The increasing production and deliveries of aircraft, mainly in the commercial sector, are generating demand for aircraft switches globally. Growing demand for advanced IFEC systems and the inclusion of more interactive systems in the IFEC are also generating demand in the aircraft switches market. The demand for IFEC is increasing due to the replacement of traditional backseat screens with restricted entertainment content in favor of personalized models.

The new generation of military and commercial aircraft includes human-machine interface (HMI) designs that can increase automation and reduce a pilot's workload. The demand for the replacement of conventional switching technologies is being driven by aircraft digitization. In the cockpit, there is a high demand for pushbutton switches that use light-emitting diodes. In addition, new-generation aircraft cockpits are integrated with digital data bus interfaces, and therefore, demand for low-profile LED pushbutton switches is increasing.

The increase in demand for lighter aircraft led to an increased interest in the use of fly-by-wire systems on airplanes. Fly-by-wire is a system of flight control systems that uses processors for the management of inputs on autopilot or automatic pilot controls. It transmits electrical signals to the flight control actuators by means of an electronic switch. The growth of the aircraft switching market is expected to be stimulated by a growing demand for installing fly-by-wire systems in new aircraft.

Aircraft Switches Market Trends

Commercial Aviation Segment Will Showcase Remarkable Growth During the Forecast Period

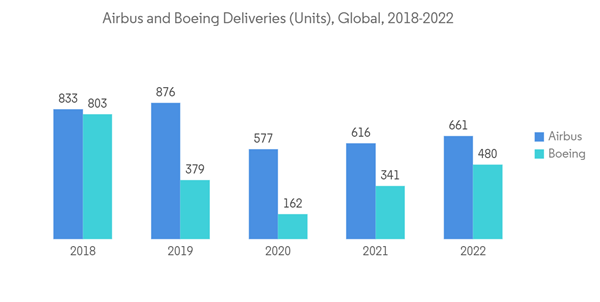

The commercial segment is expected to dominate the market during the forecast period. The increasing use of IFEC systems in commercial aircraft and the growing procurement of these aircraft are the main growth drivers for the segment. With the increasing cabin sophistication to suit the tastes of the customers, the use of switches increased over the years. They are used in the cabin for controlling the IFEC systems, lighting, and calling cabin crew, among other purposes. Compared to military and general aviation aircraft, the number of switches in commercial aircraft is higher. The use of switches in the cockpits of commercial aircraft is more common compared to general aviation aircraft. In contrast, military aircraft do not contain as many switches in the cabin as compared to commercial aircraft.Another major factor for the domination of the commercial aircraft segment is the high rate of production of commercial aircraft due to the growing demand from airlines. For instance, in June 2023, Indigo (India) ordered 500 Airbus A320neo family planes at the Paris Air Show. Similarly, Air India (India) signed purchase agreements for 250 Airbus aircraft and 220 new Boeing jets worth USD 70 billion. Air India's orders include 70 widebody planes, comprising 34 A350-1000s and six A350-900s from Airbus, 20 787 Dreamliners and 10 777Xs from Boeing. It also includes 140 Airbus A320neo, 70 Airbus A321neo, and 190 Boeing 737 MAX narrowbody aircraft. The airline also signed options to buy an additional 70 planes from Boeing, including 50 737 MAXs and 20 787 Dreamliners. Also, in May 2023, Ryanair placed a USD 40 billion order for 300 aircraft to Boeing. Out of a total of 300, 150 aircraft are 737-MAX-10 aircraft. Phased deliveries will start in 2027 and run until 2034, with half of the new purchases set to replace older aircraft in the Ryanair fleet. Thus, growing commercial aircraft procurement contracts from airlines and rising demand for air travel are driving the growth of the segment during the forecast period.

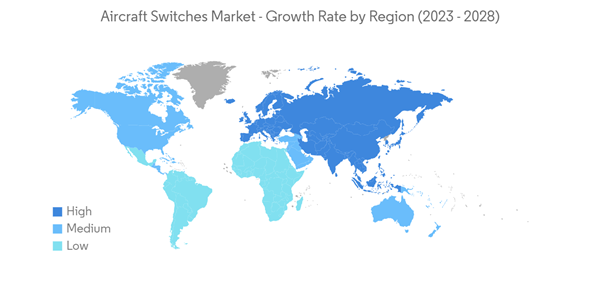

Asia-Pacific is Projected to Grow with the Highest CAGR During the Forecast Period

Asia-Pacific will showcase remarkable growth in the market during the forecast period. The region is projected to generate the highest demand for aircraft globally by virtue of the increasing passenger traffic in the region, which is making the airlines procure new aircraft. By the end of the forecast period, the region is projected to become the largest aviation market, primarily due to the demand from emerging economies like China and India. By 2025, the countries are projected to become two of the top three largest markets for commercial aviation in the world. Countries like Japan and Indonesia, among others, are also generating significant demand. Due to this, the deliveries of commercial aircraft increased in the region to the extent that it will share around one-third of aircraft deliveries globally in the next five years. For instance, the International Air Transport Association (IATA) announced that China became the world's largest aviation market by the mid-2020s in terms of passenger capacity. By 2024, India will surpass the UK and become the third-largest aviation market in the world. The huge market potential encouraged aircraft OEMs to devise strategic expansion plans to increase their penetration into the region. It, in turn, will support the growth of the aircraft exhaust systems market.Even in the military sector, with the increasing territorial conflicts in the region, countries are increasing their military aircraft strength either by indigenous production or by procurement. Thus, the production of indigenous military aircraft, combined with the procurement of new aircraft, is expected to generate a huge demand for aircraft switches for military aircraft in the years to come in the region. Thus, the growing demand for commercial and military aircraft and the rising number of business jet deliveries are driving the market growth across the region.

Aircraft Switches Industry Overview

The aircraft switches market is fragmented in nature due to the presence of a large number of local and global players. Some of the key players in the market are Safran, Honeywell International Inc., RTX Corporation, Eaton Corporation plc, and Electro-Mech Components Inc. An aircraft contains a lot of switches of various types and sizes. Suppliers of these switches are different, and thus, each aircraft includes a handful of switch suppliers, making the market fragmented. Players in the market are tailoring their product offerings to the requirements of aircraft manufacturers to gain new contracts. For instance, as of July 2023, Alto Aviation installed more than 250 Gulfstream business jets with its digital audio systems and Cadence switch panels. Alto audio systems are standard equipment on current production Gulfstream aircraft. They are available as aftermarket upgrades for older models, including the GV/550, the GIV/450/400, the GIII/300, the G200, the G150, and the G100/Astra.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Safran

- Electro-Mech Components, Inc.

- Honeywell International Inc.

- Collins Aerospace (RTX Corporation)

- Eaton Corporation plc

- AMETEK.Inc.

- C&K COMPONENTS LLC

- ITT Inc.

- Unison Industries, LLC

- Hydra-Electric Company

- TE Connectivity Ltd.