Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

EaaS is a business concept that enables businesses and families to gain access to energy-efficient solutions without investing in costly infrastructure. The service provider installs, runs, and maintains energy-efficient technologies and charges a fee based on energy consumption. This strategy makes it simple and economical for businesses and households to acquire energy-efficient solutions. Furthermore, increased demand for energy-efficient Energy as a Service and stringent government regulations aimed at lowering harmful emissions are likely to boost the Indonesian energy storage solutions market during the forecast period.

Microgrids are becoming increasingly popular in Indonesia to provide reliable and affordable energy to remote communities. EaaS solutions can provide the necessary infrastructure for microgrid systems, allowing businesses and households to access energy-efficient solutions in remote areas. The Energy as a Service (EaaS) Market in Indonesia is still in its early stages, but it is expected to grow rapidly in the coming years. Currently, Jakarta is the fastest-growing region in the EaaS market in Indonesia. This is due to several factors, including the region's high population density, industrial development, and increasing demand for energy-efficient solutions.

Increasing Demand for Renewable Energy

Renewable energy sources such as wind, solar, and hydropower are being explored more and more as viable solutions to Indonesia's energy dilemma. As the need for cleaner, more sustainable energy sources grows, wind, solar, and hydropower are becoming attractive alternatives to traditional sources of energy, including coal and nuclear power plants. With a robust energy-as-a-service industry, Indonesia is in a prime position to capitalize on the renewable energy boom. Increased competition in the energy-as-a-service sector can provide more availability and variety of energy services, giving consumers more choice and driving down prices. This boosts renewable energy uptake, leading to more efficient production, resulting in cleaner energy sources and a healthier environment for everyone. Increased demand creates greater opportunities for companies to expand or enter the Indonesian energy-as-a-service market, providing more job opportunities and economic growth.The growth of the Indonesia EaaS market is being driven by the need for energy efficiency and cost savings. With energy prices in Indonesia among the highest in Southeast Asia, many businesses are looking for ways to reduce their energy costs. EaaS providers can help companies achieve this by offering energy-efficient solutions, such as LED lighting, smart building systems, and energy management software. By optimizing energy use and reducing waste, EaaS providers can help companies save money while reducing their carbon footprint. Finally, the Indonesia EaaS MARKET is being driven by the increasing focus on sustainability and corporate social responsibility (CSR). With consumers becoming more environmentally conscious, many companies are looking to demonstrate their commitment to sustainability by adopting renewable energy and reducing their carbon footprint. EaaS providers can help companies achieve these goals by providing renewable energy solutions and helping them track and report on their sustainability initiatives.

In conclusion, a range of factors is driving the Indonesia EaaS Market, including urbanization, the adoption of renewable energy, the need for energy efficiency and cost savings, and the focus on sustainability and CSR. As the demand for electricity continues to grow, EaaS providers will play an increasingly important role in helping companies access reliable and affordable energy solutions. By leveraging their expertise in renewable energy and energy management, EaaS providers can help businesses navigate the complex energy landscape in Indonesia, while contributing to the country's sustainable development goals

Need for Energy-efficient Solutions.The need for energy-efficient solutions is a crucial driver for the growth of the Indonesia energy as a service (EaaS) market. The need for energy-efficient solutions is set to have a profound impact on the Indonesia energy as a service market. With the government’s commitment to reduce energy consumption and increase renewable energy sources, energy efficiency solutions are gaining momentum. This is driving companies into exploring innovative solutions to improve their energy efficiency and reduce their impact on the environment. The Indonesian government has implemented several policies designed to support and incentivize the adoption of sustainable energy solutions. In addition, the government has introduced regulations to promote energy efficiency, reduce emissions, and invest in renewable energy sources.

The increased focus on energy efficiency is expected to drive demand for energy as a service solution, such as Demand Response (DR) services. DR solutions allow companies and households to manage their power consumption in a more efficient manner by responding to pricing signals in real-time. As a result, customers can better control their energy consumption and reduce power consumption costs. Overall, the demand for energy-efficient solutions will contribute to increased revenue potential in the Indonesia Energy as a Service Market.

In addition to cost savings, energy-efficient solutions help reduce carbon emissions, which is crucial for Indonesia's sustainability goals. Indonesia has committed to reducing its greenhouse gas emissions by 29% by 2030, and adopting energy-efficient solutions is an essential step towards achieving this target. EaaS providers can help companies reduce their carbon footprint by providing renewable energy solutions and helping them track and report on their sustainability initiatives. Another benefit of energy-efficient solutions is improved energy security. With the growing demand for energy in Indonesia, it is essential to have a reliable and stable energy supply. Energy-efficient solutions can help achieve this by reducing energy waste and optimizing energy use. By adopting energy-efficient solutions, companies can ensure a stable energy supply and reduce their dependence on the grid.

EaaS providers can help companies take advantage of these incentives and adopt renewable energy solutions to meet their energy needs. Also, energy-efficient solutions can improve the comfort and productivity of buildings. By adopting smart building systems, companies can optimize the use of energy and improve the indoor environment for employees.

In conclusion, the need for energy-efficient solutions is a crucial driver for the growth of the Indonesia EaaS Market. Energy-efficient solutions provide cost savings, reduce carbon emissions, improve energy security, align with the government's energy policy, and improve the comfort and productivity of buildings.

Government Initiatives

The Indonesian government recognizes the importance of sustainable energy and has taken steps to promote the development of EaaS to achieve its renewable energy goals. To achieve these targets, the government has implemented a range of policies and incentives, such as feed-in tariffs, tax exemptions, and investment incentives, to encourage investment in renewable energy projects. This creates a favorable environment for EaaS providers to enter the market and offer renewable energy solutions to meet the growing energy demands.The government has launched several programs to promote the adoption of energy-efficient solutions. For instance, the government has launched the National Energy Efficiency Action Plan (NEEAP) to promote energy-efficient practices and reduce energy consumption. This initiative provides a favorable environment for EaaS providers to offer energy-efficient solutions to businesses and individuals and achieve their energy-saving targets.

The government has implemented regulations and policies to promote the development of the EaaS market. One such regulation is the Energy Law, which provides a legal framework for the development of renewable energy and EaaS in Indonesia. This law encourages private investment in renewable energy projects, which creates an opportunity for EaaS providers to participate in the development of renewable energy solutions and services.

Also, the government has launched various initiatives to increase access to electricity, particularly in rural areas. For instance, the government has launched the 35,000 MW Electricity Program, which aims to provide access to electricity to all Indonesian citizens by 2020. This program creates a demand for energy solutions, particularly in rural areas where traditional power infrastructure is lacking, which provides an opportunity for EaaS providers to offer off-grid and renewable energy solutions.

Additionally, the government has recognized the potential of digital technology to transform the energy sector. The government has launched the Indonesia Smart City program, which promotes the use of digital technology to improve energy efficiency, reduce energy consumption and promote renewable energy solutions. This initiative creates opportunities for EaaS providers to offer digital solutions, such as smart grid management systems and energy management software, to optimize energy use and improve the efficiency of the energy system.

In conclusion, the Indonesian government initiatives are a significant driving force in the country's EaaS market. The government's renewable energy targets, energy efficiency programs, regulations and policies, rural electrification initiatives, and digital transformation programs create an enabling environment for EaaS providers to offer renewable energy solutions, energy-efficient practices, and digital solutions to meet the growing energy demands in Indonesia.

Market Segments

The Indonesia Energy as a Service Market is segmented into service type, end-user industry, and region. Based on service type, the market is segmented into power generation services, energy efficiency & optimization services, operational & maintenance services and microturbine. Based on end-user industry, the market is segmented into Industrial and Commercial. The market analysis studies regional market segmentation, divided among Java, Sumatra, Kalimantan, Sulawesi and Rest of Indonesia

Market Players

Major market players of Indonesia Energy as a Service Market are Schneider Electric Indonesia PT, ENGIE Indonesia, MTS Systems Corporation, PT Pertamina(Persero), ABM Investama, Honeywell Indonesia PT, SGS Indonesia, PT. Siemens Indonesia., Indika Energy, Huawei Technologies. To achieve good market growth, businesses that are active in the market employ organic tactics such as product launches, mergers, and partnerships.Report Scope:

In this report, Indonesia Energy as a Service Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Energy as a Service Market, By Service Type

- Power Generation Services

- Energy Efficiency & Optimization Services

- Operational & Maintenance Services

Energy as a Service Market, By End-User Industry

- Industrial

- Commercial

Energy as a Service Market, By Region

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Rest of Indonesia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Indonesia Energy as a Service Market

Available Customizations:

Indonesia Energy as a Service Market with the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schneider Electric Indonesia PT

- ENGIE Indonesia

- PT. SIEMENS INDONESIA

- Honeywell Indonesia PT

- SGS Indonesia

- PT Perusahaan Listrik Negara

- PT Pertamina(Persero)

- Indika Energy

- ABM Investama

- Huawei Technologies

Table Information

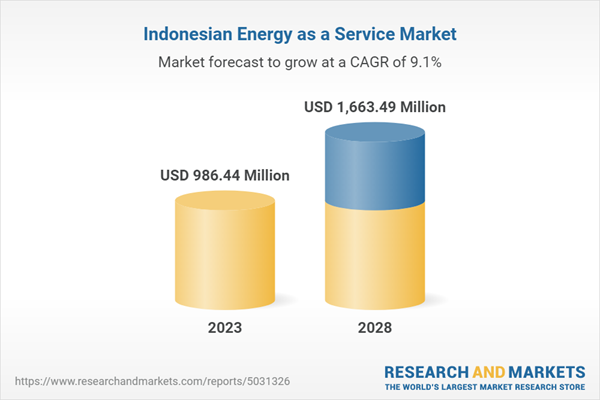

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 986.44 Million |

| Forecasted Market Value ( USD | $ 1663.49 Million |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 10 |