Global CO2 Enhanced Oil Recovery (EOR) Market - Key Trends & Drivers Summarized

How Is CO2 EOR Revolutionizing the Oil Recovery Industry?

CO2 Enhanced Oil Recovery (EOR) is emerging as a critical technology in the oil and gas sector, aimed at maximizing the extraction of oil from mature and declining oil fields. The process involves injecting carbon dioxide into reservoirs to increase pressure and improve oil flow, thereby enhancing recovery rates. This technology is gaining attention as it not only improves oil production but also offers a method for carbon capture and storage (CCS), contributing to emission reduction goals. As the demand for energy continues to grow, CO2 EOR presents a viable solution for extending the life of existing oil fields and optimizing production efficiency.What Factors Are Driving the Adoption of CO2 EOR Technologies?

The adoption of CO2 EOR technologies is primarily driven by the need to improve oil recovery rates and reduce greenhouse gas emissions. With conventional oil fields maturing and the discovery of new fields becoming increasingly rare and expensive, the oil industry is turning to EOR technologies to maximize existing resources. Additionally, the growing focus on sustainable practices and emission reduction is propelling the adoption of CO2 EOR, as it provides an effective means of sequestering CO2 while enhancing oil production. The technology's ability to produce low-carbon oil is particularly appealing in regions with stringent environmental regulations, further boosting its adoption.How Are Government Policies and Investments Shaping the Market?

Government policies and investments are critical in shaping the CO2 EOR market. Several countries, particularly in North America and the Middle East, are investing heavily in CO2 EOR projects to enhance domestic oil production and achieve energy independence. Government incentives, including tax credits and subsidies for carbon capture and utilization, are encouraging oil companies to adopt CO2 EOR technologies. Moreover, the alignment of EOR with climate goals, particularly in the U.S. through initiatives like the 45Q tax credit, is driving significant investment in CO2 capture and storage infrastructure, thereby supporting the growth of the CO2 EOR market.What Drives the Growth in the CO2 EOR Market?

The growth in the CO2 EOR market is driven by several factors, including the increasing demand for energy, the need to extend the life of mature oil fields, and stringent environmental regulations that promote low-carbon technologies. The potential of CO2 EOR to serve as both an enhanced oil recovery method and a carbon sequestration technique is a significant growth driver, aligning with global climate goals. Technological advancements in CO2 capture, transportation, and injection are also reducing operational costs, making EOR more economically viable. Additionally, collaborative efforts between governments and private companies to develop large-scale CO2 EOR projects are paving the way for future market expansion.Report Scope

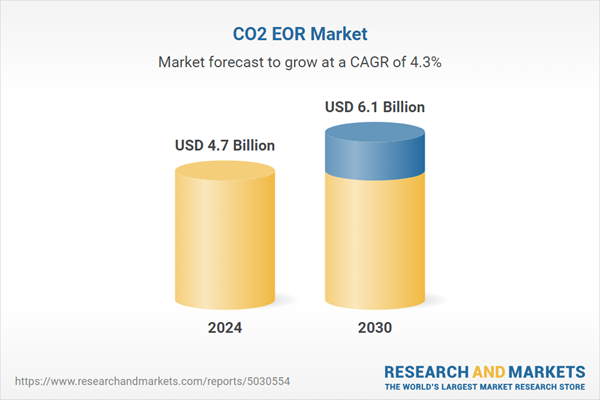

The report analyzes the CO2 EOR market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (CO2 EOR).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global CO2 EOR Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global CO2 EOR Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global CO2 EOR Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Baker Hughes, a GE company, BP PLC, Chevron Corporation, ConocoPhillips Company, Denbury Resources Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this CO2 EOR market report include:

- Baker Hughes, a GE company

- BP PLC

- Chevron Corporation

- ConocoPhillips Company

- Denbury Resources Inc.

- Exxon Mobil Corporation

- Halliburton

- Kinder Morgan, Inc.

- Lukoil Oil Company

- Nalco an Ecloab Company

- Occidental Petroleum Corporation

- Petroleum Development Oman

- Royal Dutch Shell PLC

- Schlumberger Ltd.

- Statoil ASA

- Total SA

- Wintershall Holding GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baker Hughes, a GE company

- BP PLC

- Chevron Corporation

- ConocoPhillips Company

- Denbury Resources Inc.

- Exxon Mobil Corporation

- Halliburton

- Kinder Morgan, Inc.

- Lukoil Oil Company

- Nalco an Ecloab Company

- Occidental Petroleum Corporation

- Petroleum Development Oman

- Royal Dutch Shell PLC

- Schlumberger Ltd.

- Statoil ASA

- Total SA

- Wintershall Holding GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |