Growth in the defense spending of military forces worldwide coupled with the growing need for the development of new battlefield management systems to improve defense capabilities are some of the factors which is anticipated to generate significant market growth during the forecast period. Also, the growing demand for enhanced situational awareness to support the military defense decision-making process and protect the troops on the battlefield will drive the adoption of such systems by the global armed forces.

On the other hand, the higher costs involved in implementing battlefield management systems in the defense sector will hamper market growth.

Furthermore, the growing use of advanced technologies such as artificial intelligence, leading to growth in cybersecurity, situational awareness, decision support, automation, and adaptability will provide newer business opportunities within the market during the forecast period.

Battlefield Management Systems Market Trends

Army Segment To Witness Highest Growth During the Forecast Period

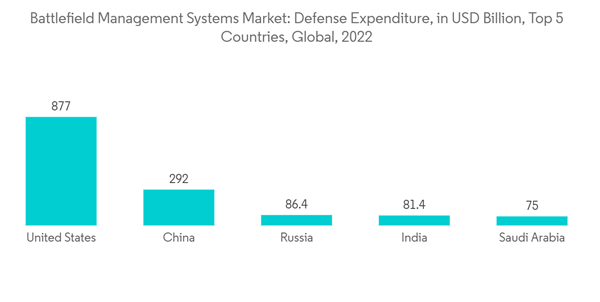

The changing scenario of warfare across the world has led to various countries increasing their defense budget to acquire new and advanced battlefield management systems to improve their military proficiency. According to the data provided by the Stockholm International Peace Research Institute (SIPRI), in 2022, the global defense expenditure amounted to USD 2.2 trillion.On this note, in July 2023, the US Army awarded a contract to Systematic A/S for using its SitaWare software suite to improve the security and performance of its tactical communications network and battle management systems as part of the LAND 200 Phase 3 Battlefield Command Systems initiative.

Also, in August 2023, the UK Ministry of Defence (MoD) awarded a GBP 89 million (around USD 113 million) contract to BAE Systems plc to enhance front-line connectivity for military personnel, linking small reconnaissance drones, combat vehicles, fighter jets, aircraft carriers, and military commands. the five-year contract entails the design, development, and deployment of a tactical wide area network called Trinity.

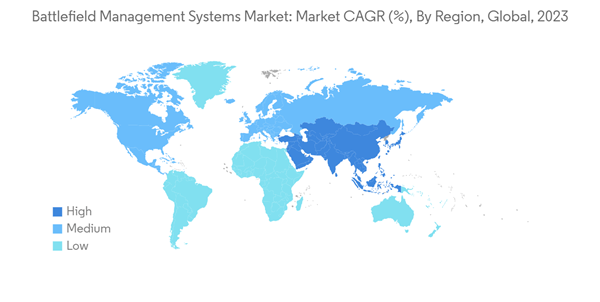

Asia-Pacific to Witness Significant Growth During the Forecast Period

Asia-Pacific has been a hotspot for border conflicts which has led to major countries within the region realigning their military strategies and organizational structures to counter such conflicts. This has led to significant growth in terms of demand for advanced battlefield management systems within the region. For instance, in December 2023, the Indian Army announced that they are in the process of developing military-grade 5G and 6G telecom apps. Moreover, this project will help to address the future warfare requirements of the country.There has also been notable growth in terms of integration of advanced technology such as artificial intelligence into the newer generation systems which is expected to provide a boost to the current capabilities of an end-user country in terms of cybersecurity, situational awareness, decision support, automation, and adaptability. Thus, growth in the acquisition of new battlefield management systems as well as the growing need to integrate advanced technologies within the existing systems will drive market growth in the region.

Battlefield Management Systems Industry Overview

The battlefield management system market is fragmented with various players dominating the market. Some of the major players in the battlefield management system market are BAE Systems plc, RTX Corporation, Elbit Systems Ltd., General Dynamics Corporation, and L3Harris Technologies, Inc. amongst others.Various players in the market are investing significantly in the research and development of advanced battlefield management systems which will help to protect troops on the battlefield. Furthermore, changing battlefield scenarios have led to various players collaborating with defense forces worldwide to understand the military requirements and introduce new generations of BMS which will help in leveraging terrain modeling with advanced networking capabilities. Furthermore, growing investments by dominant market players will lead them to capture significant market share in the years to come.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ASELSAN AS

- BAE Systems PLC

- Raytheon Technologies Corporation

- Elbit Systems Ltd

- General Dynamics Corporation

- Indra Sistemas SA

- Israel Aerospace Industries Limited

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Leonardo S.p.A

- Rheinmetall AG

- Saab AB

- Systematic

- Thales Group