Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Their primary role is to prevent the proliferation of foodborne pathogens like Listeria monocytogenes, Salmonella, and Escherichia coli, thereby extending product shelf life without the need for synthetic preservatives. This aligns with the growing consumer demand for natural and clean-label products. The protective cultures help manufacturers reduce waste, improve operational efficiency, and maintain consistent product quality, contributing to higher profit margins. Common microorganisms used include Lactobacillus, Streptococcus, Bifidobacterium, Bacillus spp., and beneficial yeasts and molds such as Saccharomyces and Aspergillus. By integrating protective cultures, food producers can achieve safer, fresher, and more appealing products.

Key Market Drivers

Increasing Demand of Fermented and Functional Food

Fermented and functional food and beverages have been experiencing a surge in popularity in recent times. Recent industry developments highlight this trend. In 2024, DSM launched “DelvoBiotics,” a fermentation platform designed for probiotic dairy and supplements, emphasizing the role of protective cultures in functional food innovation. Danone expanded its Alpro line with shelf-stable plant-based probiotic drinks that remain viable for 12 months, relying on protective microbial systems for longevity and quality. Similarly, AB InBev introduced a kombucha-beer blend in the U.S. and Europe, targeting health-conscious consumers seeking low-alcohol, probiotic-rich alternatives.Protective cultures find applications in a diverse range of fermented products, including cheese, yoghurts, sour cream, fermented vegetables, pickles, and fermented sausages. Consequently, one of the key drivers behind the growth of protective cultures is the increasing demand for fermented food products. The expanding consumer interest in clean-label and shelf-stable products is expected to propel the growth of the protective cultures market. Factors such as rising disposable income and evolving consumer preferences also play a significant role in the development of the protective cultures market. Given that protective cultures are utilized in the bio-preservation of products, the growing demand for natural preservatives is contributing to the expansion of the global market.

Key Market Challenges

Scale and Cost-effectiveness

Scaling up the production of protective cultures and making their incorporation cost-effective can be a hurdle. Achieving consistent quality and performance at larger production scales while maintaining affordability can be a challenge. Maintaining consistent quality and performance of protective cultures at larger scales is complex and requires meticulous control of fermentation conditions. Some protective cultures may behave differently when scaled up, leading to variations in performance and quality.Developing cost-effective fermentation media that support robust growth and high yields can be challenging when scaling up. Extracting, purifying, and formulating protective cultures for incorporation into final products can become more complex at larger scales. Ensuring consistent quality and safety of protective cultures across different production batches is vital but challenging. Achieving cost-effectiveness while scaling up can be difficult due to economies of scale not always being realized as expected.

Key Market Trends

Increasing Consumption of Dairy Products

The growing consumption of dairy products and increasing consumer awareness of clean label products and their benefits are key factors driving the growth of the protective cultures market. For example, Chr Hansen's introduction of protective culture products has enabled consumers to replace artificial preservatives, thereby extending the shelf life of yogurt and cheese products. The rising global demand for natural preservative-free items is fueling the market expansion of protective cultures. The increasing need for long-term preservatives and highly transparent products has contributed to the growth of the protective cultures market.The utilization of protective cultures allows for the creation of a wider variety of dairy products with unique flavors, textures, and characteristics. This fosters innovation in the dairy industry, leading to the development of new product offerings that attract consumer interest and contribute to increased consumption. Dairy products containing protective cultures can be positioned as premium and value-added options. Manufacturers can market these products as being of higher quality, with extended freshness and potential health benefits, allowing them to command higher prices and margins.

Key Market Players

- Aristomenis D. Phikas & Co S.A

- Biochem S.R.L

- Bioprox

- Chr. Hansen

- CSK Food Enrichment B.V.

- Dalton Biotechnologies S.R.L

- Dow, Inc.

- DuPont de Nemours, Inc.

- DSM

- Kerry Group PLC

Report Scope:

In this report, the Global Protective Cultures Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Protective Cultures Market, By Product Form:

- Freeze-Dried

- Frozen

Protective Cultures Market, By Target Microorganism:

- Yeasts & Molds

- Bacteria

Protective Cultures Market, By Composition:

- Single-Strain

- Multi-Strain

- Multi-Strain Mixed

Protective Cultures Market, By Application:

- Dairy & Dairy Products

- Meat & Poultry Products

- Seafood

- Others

Protective Cultures Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Protective Cultures Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Aristomenis D. Phikas & Co S.A

- Biochem S.R.L

- Bioprox

- Chr. Hansen

- CSK Food Enrichment B.V.

- Dalton Biotechnologies S.R.L

- Dow, Inc.

- DuPont de Nemours, Inc.

- DSM

- Kerry Group PLC

Table Information

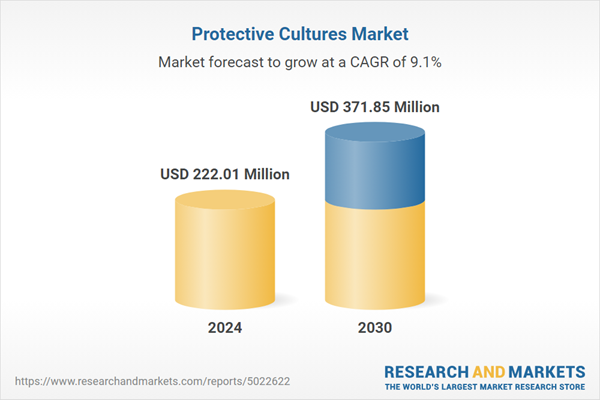

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 222.01 Million |

| Forecasted Market Value ( USD | $ 371.85 Million |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |