Singapore intends to develop an insurance hub in Asia. Among different insurance segments in Singapore, motor insurance is among one of the largest segment. Various Insurance Companies started working closely with key partners and stakeholders like the Singapore Road Safety Council and Traffic Police on the way to improving education and awareness for road users in Singapore. Sales of motor vehicles have improved post covid, reflecting the improvement in customer demand, which is expected to support the growth in motor insurers’ premiums in the short term. The total of insurance companies has been increasing, especially in the last two years, with confined and direct insurers leading the industry. Additionally, electric vehicle sales grew over the last 2 years, which has contributed to the high demand for motor insurance. In addition, the surge in environmental consciousness among the customers of the Singapore will enable market of EV insurance. This driving in demand for electric vehicles is expected to surge the demand for new motor vehicle insurance policies, thus, driving the development of the motor insurance market in Singapore.

Singapore Motor Insurance Market Trends

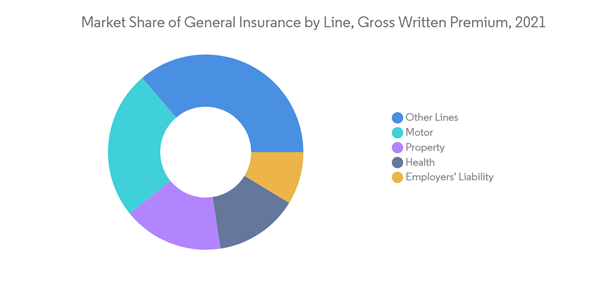

Motor insurance has the highest market share in general Insurance

The star-studded performance of the motor insurance segment testifies to the effectiveness of government strategy. The division attained underwriting profits to reverse the underwriting losses reported in 2020 Q2. The demand for motor vehicles in Singapore is significantly boosted due to the rise in urbanization and increase in the per capita income of customers. There is an expansion in sales of motor vehicles in Singapore because of the availability of motor vehicles for sale, which is because the automobile industry is supported by multiple factors such as labor accessibility, R&D efforts, geographic advantage, and government support. This is attributed to the automation and digital innovations executed by companies, and the insurance association works together to reduce operating costs, improve efficiency, and ease the incidence of fraudulent claims.Insurtech is Driving the market

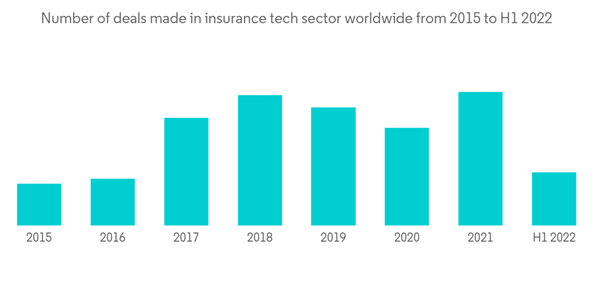

Insurance has been a hard nut to crack, particularly in the city-state. Singapore is home to one of the maximum saturated insurance markets globally - measured by gross written premiums (GWP) as a percentage of per-capita gross domestic product (GDP). A report presented incumbents accounted for more than 45 percent of GWP and annual growth was at 1 percent for the general insurance market. Additionally, traditional distribution channels through agents and financial advisors remain the preferred avenue for local customers to purchase their policies. In a mature market with incumbents upholding a strong foothold,Insurtech firms in Singapore have been dealt a challenging hand. Though, they have played it well. Insurtech in Singapore is driving the motor insurance market. There are more than 80 Insurtech registered with the Singapore Fintech Association. And there has been no shortage of investment in the sector. According to BCG, funding for local Insurtech firms accounted for 29 percent of total fintech funding in 2021. Several Insurtech in Singapore is looking to change this narrative with their digital offerings. Bolttech is one such example. Under Richard Li’s Pacific Century Group (PCG), the Singapore-based Insurtech firm claims it operates the world’s major online insurance exchange, having transacted US$5 billion in premiums, with over 5,000 products and 150 insurance providers on its platform. Leveraging PCG’s strength in the insurance space - FWD Insurance is among the investment group’s portfolio - Boltech was able to serve over 7.7 million customers within a year of its launch in 2020. It recently result in a US$180 million Series A round that saw the company valued at over US$1 billion. While Bolttech impressive numbers offer local Insurtech a hint of the global Insurtech market size they could target, we should not discount the fact being backed by a corporate powerhouse like PCG did significantly step up Bolttech’s rise.

Hence, it is clear that Insurtechs have a role to play within the Singapore Motor insurance industry.

Singapore Motor Insurance Industry Overview

The Singapore Motor Insurance Market is moderately saturated in nature in terms of market share. Some of the major key players operating currently dominate the market. The market is likely to grow during the forecast period due to the rise in sales of motor vehicles and many other factors that are driving the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- MSIG Insurance (Singapore) Pte.Ltd.

- Tokio Marine Life Insurance Singapore Ltd.

- The Great Eastern Life Assurance Company Ltd.

- Aviva Ltd.

- Liberty Insurance Pte. Ltd.

- United Overseas Insurance Ltd.

- Axa Insurance Pte. Ltd.

- Etiqa Insurance

- Auto & General Insurance (Singapore) Pte. Ltd.

- Ecics Limited*