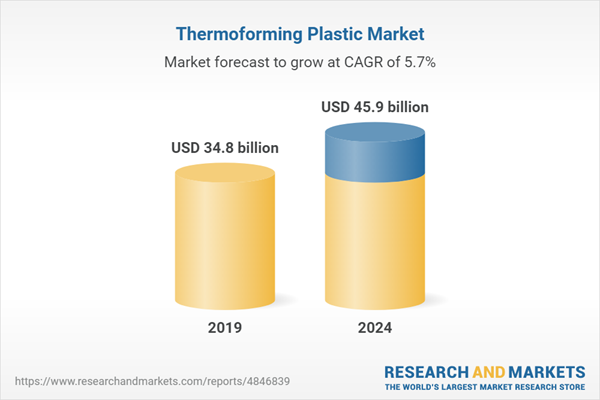

The thermoforming plastic market is projected to register a CAGR of 5.7% during the forecast period

Automotive packaging & structures are the fastest-growing end-use industry of thermoforming plastic, in terms of value

Thermoforming plastic is gaining importance in the automotive packaging & structures end-use industry. Thermoformed plastic parts in the automotive sector are durable, reusable, and can be customized in any color. These parts do not require painting. Thermoformed parts are strong and can be reinforced. Some other properties include lightweight, easy to clean, and chemical resistance. Some of the major applications include dashboard assemblies, interior door panels, seating parts, engine bay paneling, exterior body panels, bumpers, air ducts, pickup truck bed liners, wheel well liners, truck liners, floor mats, and cargo mats.

The vacuum forming thermoforming plastic segment accounted for a major share of the thermoforming plastic market, in terms of value, during the forecast period

The global thermoforming plastic market is projected to be dominated by the vacuum forming thermoforming plastic segment, in terms of both value and volume during the forecast period. Vacuum forming is cost-effective, provides quicker tooling, and has the ability to form very large parts. This process also allows for sharper details, undercuts, mold-in-texture, and has tighter tolerances. Whereas pressure forming process is used mostly for complex shapes. The mechanical forming process is used rarely for thermoforming plastic.

North America is the largest, and APAC is the fastest-growing thermoforming plastic market

North America is the largest region in the thermoforming plastic market due to the high demand for thermoformed structural parts and thermoformed packaging from automotive, food & agriculture packaging, consumer goods & appliances, and healthcare industries. North America is home to some of the prominent thermoforming plastic manufacturers such as Pactiv LLC, Sonoco Products Company, D&W Fine Pack LLC, and so on. APAC is the fastest-growing region as the growing population presents a huge customer base for FMCG products and consumer durables, which in turn is expected to lead to the growth of the thermoforming plastic market.

This study has been validated through primaries conducted with various industry experts, globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 35%, Tier 2- 25%, and Tier 3- 40%

- By Designation- C Level- 35%, Director Level- 30%, and Others- 35%

- By Region- APAC- 30%, Europe- 30%, North America- 25%, MEA-10%, Latin America-5%

The report provides a comprehensive analysis of company profiles listed below:

- Fabri-Kal Corp. (US)

- Berry Global Inc. (US)

- Genpak LLC (US)

- Pactiv LLC (US)

- D&W Fine Pack LLC (US)

- Amcor Ltd. (Australia)

- Dart Container Corp. (US

- Anchor Packaging (US)

- Sabert Corporation (US)

- Sonoco Products Company (US)

Research Coverage:

This report covers the global thermoforming plastic market and forecasts the market size until 2024. The report includes the market segmentation - Plastic Type (PP, PS, PET, PE, PVC, Bio-plastics, ABS), Thermoforming Type (Vacuum Formed, Pressure Formed, Machines Formed), Parts Type (Thin Gauge, Thick Gauge), End-use Industry (Food & Agriculture Packaging, consumer goods & appliances, healthcare & pharmaceutical, construction, electrical & electronics, automotive packaging & structures), and region (Europe, North America, APAC, Latin America, and MEA). Porter’s Five Forces analysis, along with the drivers, restraints, opportunities, and challenges are discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global thermoforming plastic market.

Key benefits of buying the report:

- This report segments the global thermoforming plastic market comprehensively and provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

- The report helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product launches, partnerships, expansions, and acquisitions.

Reasons to buy the report:

- The report will help market leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall thermoforming plastic market and the sub-segments.

- This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

- The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Thermoforming Plastic Market: Market Segmentation

1.3.2 Years Considered for the Report

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primary Interviews

2.3 Market Size Estimation

2.3.1 Supply Side Analysis

2.4 Data Triangulation

2.5 Research Assumptions

2.6 Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Thermoforming Plastic Market

4.2 Thermoforming Plastic Market, By Thickness

4.3 Thermoforming Plastic Market, By Thermoforming Type

4.4 Thermoforming Plastic Market Size, By Plastic Type

4.5 Thermoforming Plastic Market, By End-Use Industry and Region

4.6 Thermoforming Plastic Market, By Country

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand From Food Packaging Industry

5.2.1.2 Growing Demand From Healthcare & Pharmaceutical Industry

5.2.1.3 Reduced Packaging Waste

5.2.1.4 Cost Effectiveness

5.2.2 Restraints

5.2.2.1 Not Supportive to Package Heavy Items

5.2.3 Opportunities

5.2.3.1 Increasing Demand of In-Mold Labelling in Packaging

5.2.3.2 Potential Opportunities of Thermoforming Plastic in Emerging Economies

5.2.3.3 Investment in R&D Activities

5.2.4 Challenges

5.2.4.1 Compliance With Stringent Regulations

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends

6.1 Introduction

6.2 Trends and Forecast of Gdp

6.3 Trends in Aerospace Industry

6.4 Trends in the Automotive Industry

7 Thermoforming Plastic Market, By Plastic Type

7.1 Introduction

7.2 Polypropylene (PP)

7.3 Polystyrene (PS)

7.4 Polyethylene Terephthalate (PET)

7.5 Polyethylene (PE)

7.6 Poly Vinyl Chloride (PVC)

7.7 Bio-Plastics

7.8 Acronytrile Butadiene Styrene (ABS)

7.9 Others

8 Thermoforming Plastic Market, By Thermoforming Type

8.1 Introduction

8.2 Vacuum Forming

8.3 Pressure Forming

8.4 Mechanical Forming

9 Thermoforming Plastic Market, By Thickness

9.1 Introduction

9.2 Thin Gauge

9.3 Thick Gauge

10 Thermoforming Plastic Market, By End-Use Industry

10.1 Introduction

10.2 Food & Agriculture Packaging

10.3 Consumer Goods & Appliances

10.4 Healthcare & Pharmaceutical

10.5 Construction

10.6 Electrical & Electronics

10.7 Automotive Packaging & Structures

10.8 Others

11 Thermoforming Plastic Market, By Region

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increasing Sales of Consumer Durables and Presence of Large Thermoforming Plastic Manufacturers in the US are Driving the Market

11.2.2 Canada

11.2.2.1 Flourishing Food & Beverage and Consumer Durables Industries are Propelling the Market

11.3 Europe

11.3.1 Germany

11.3.1.1 Large Food Processing Industry is A Major Driving Factor for the Thermoforming Plastic Market in Germany

11.3.2 UK

11.3.2.1 High Spending on Healthcare Sector is Fueling the Market Growth in the UK

11.3.3 France

11.3.3.1 Large Electrical & Electronics and Automotive Industries in the Country is Helping the Market Growth

11.3.4 Italy

11.3.4.1 Growth of Major End-Use Industries, Including Consumer Goods & Appliances and Electrical & Electronics is Expected to Support the Market Growth

11.3.5 Netherlands

11.3.5.1 Thermoforming Plastic Finds Wide Use in the Netherlands Food & Agriculture Packaging and Healthcare & Pharmaceutical Packaging Industries 104

11.3.6 Rest of Europe

11.4 APAC

11.4.1 China

11.4.1.1 Growing Food & Beverages Industry and Large Population are Expected to Drive the Market

11.4.2 Japan

11.4.2.1 Technology Advancements and Large Retail Industry are the Two Major Factors That are Driving the Market

11.4.3 India

11.4.3.1 Rising Middle-Class Population, Rapid Industrialization, Continuous Influx of Multinational Companies Will Influence the Market Positively

11.4.4 Australia

11.4.4.1 Rising Consumption of Packed Foods and Presence of Prominent Thermoforming Plastic Manufacturers Will Influence the Market Positively

11.4.5 South Korea

11.4.5.1 Heavy Investment in Automotive and Consumer Electronics Sectors is Anticipated to Increase Thermoforming Plastic Consumption

11.4.6 Rest of Asia-Pacific

11.5 Latin America

11.5.1 Brazil

11.5.1.1 Advantages Associated With Use of Thermoforming Plastic is Driving the Market

11.5.2 Mexico

11.5.2.1 Increasing Demand From Automotive and Electrical & Electronics Industries is Expected to Drive the Market

11.5.3 Argentina

11.5.3.1 Rapid Urbanization is Fueling the Thermoforming Plastic Market Growth

11.6 Middle East & Africa (MEA)

11.6.1 South Africa

11.6.1.1 The Growth of the Middle Class Population is Increasing the Demand for Thermoforming Plastic

11.6.2 UAE

11.6.2.1 High Investments in Infrastructure Projects and Changing Consumer Preferences are Driving the Market

11.6.3 Saudi Arabia

11.6.3.1 Large Middle Class Population is Driving the Market

12 Competitive Landscape

12.1.1 Partnerships

12.1.2 Expansions

12.1.3 New Product Launches

12.1.4 Acquisitions

13 Competitive Landscape

13.1 Introduction

13.1.1 Dynamic Differentiators

13.1.2 Innovators

13.1.3 Visionary Leaders

13.1.4 Emerging Companies

13.2 Competitive Benchmarking

1.3.1 Product Offering

1.3.2 Business Strategy

13.2.1 Market Ranking

14 Company Profiles

14.1 Pactiv LLC

14.2 Amcor Limited

14.3 Dart Container Corporation

14.4 Sonoco Products Company

14.5 D&W Fine Pack LLC

14.5 Sabert Corporation

14.6 Genpak LLC

14.7 Fabri-Kal Corporation

14.8 Anchor Packaging

14.9 Berry Global Group Inc.

14.10 Other Key Players

14.10.1 Consolidated Container Company

14.10.2 Brentwood Industries

14.10.3 Placon Corporation

14.10.4 Winpak Ltd.

14.10.5 Spencer Industries Incorporated

14.10.6 Display Pack Inc.

14.10.7 Greiner Packaging International GmbH

14.10.8 Penda Corporation

14.10.9 Huntamaki

14.10.10 Zhuhai Zhongfu Enterprise Co. Limited.

15 Appendix

15.1 Discussion Guide

15.2 Knowledge Store: Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author DetailsList of Tables

Table 1 Thermoforming Plastic Market Size, 2017–2024

Table 1 Trends and Forecast of Gdp, 2017–2024 (USD Billion)

Table 2 Number of New Airplane Deliveries, By Region, 2017

Table 3 Automotive Production, Million Units (2017–2018)

Table 4 Thermoforming Plastic Market Size, By Plastic Type, 2017–2024 (USD Million)

Table 5 Thermoforming Plastics Market Size, By Plastic Type, 2017–2024 (Kiloton)

Table 6 PP Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 7 PP Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 8 PS Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 9 PS Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 10 PET Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 11 PET Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 12 PE Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 13 PE Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 14 Pvc Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 15 Pvc Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 16 Bio-Plastics Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 17 Bio-Plastics Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 18 ABS Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 19 ABS Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 20 Others Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 21 Others Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 22 Thermoforming Plastic Market Size, By Thermoforming Type, 2017–2024 (USD Million)

Table 23 Thermoforming Plastics Market Size, By Thermoforming Type, 2017–2024 (Kiloton)

Table 24 Vacuum Forming Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 25 Vacuum Forming Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 26 Pressure Forming Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 27 Pressure Forming Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 28 Mechanical Forming Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 29 Mechanical Forming Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 30 Thermoforming Plastic Market Size, By Parts, 2017–2024 (USD Million)

Table 31 Thermoforming Plastics Market Size, By Parts, 2017–2024 (Kiloton)

Table 32 Thin Gauge Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 33 Thin Gauge Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 34 Thick Gauge Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 35 Thick Gauge Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 36 Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 37 Thermoforming Plastics Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 38 Food & Agriculture Packaging Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 39 Food & Agriculture Packaging Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 40 Consumer Goods & Appliances Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 41 Consumer Goods & Appliances Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 42 Healthcare & Pharmaceautical Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 43 Healthcare & Pharmaceautical Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 44 Construction Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 45 Construction Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 46 Electrical & Electronics Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 47 Electrical & Electronics Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 48 Automotive Packaging & Structures Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 49 Automotive Packaging & Structures Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 50 Others Thermoforming Plastic Market, By Region, 2017–2024 (USD Million)

Table 51 Others Thermoforming Plastics Market, By Region, 2017–2024 (Kiloton)

Table 52 Thermoforming Plastic Market Size, By Region, 2017–2024 (Kiloton)

Table 53 Thermoforming Plastics Market Size, By Region, 2017–2024 (USD Million)

Table 54 North America: Thermoforming Plastic Market Size, By Country, 2017–2024 (Kiloton)

Table 55 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 56 North America: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 57 North America: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 58 North America: Market Size, By Plastic Type, 2017–2024 (USD Million)

Table 59 North America: Market Size, By Plastic Type, 2017–2024 (Kiloton)

Table 60 North America: Market Size, By Thermoforming Type, 2017–2024 (USD Million)

Table 61 North America: Market Size, By Thermoforming Type, 2017–2024 (Kiloton)

Table 62 North America: Market Size, By Parts Type, 2017–2024 (USD Million)

Table 63 North America: Market Size, By Parts Type, 2017–2024 (Kiloton)

Table 64 US: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 65 US: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 66 Canada: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 67 Canada: Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 68 Europe: Thermoforming Plastic Market Size, By Country, 2017–2024 (USD Million)

Table 69 Europe: Market Size, By Country, 2017–2024 (Kiloton)

Table 70 Europe: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 71 Europe: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 72 Europe: Market Size, By Plastic Type, 2017–2024 (USD Million)

Table 73 Europe: Market Size, By Plastic Type, 2017–2024 (Kiloton)

Table 74 Europe: Market Size, By Thermoforming Type, 2017–2024 (USD Million)

Table 75 Europe: Market Size, By Thermoforming Type, 2017–2024 (Kiloton)

Table 76 North America: Market Size, By Parts Type, 2017–2024 (USD Million)

Table 77 Europe: Market Size, By Parts Type, 2017–2024 (Kiloton)

Table 78 Germany: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 79 Germany: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 80 UK: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 81 UK: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 82 France: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 83 France: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 84 Italy: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 85 Italy: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 86 Thermoforming Plastics: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 87 Thermoforming Plastics: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 88 APAC: Thermoforming Plastic Market Size, By Country, 2017–2024 (USD Million)

Table 89 APAC: Market Size, By Country, 2017–2024 (Kiloton)

Table 90 APAC: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 91 APAC: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 92 APAC: Market Size, By Plastic Type, 2017–2024 (USD Million)

Table 93 APAC: Market Size, By Plastic Type, 2017–2024 (Kiloton)

Table 94 APAC: Market Size, By Thermoforming Type, 2017–2024 (USD Million)

Table 95 APAC: Market Size, By Thermoforming Type, 2017–2024 (Kiloton)

Table 96 APAC: Market Size, By Parts Type, 2017–2024 (USD Million)

Table 97 APAC: Market Size, By Parts Type, 2017–2024 (Kiloton)

Table 98 China: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 99 China: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 100 Japan: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 101 Japan: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 102 India: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 103 India: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 104 Australia: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 105 Australia: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 106 South Korea: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 107 South Korea: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 108 Latin America: Thermoforming Plastic Market Size, By Country, 2017–2024 (USD Million)

Table 109 Latin America: Market Size, By Country, 2017–2024 (Kiloton)

Table 110 Latin America: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 111 Latin America: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 112 Latin America: Market Size, By Plastic Type, 2017–2024 (USD Million)

Table 113 Latin America: Market Size, By Plastic Type, 2017–2024 (Kiloton)

Table 114 Latin America: Market Size, By Thermoforming Type, 2017–2024 (USD Million)

Table 115 Latin America: Market Size, By Thermoforming Type, 2017–2024 (Kiloton)

Table 116 Latin America: Market Size, By Parts Type, 2017–2024 (USD Million)

Table 117 Latin America: Market Size, By Parts Type, 2017–2024 (Kiloton)

Table 118 Brazil: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 119 Brazil: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 120 Mexico: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 121 Mexico: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 122 Argentina: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 123 Argentina: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 124 MEA: Thermoforming Plastic Market Size, By Country, 2017–2024 (USD Million)

Table 125 MEA: Market Size, By Country, 2017–2024 (Kiloton)

Table 126 MEA: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 127 MEA: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 128 MEA: Market Size, By Plastic Type, 2017–2024 (USD Million)

Table 129 MEA: Market Size, By Plastic Type, 2017–2024 (Kiloton)

Table 130 MEA: Market Size, By Thermoforming Type, 2017–2024 (USD Million)

Table 131 MEA: Market Size, By Thermoforming Type, 2017–2024 (Kiloton)

Table 132 MEA: Market Size, By Parts Type, 2017–2024 (USD Million)

Table 133 MEA: Market Size, By Parts Type, 2017–2024 (Kiloton)

Table 134 South Africa: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 135 South Africa: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 136 UAE: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 137 UAE: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 138 Saudi Arabia: Thermoforming Plastic Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 139 Saudi Arabia: Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 140 Partnerships, 2015–2019

Table 141 Expansions, 2015–2019

Table 142 New Product Launches, 2015–2019

Table 143 Acquisitions, 2015–2019List of Figures

Figure 1 Thermoforming Plastic Market: Research Design

Figure 2 Market Number Estimation

Figure 3 Methodology: Supply Side Sizing

Figure 4 Thermoforming Plastic Market: Data Triangulation

Figure 5 Vacuum Forming Segment Dominated Overall Market in 2018

Figure 6 Thin Gauge Segment Dominated Overall Market in 2018

Figure 7 PP Based Thermoforming Plastic Dominated Overall Market in 2018

Figure 8 Food & Agriculture Packaging Dominates Overall Thermoforming Plastic Market

Figure 9 US to Be the Largest Market for Thermoforming Plastic, in Terms of Value

Figure 10 North America to Be the Largest Thermoforming Plastic Market

Figure 11 High Demand From Healthcare & Pharmaceautical and Automotive Industries to Drive the Market

Figure 12 Thin Gauge Thermoforming Plastic to Dominate Overall Thermoforming Plastic Market

Figure 13 Vacuum Forming Plastic to Be Fastest-Growing Segment in Overall Market

Figure 14 PP Segment to Be Dominant Plastic Type of Thermoforming Plastic Market

Figure 15 Food & Agriculture Packaging Segment to Dominate Overall Thermoforming Plastic Market

Figure 16 China to Register Highest CAGR in Thermoforming Plastic Market

Figure 17 Drivers, Restraints, Opportunities, and Challenges in the Thermoforming Plastic Market

Figure 18 Porter’s Five Forces Analysis

Figure 19 Trends and Forecast of Gdp, 2019–2024 (USD Billion)

Figure 20 New Airplane Deliveries, By Region, 2017

Figure 21 Automotive Production in Key Countries, Million Units (2017 vs. 2018)

Figure 22 PP to Dominate the Overall Thermoforming Plastic Market, in Terms of Value, During Forecast Period

Figure 23 North America to Dominate the Overall PP Market, in Terms of Value, During Forecast Period

Figure 24 North America to Dominate the PS Market, in Terms of Value, During Forecast Period

Figure 25 North America to Dominate the PET Market, in Terms of Value, During Forecast Period

Figure 26 Vacuum Forming to Dominate the Overall Thermoforming Plastic Market, in Terms of Value, During Forecast Period

Figure 27 Thin Gauge to Dominate the Overall Thermoforming Plastic Market, in Terms of Value, During Forecast Period

Figure 28 Food & Agriculture Packaging to Dominate the Overall Thermoforming Plastic Market, in Terms of Value, During Forecast Period

Figure 29 North America to Dominate the Food & Agriculture Packaging Market, in Terms of Value, During Forecast Period

Figure 30 North America to Dominate the Consumer Goods & Appliances Market, in Terms of Value, During Forecast Period

Figure 31 North America to Dominate the Healthcare & Pharmaceautical Market, in Terms of Value, During Forecast Period

Figure 32 China to Register the Highest CAGR

Figure 33 North America: Thermoforming Plastic Market Snapshot

Figure 34 Europe: Thermoforming Plastic Market Snapshot

Figure 35 APAC: Thermoforming Plastic Market Snapshot

Figure 36 Acquisition is the Most Preferred Growth Strategies Adopted By Major Players Between 2015 and 2019

Figure 37 Dive Chart

Figure 38 Pactiv LLC: Company Snapshot

Figure 39 Amcor Limited: Company Snapshot

Figure 40 Dart Container Corporation: Company Snapshot

Figure 41 Dart Container Corporation: SWOT Analysis

Figure 42 Sonoco Products Company: Company Snapshot

Figure 43 Sonoco Products Company: SWOT Analysis

Figure 44 D&W Fine Pack LLC: Company Snapshot

Figure 45 D&W Fine Pack LLC: SWOT Analysis

Figure 46 Sabert Corporation: Company Snapshot

Figure 47 Genpak LLC: Company Snapshot

Figure 48 Fabri-Kal Corporation: Company Snapshot

Figure 49 Anchor Packaging: Company Snapshot

Figure 50 Berry Global Group Inc.: Company Snapshot

Companies Mentioned

- Amcor Limited

- Anchor Packaging

- Berry Global Group Inc.

- Brentwood Industries

- Consolidated Container Company

- D&W Fine Pack LLC

- Dart Container Corporation

- Display Pack Inc.

- Fabri-Kal Corporation

- Genpak LLC

- Greiner Packaging International GmbH

- Huntamaki

- Pactiv LLC

- Penda Corporation

- Placon Corporation

- Sabert Corporation

- Sonoco Products Company

- Spencer Industries Incorporated

- Winpak Ltd.

- Zhuhai Zhongfu Enterprise CoLimited.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 167 |

| Published | September 2019 |

| Forecast Period | 2019 - 2024 |

| Estimated Market Value ( USD | $ 34.8 billion |

| Forecasted Market Value ( USD | $ 45.9 billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |