated Plate Handlers segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $951.4 Million in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $835.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Modular Laboratory Automation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Modular Laboratory Automation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Modular Laboratory Automation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Honeywell International, Inc., Agilent Technologies, Inc., Becton, Dickinson and Company, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Modular Laboratory Automation market report include:

- Honeywell International, Inc.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- Eppendorf AG

- BioTek Instruments, Inc.

- F. Hoffmann-La Roche AG

- Analytik Jena AG

- Hudson Robotics, Inc.

- HighRes Biosolutions

- A&T Corporation

- Formulatrix

- Anton Paar GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Honeywell International, Inc.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- Eppendorf AG

- BioTek Instruments, Inc.

- F. Hoffmann-La Roche AG

- Analytik Jena AG

- Hudson Robotics, Inc.

- HighRes Biosolutions

- A&T Corporation

- Formulatrix

- Anton Paar GmbH

Table Information

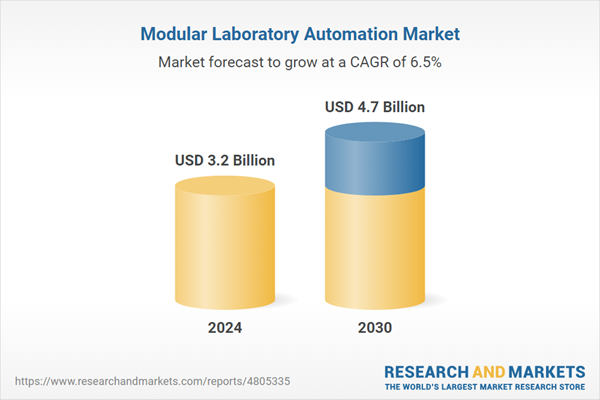

| Report Attribute | Details |

|---|---|

| No. of Pages | 397 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |