Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to the International Energy Agency, global investment in electricity grids was projected to reach USD 400 billion in 2024 to facilitate digital integration and system flexibility. This investment emphasizes the growing infrastructure capabilities required to support external energy management solutions. However, the market faces considerable obstacles due to diverse and intricate regulatory frameworks, which complicate the standardization of service contracts across international boundaries.

Market Drivers

The rapid incorporation of renewable energy sources significantly propels the Global Energy as a Service Market by creating a critical need for flexible power management solutions. As decentralized generation assets become more common, traditional grid infrastructures often struggle to manage intermittent supply, necessitating service-based energy optimization. According to the International Renewable Energy Agency's 'Renewable Capacity Statistics 2024' report from March 2024, the global power sector added a record 473 GW of renewable capacity in 2023. This massive influx demands advanced monitoring capabilities from EaaS platforms to maintain grid stability, while the Global Wind Energy Council's 'Global Wind Report 2024' noted a record 117 GW of new wind capacity installed in 2023, highlighting the diverse generation mix providers must manage.Concurrently, the rising demand for cost optimization and energy efficiency drives organizations to transition from capital-intensive ownership to operational expenditure models. EaaS enables enterprises to adopt clean technologies without the burden of upfront infrastructure costs, effectively shifting financial risk to the service provider. This transition is supported by substantial capital flows into clean technologies, which EaaS models help monetize and maintain. As per the International Energy Agency's 'World Energy Investment 2024' report from June 2024, investment in solar PV alone was projected to reach USD 500 billion in 2024, surpassing all other electricity generation technologies combined. This scale underscores the market's pivot toward managed, efficient energy assets that deliver predictable operational costs and sustainability benefits.

Market Challenges

The presence of diverse and complex regulatory frameworks acts as a major barrier to the growth of the Global Energy as a Service Market by complicating the standardization of service contracts. EaaS models rely heavily on scalability and replicable subscription structures to maintain low costs and operational efficiency across different regions. However, fragmented regulations regarding grid access, net metering, and carbon reporting force providers to customize contracts for each specific jurisdiction. This necessity for bespoke compliance increases administrative burdens and transaction costs, thereby eroding the financial appeal of the subscription model for multinational clients seeking uniform energy solutions.These regulatory bottlenecks create substantial delays in project implementation and asset deployment. According to the International Energy Agency, in 2024, at least 1,650 gigawatts of renewable capacity were in advanced stages of development but remained stalled while waiting for a grid connection. This backlog highlights how permitting hurdles and regulatory inefficiencies prevent ready-to-deploy assets from becoming operational. Consequently, these delays strand capital and stall the delivery of promised energy savings, directly undermining the agility and reliability that define the Energy as a Service value proposition.

Market Trends

The Integration of Artificial Intelligence for Predictive Energy Analytics is fundamentally reshaping the market by transitioning providers from reactive asset maintenance to autonomous system optimization. EaaS platforms are increasingly deploying machine learning algorithms to forecast energy price spikes and equipment failures, thereby securing the performance guarantees central to subscription contracts. This technological shift allows customers to maximize the value of distributed assets while ensuring providers can meet stringent efficiency baselines without incurring excessive operational penalties. According to Siemens Energy's 'Earnings Release Q4 FY 2024' in November 2024, the Grid Technologies segment reported comparable revenue growth of approximately 32%, underscoring the rapid industrial uptake of intelligent infrastructure and digital stability services necessary to support these advanced analytical capabilities.Simultaneously, the Convergence of Electric Vehicle Charging with Energy Services has emerged as a critical trend, effectively turning corporate fleets into flexible grid resources. Service providers are now bundling charging infrastructure installation with smart load management software that mitigates peak demand charges and enables vehicle-to-grid revenue streams. This integration transforms EVs from simple power consumers into dynamic assets that EaaS vendors utilize to balance local microgrids and lower overall energy procurement costs for commercial clients. According to the International Energy Agency's 'World Energy Outlook 2024' from October 2024, global electric car sales were set to reach 17 million units in 2024, representing a massive new distributed load that necessitates the sophisticated, managed charging solutions offered through service-based models.

Key Players Profiled in the Energy as a Service Market

- Schneider Electric SE

- Siemens AG

- Engie SA

- Honeywell International Inc.

- Veolia Environnement S.A.

- Johnson Controls International PLC

- General Electric Company

- EDF Renewables North America

- Enel X

- Ameresco Inc.

Report Scope

In this report, the Global Energy as a Service Market has been segmented into the following categories:Energy as a Service Market, by Service Type:

- Energy Supply Service

- Operational & Maintenance Service

- Energy Optimization & Efficiency Service

Energy as a Service Market, by End-user:

- Commercial

- Industrial

Energy as a Service Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Energy as a Service Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Energy as a Service market report include:- Schneider Electric SE

- Siemens AG

- Engie SA

- Honeywell International Inc.

- Veolia Environnement S.A.

- Johnson Controls International PLC

- General Electric Company

- EDF Renewables North America

- Enel X

- Ameresco Inc

Table Information

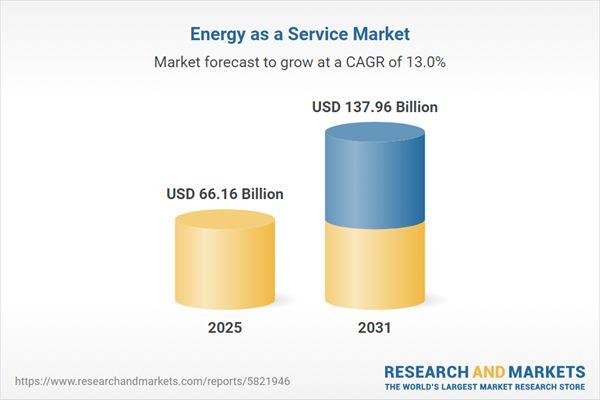

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 66.16 Billion |

| Forecasted Market Value ( USD | $ 137.96 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |