Boarding is one of the major processes of aircraft turnaround time with a direct influence on airline companies' costs. One of the main growth factors in the market for apron buses is the quicker boarding process. Apron buses are the best option at some airports to transport passengers from the plane to the terminal or vice versa. As airlines continuously strive for better passenger satisfaction, they must speed up the boarding process. The increasing air passenger traffic and the corresponding growth in airline fleets are the main drivers for the market growth. Also, the lack of available boarding bridges at airports is causing the need to introduce apron buses. In addition, the faster boarding process and its contribution to improving a comfortable experience for all passengers should attract customer attention. In addition, in order to limit emissions caused by the aging diesel engines on buses, a number of airlines are adopting an electrical bus equipped with Anaba's electronic motors.

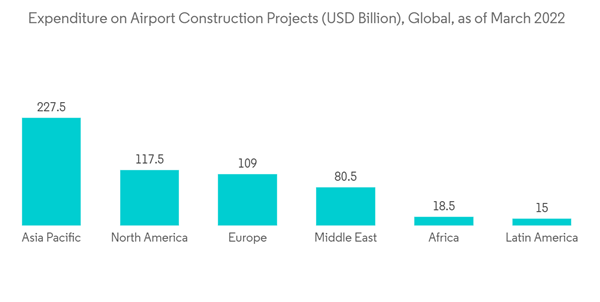

In order to dominate the market, bus manufacturers are shifting toward all-electric buses. The construction of new airports is expected to further generate the demand for apron buses during the forecast period.

Apron Bus Market Trends

Electric Segment is Expected to Show Significant Growth During the Forecast Period

The electric segment is anticipated to show significant growth in the market during the forecast period. The growth is due to the increasing number of air passengers and growing spending on enhancing airport infrastructure. Airports and airlines are striving to reduce their carbon footprint by adopting advanced technologies and systems. Of the total emissions at airports, ground support vehicles, like tugs, tractors, and buses ferrying passengers between the terminals and the aircraft are also contributing significantly. Airlines and airports, in order to achieve carbon neutrality, are replacing aging diesel engine-powered buses with new electric buses. Electric buses offer advantages like ease of operation, low maintenance, and, most importantly, zero-emission.Several airports across Europe were successful, over the past decade, in achieving or reducing their carbon footprint. As airports across the world are trying to reduce their global aviation emissions by about half over the next three decades, the electric bus segment will experience accelerated growth in the coming years. The CORSIA CO2 offset and reduction scheme for international air transport aims to stabilize emission levels by requiring airlines to mitigate the future growth of emissions after 2020. During the period 2021-2035, and based on expected participation, the scheme is estimated to offset around 80% of the emissions above 2020 levels. Participation of states in the first phase is voluntary, and there are exceptions for those with low aviation activity. For instance, Aviator Airport Alliance AB set itself a goal of becoming net zero by 2030. The authority plans to incorporate sustainable fuel into operations and transition its Ground Support Equipment (GSE) fleet to electric power. The company can confidently accomplish this objective.

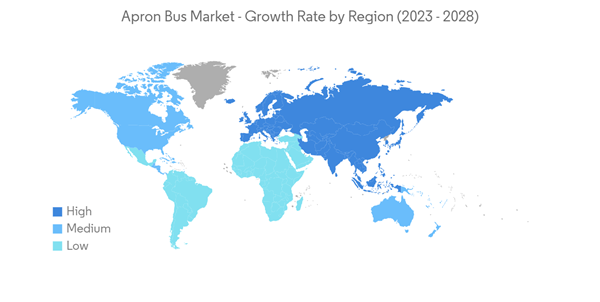

Europe Holds Highest Shares in the Market

Europe holds the highest shares in the market and continue its domination during the forecast period. The growth is due to the increasing number of airport construction projects and rising demand for new apron buses due to increased air traffic. Several airports in Europe, in order to reduce their carbon footprint, replaced their diesel or gas-powered apron buses with emission-free electric buses in the past few years.Some of the European airports that operate apron buses are Munich, Pisa, Frankfurt, Madrid, London Luton, and Amsterdam Schiphol, among others. For instance, in September 2021, Bristol Airport (UK) ordered an electric airside bus in a bid to reduce airport operating emissions. The electric bus, capable of transporting up to 110 passengers and operating between the terminal building and an aircraft, is supplied by COBUS Industries GmbH (Germany). The fully electric vehicle includes state-of-the-art features to maximize safety and comfort. The airport will use the trial to study the operating benefits of the bus and compare it to its existing fleet. Similarly, in June 2023, the Go-Ahead Group invested USD 38 million in a hydrogen bus fleet and refueling station for services in and around London Gatwick Airport.

Apron Bus Industry Overview

The apron bus market is consolidated in nature as a few established players dominate it. Some of the prominent players in the market are COBUS Industries GmbH, YUTONG, BYD Company Ltd, Proterra Inc., and TAM - EUROPE. The construction of new airports and the replacement of aging buses will offer new opportunities to the players. Bus manufacturers, in order to gain new contracts, are expanding their product portfolios by introducing new buses with advanced features. Globally, as the airlines look forward to reducing their carbon footprint, bus manufacturers are also shifting toward electric apron buses with increased space for passengers and their baggage.For instance, Quantron (Germany) is a specialist in 'e-mobility,' offering electric trucks and transporters of various kinds, including buses. For the airport market, it provides a number of vehicle models for catering applications and aircraft supply/service or surface sweepers. In December 2022, SpeediShuttle (Hawaii, US) was awarded the interterminal contract to operate the Wiki Wiki Shuttle service within the Daniel K. Inouye Airport (Hawaii, US). Flyers use the service as a speedy way to get across the airport to baggage claim or a different terminal. SpeediShuttle will be implementing a management system that gives riders arrival times. Moreover, in March 2023, Amsterdam Schiphol Airport plans the trials of self-driving buses. The trials are a result of the Royal Schiphol Group teaming up with nlmtd and TNW (The Next Web) to further accelerate innovation at the airport.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Yutong Bus Co., Ltd.

- COBUS Industries GmbH

- TAM - EUROPE

- BYD Company Ltd

- Xinfa Airport Equipment Ltd

- Proterra Inc.

- Xiamen King Long International Trading Co.,Ltd.

- Solaris Bus & Coach sp. z o.o.

- AB Volvo

- Ashok Leyland

- Mallaghan (G.A.) Inc