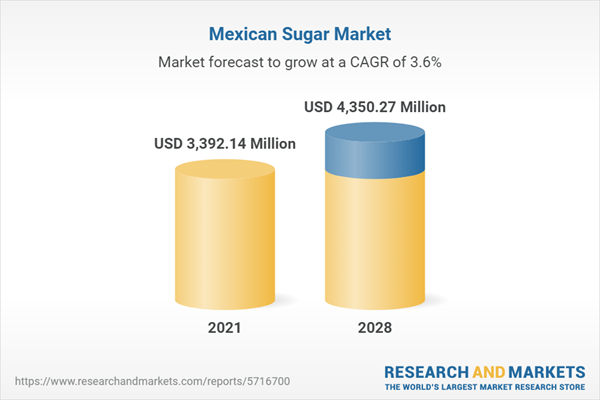

The Mexico sugar market is expected to grow at a compound annual growth rate of 3.62% over the analysed period to reach a market size of US$4, 350.270 million by 2028 from US$3, 392.135 million in 2021.

In Mexico, sugar is used in a wide range of businesses, including fast food, confectionery, and food and beverages. Due to better weather, more water in reservoirs, and anticipated late summer rains that could increase cane yields, production is anticipated to be stronger. However, the industry's expansion is significantly impacted by the rising incidence of lifestyle-related health issues including obesity and diabetes linked to excessive sugar consumption.Rising sugar production

The Mexico sugar market will be driven by rising consumer demand for cane sugar as a sweetener in food and beverage items which is increasing sugarcane production. For instance, USDA reported that 51, 292, 545 million tons of sugarcane was processed in 2021 which increased to 54, 680, 831 million tons in 2022. Further, the demand is increasing as sugar is well-liked as a sweetener due to rising demand from numerous industries. The market for cane sugar has expanded dramatically because it is used as a source of energy, trace levels of minerals, and antioxidants in the food and beverage industries.In addition, new variations of conventional sugar, such as brown sugar, which has been added molasses to improve flavor and appearance, have been developed by businesses. Because of the nutritional advantages the production of sugar has increased. For instance, as per the 2022 report by USDA, sugar production increased from 5, 715, 448 million tons in 2021 to 6, 185, 050 million tons in 2022.

Mexico is the eighth-largest producer of sugar in the world.

As per the National Chamber of the Sugar and Alcohol Industries, Mexico is the eighth-largest producer of sugar in the world, with a production of over 5.7 million tons (at raw value) valued at nearly 4, 200 million dollars during the 2020–2021 harvest. Additionally, 49 mills were in operation in Mexico during the harvest of 2020–2021. Three groups that produced 2.8 million tons of sugar annually, BSM, Zucarmex, and Piasa, which together accounted for 48.6% of the country's production in the harvest of 2020–2021, stand out among the groups that primarily manage these mills.The Mexican granular sugar market is projected to grow significantly.

The demand for granular sugar in Mexico is driven by the increasing consumption of sugar-based products, which is influenced by factors such as population growth, urbanization, changing lifestyles, and dietary habits. Ingenio San Nicolás (ISN), a prominent sugarcane company, plays a crucial role in ensuring food security, contributing to the Mexican economy, and generating electricity for the state-owned electric utility company. Following ASR Group's acquisition of ISN in 2022, investments were made to expand the milling capacity to 1.3 million tons of sugarcane, enabling a cane sugar production capacity of 140, 000 tons per crop season.Moreover, the food and beverage industry exhibit significant consumption of granular sugar, driven by growth, innovation, and the development of novel products in bakery items, confectioneries, beverages, and processed foods. Granular sugar finds application in diverse industrial sectors like pharmaceuticals, cosmetics, and chemicals, bolstering demand due to its ingredient versatility. The expansion and advancements in these industries, coupled with the increasing utilization of sugar, contribute to the sustained demand for granular sugar.

Mexico to experience an increase in sugar production.

The substantial increase in sugar production in Mexico undoubtedly correlates with a proportional growth in the granular segment of the sugar market. As the primary form of sugar, granular sugar directly benefits from the surge in overall sugar production. The heightened consumption of sugar-based products in Mexico plays a pivotal role in driving the growth of the granular segment. Moreover, the industrial applications of granular sugar in sectors such as food and beverages, pharmaceuticals, cosmetics, and chemicals contribute significantly to its increased demand. Additionally, favorable export opportunities enable the granular segment to expand its reach beyond domestic consumption, further fueling its growth. The combination of these factors reaffirms the claim that the granular segment in the Mexico sugar market has experienced corresponding growth, capitalizing on the increased production of sugar, and aligning with the diverse applications and preferences of consumers both domestically and internationally.The effectiveness of processed foods in the market

The use of highly processed foods, sugar-sweetened drinks (SSB), and the quantity of big-box, discount, and convenience stores are all rising in Mexico. Consequently, in the nation, supermarkets are related to increased purchases of ultra-processed food.According to the National Library of Medicine report in 2021, 33.8% of the 17, 264 goods exhibited nutrition claims, while 3.4% did so for health. 80.8% of all items sold in Mexico were deemed to be "less healthy" overall; 48.2% of these products had too many calories, 44.6% had too much salt, and 40.7% had too many free sugars. The highest decline is shown for ultra-processed foods (51.1%, P 0.001); the new legislation would restrict the presentation of health and nutrition claims on 39.4% of goods having claims (P 0.001). Calories and non-sugar sweeteners had the highest reduction in claims (OR 0.62, P 0.001 and OR 0.54, P 0.001, respectively).

Food Labelling Legislation in Mexico

The General Health Law was amended by the Mexican Congress in October 2019 to include front-of-pack warning labels in place of the Guideline Daily Amount (GDA) nutrition labelling. From August 2019 to January 24, 2020, when the revision was authorized, the official Front-of-Pack Labelling (FOPL) Regulation, NOM-051, which implements this section of the legislation, was examined, and discussed.There are three phases to the implementation of the new food labelling legislation. Products with one or more warning flags must no longer have any marketing pictures aimed at children after the initial phase, which began on April 21, 2021. Cartoons, graphics, images of athletes or celebrities, toys, interactive features, and digital downloads all fall under this category. Mexico passed legislation in 2020 mandating warning labels on the front of food products that, by Official Mexican Standards, include "excess" sugar, calories, salt, or saturated fat.

Key Developments

- In Mar 2022, the natural sweetener company Sweegen entered Mexico when the Mexican food safety agency approved the Codex Alimentarius requirements for steviol glycosides produced using several methods.

- In January 2022, The Barentz Company began selling rice-based sweeteners and proteins from ACT Polyols across the countries of North America, including the United States, Canada, and Mexico. Dietary supplements, candy, energy bars, desserts, sweets, and baked foods are a few applications for it. These developments are expected to impact the Mexican sugar market during the forecast period.

Segmentation:

By Type

- Granular

- Powder

- Liquid

By Application

- Dairy

- Beverages

- Confectionery & Bakery

- Processed Food

- Others

By Distribution Channel

- Online

- Offline

Table of Contents

Companies Mentioned

- BSM

- Zucarmex SA De CV

- PROMOTORA INDUSTRIAL AZUCARERA, SA DE CV

- Wilmar International Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | October 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 3392.14 Million |

| Forecasted Market Value ( USD | $ 4350.27 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 4 |