Key Highlights

- Agriculture in Tanzania is the source of livelihood for a majority of the population while contributing 25.9% of the total GDP in 2021, as per the world bank.

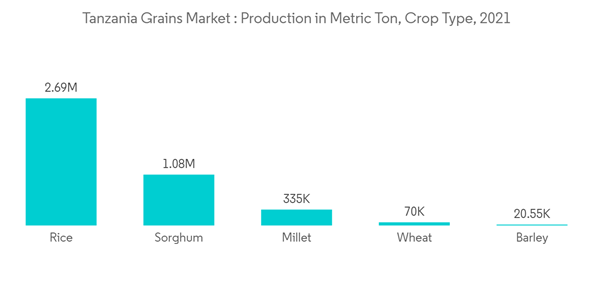

- The Tanzanian grain market caters mainly to domestic demand. The grain market includes cereals, pulses, and oilseeds. Maize and rice are the top cereals produced in the country. According to Food and Agriculture Organization (FAO), maize is the most widely cultivated cereal, producing 7,039,000 metric ton in 2021. Rice and sorghum are the most cultivated crops in Tanzanian after maize, with production totaling 2,688,000 metric ton and 1,077,000 metric ton, respectively, in 2021.

- Furthermore, Pigeon peas and dry beans lead the pulses production. Groundnuts and sunflowers are the highest-produced oilseeds. Cereal crops are mainly grown for domestic consumption purposes in Tanzania. With increasing cultivation and the adoption of hybrid varieties and GM technologies, the country is expected to increase its share in the grain trade over the coming years.

- The traditional staple diet in Tanzania is based on cereals (maize and sorghum), starchy roots (cassava), and pulses (mainly beans). Cereals and root tubers serve as staples for most of the population in rural and urban areas, and maize is consumed in all regions in Tanzania. Moreover, the country’s grain production has the potential and capacity to satisfy the local grain requirements and those of the regional markets. It can significantly contribute to both local and regional food security. However, the threat of climate change, lack of efficient financial support, and extension activities to the small-scale farmers of Tanzania are expected to restrain the grain market during the forecast period.

Tanzania Grains Market Trends

Increasing Demand for Animal Feed Accelerating the Grain Market

- The rising scale of urbanization due to changing consumer preferences in meat products and growing awareness of nutrient management in cattle, sheep, and goats by livestock raisers are projected to boost the demand in the feed market in the coming years. Thus, the demand for cereals such as soybean, wheat, and maize is increasing due to a significant increase in animal feed demand.

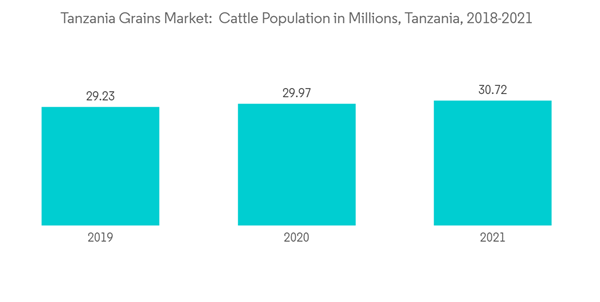

- Production of crops like maize has significantly increased due to the increasing livestock population, which drives demand for the feed industry. For instance, according to the Food and Agriculture Organization (FAO) report, in 2020, there were 29.97 million cattle, which increased and reached 30.72 million in 2021 in Tanzania.

- Since commercial broiler feed in the country is very expensive and not affordable for small-holder farmers, Maize and protein concentrate traditionally comprise more than 70% of farm-made diets. Which, in turn, is expected to boost the revenue of grains in the market studied.

- Recently, the International Institute of Tropical Agriculture, in collaboration with Wageningen University and Catholic Relief Services (CRS), promoted soybean production in the Southern Highlands of Tanzania (SH), aiming to improve household nutrition and cash income and enhance soil fertility.

- The increase in soybean production in Tanzania is primarily driven by increasing demand for animal feed. Therefore, increasing demand from the animal feed industry is accelerating the production of grains, which is expected to further fuel the growth of the market studied over the forecast period.

Maize Dominating the Grain Market

- Maize is one of the staple crops grown in Tanzania, providing over 45.0% of the country's daily calorie consumption. To meet the domestic demand, most farmers grow maize on their farmland. It is one of the largest agricultural commodities in terms of production volume. Maize is also important for poultry feed and a substitute for the brewing industry. It is cultivated under hybrid varieties and GM technologies.

- Maize in Tanzania is grown in unimodal and bimodal areas. However, the leading producing areas are mainly in the Iringa, Morogoro, and Ruvuma (southern highlands), Tanga and Arusha (northern highlands), and Kagera (Lake Zone) of the country. According to Food and Agriculture Organization (FAO), maize production was 5,652,005 metric ton in 2019, which increased and reached 7,039,000 metric ton in 2021. It is expected to increase further in the forecast period to meet the export and domestic demand.

- Furthermore, about three-quarters of maize consumption in the country is from its local production. As per the United States Department of Agriculture (USDA), in 2021, Tanzania’s annual per capita consumption of maize was around 135 kilograms, and white maize is the most popular variety. Maize provides 80 percent of dietary calories and more than 35 percent of utilizable protein in the country. On average, maize purchases account for 16 percent of household food expenditures, but this figure varies dramatically by region. Therefore, the growing demand for maize among the population is expected to drive the grain market in Tanzanian over the forecast period.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.