The enhanced safety requirements of the aviation industry drive the market. The advent of the fly-by-wire (FBW) concept necessitates the integration of advanced flight computers onboard an aircraft. Furthermore, to ensure optimal safety levels and enhance the situational awareness of the pilots, the global aviation regulatory agencies have mandated the installation of an autopilot system in conjunction with the flight director system.

The development of advanced aircraft capable of automated flights is driving the ongoing R&D aspect for aircraft autopilot systems and is anticipated to enhance the business prospects of the market players once the technology is fully developed and becomes commercially feasible.

Moreover, stringent regulations from aviation authorities regarding the utilization of autopilot systems will require the developers to increase their scope of R&D to get their autopilot systems certified. For instance, the European Union Aviation Safety Agency (EASA) has filed a proposal to develop various ways for airlines to operate aircraft with a single pilot. EASA anticipates that the transition might happen as early as 2027. The EASA plan has two concepts that need to be incorporated: extended minimum manned operations (eMCO) and single pilot operations (SiPO). Such developments are going to fuel the autopilot systems market as this will demand single pilot autonomy systems and error-tolerant cockpit designs.

Aircraft Autopilot System Market Trends

Commercial Segment to Dominate Market Share

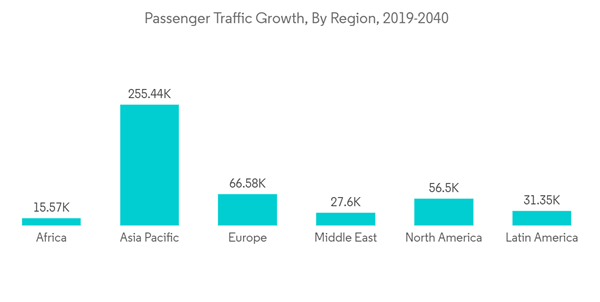

As Per ICAO estimates, the demand for air transport will likely increase by 4.3% YoY on average over the two decades. To address the passenger traffic growth, airline operators have initiated procurement drives for new-generation aircraft. Airbus and Boeing together exceeded 1,000 aircraft deliveries in 2022, and both are planning to ramp up more deliveries in 2023. In 2022, Boeing received 561 orders for 737 MAX, 213 orders for widebodies, and 78 orders for Boeing’s freighter line. Boeing also received 50 orders for 777-8 Freighter aircraft. Collins Aerospace's avionics division is providing ADF 900 Automatic direction finder to Airbus A320, A330, A350 A380, Boeing B737, and B767 aircraft. It also supplies Automatic flight control systems with redundant digital autopilot to Boeing B777 aircraft. Garmin is the supplier of autopilot systems for Airbus A220 aircraft.The dominant aviation regulatory agencies, such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA), have mandated the installation of autopilot systems in commercial aircraft to address several safety concerns. For instance, in August 2023, Aspen Avionics and Trio Avionics released an affordable digital autopilot/electronic flight display (EFIS) system with combined packages of Aspen Evolution E5 flight display and Trio Pro Pilot autopilot for more than 12 general aviation aircraft models. Similarly, in August 2023, in a demo flight in a Eurocopter AS350 B2, Garmin showcased its GFC 600H autopilot system. Garmin is working to receive supplemental-type certificate (STC) approvals for the GFC 600H system.

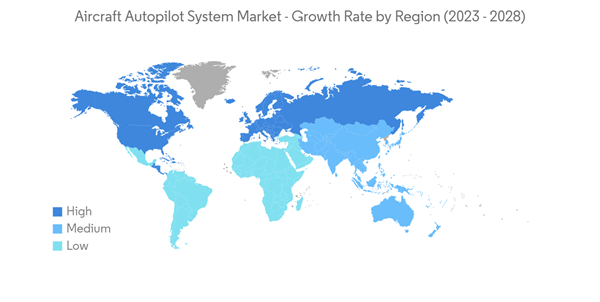

Asia-Pacific Region to Lead the Market in the Forecast Period

According to Airports Council International (ACI), the Asia-Pacific region is expected to have an aircraft movement share of 45.2% in the year 2041, from 32.5% in the year 2021. China is anticipated to become the world's largest aviation market in terms of air traffic. During the same period, India is anticipated to develop into the world's third-largest aviation market, while other countries, such as Indonesia and Thailand, are forecasted to enter the top 10 global markets. The demand for new aircraft is driven by the ever-growing passenger traffic in the region.On account of the profound changes in the international strategic landscape, the configuration of the international security system has been undermined by the growing regional conflicts. To enhance military prowess, several countries, such as China and India, have resorted to new procurements to effectively respond to security threats and accomplish urgent, critical, and dangerous strategic missions. For instance, in August 2023, the Indian Air Force plans to give a contract of USD 8 billion for 100 Mk1A variants of Light Combat Aircraft (LCA) to Hindustan Aeronautics Limited (HAL). The Mk1A version is equipped with modern avionics, radar, electronic warfare suite, and missile capabilities.

Modern fighter aircraft are equipped with advanced autopilot systems and flight computers for augmenting the overall situation awareness of the pilot. An increase in demand for aircraft is anticipated to bolster the business prospects of the market players in the region during the forecast period. While numerous military aircraft prototypes are being developed, several military procurement programs are currently underway to cater to the global demand for military aircraft. Military fighter aircraft manufacturers are trying to enhance their production capabilities to ensure timely deliveries.

Aircraft Autopilot System Industry Overview

The aircraft autopilot market is fragmented, with a handful of global players present in the market. Some of the prominent players in the market include BAE Systems plc, Honeywell International Inc., Meggitt (Parker Hannifin Corporation), Avidyne Corporation, and Safran, among others. Besides air traffic, the emerging security environment, fueled by the growing geopolitical unrest in several countries, is resulting in the growing demand for aircraft. In order to gain long-term contracts and expand their global presence, players are investing significantly in the procurement of new aerial assets. Furthermore, continuous R&D has been fostering the advancements of accuracy and efficiency of integrated autopilot technologies and associated subsystems. For instance, in October 2021, Garmin Ltd. announced that its GFC 500 autopilot received Supplemental Type Certification (STC) from the Federal Aviation Administration (FAA) for use in Beechcraft 19 Sport, Beechcraft 23 Musketeer/Sundowner, and Beechcraft 24 Musketeer/Sierra aircraft models. Similarly, in June 2021, Bell Textron Inc. announced that the Genesys HeliSAS autopilot incorporated into the Bell 505 helicopter had received certification from the UK’s Civil Aviation Authority (CAA).Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BAE Systems plc

- Safran

- Avidyne Corporation

- Honeywell International Inc.

- Meggitt (Parker Hannifin Corporation)

- Collins Aerospace (RTX Corporation)

- Dynon Avionics

- Genesys Aerosystems

- Lockheed Martin Corporation

- Moog Inc.

- THALES

- Garmin Ltd.