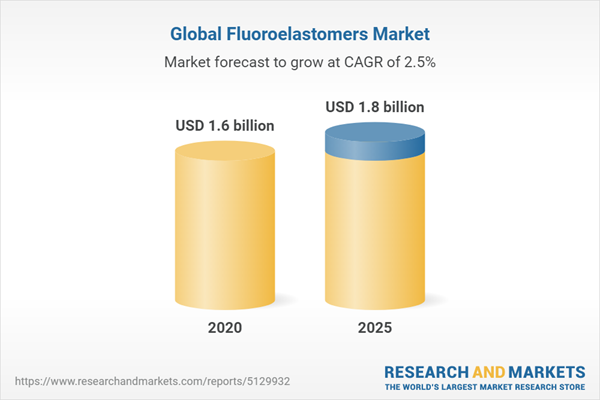

The global fluoroelastomers market size is projected to grow from USD 1.6 billion in 2020 to USD 1.8 billion by 2025, at a compound annual growth rate (CAGR) of 2.5% between 2020 and 2025. The global fluoroelastomers industry has witnessed growth primarily because of the strict emission regulations adopted by the automotive industry and the growing demand for more fuel-efficient vehicles.

The o-rings application of the fluoroelastomers market is projected to witness the highest growth during the forecast period. Fluoroelastomer-based O-rings are used in extreme environments due to their capability to resist high temperatures, ozone, oxygen, mineral oils, synthetic hydraulic fluids, and fuels. Due to this, they are used widely in the automotive, aerospace, oil & gas, and chemical industries and are replacing the conventional rubber O-rings in many applications.

“Automotive industry is projected to lead the fluoroelastomers market from 2020 to 2025.”

The automotive industry is expected to lead the fluoroelastomers market. Fluoroelastomers show superior resistance to chemicals and fluids, including fuels and are thus, replacing other conventional elastomers in sealing applications in the automotive industry. They help reduce emissions and increase the fuel efficiency of vehicles.

“North America is projected to account for the maximum revenue share of the fluoroelastomers market during the forecast period.”

North America is projected to lead the global fluoroelastomers market from 2020 to 2025 in terms of value. The large-scale automobile and aircraft production are the key segments that consume the majority of the fluoroelastomers market in the region.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, innovation and technology directors, and other executives from various key organizations operating in the fluoroelastomers market.

- By Company Type: Tier 1: 40%, Tier 2: 20%, and Tier 3: 40%

- By Designation: C-level Executives: 20%, Directors: 20%, and Others: 60%

- By Region: North America: 10%, Europe: 15%, Asia Pacific: 65%, Middle East & Africa: 5%, and South America: 5%

The global fluoroelastomers market comprises major manufacturers such as The Chemours Company (US), Solvay SA (Belgium), and 3M (US), Asahi Glass Company (Japan), Daikin Industries (Japan) and Gujarat Fluorochemicals Limited (India).

Research Coverage

The market study covers the fluoroelastomers market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type, material, application, and region. The study also includes an in-depth competitive analysis of key players in the market, along with their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to enhance their position in the fluoroelastomers market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers of the overall fluoroelastomers market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market and gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

Table of Contents

Companies Mentioned

- 3M

- Airboss of America Co.

- Asahi Glass Company (AGC)

- Chenguang Fluoro & Silicone Elastomers

- Daikin Industries

- Dongyue Group

- Dynafluon

- Eagle Elastomers Inc.

- Greene, Tweed & Co.

- Gujarat Fluorochemicals Limited

- Halopolymer Ojsc

- James Walker & Co.

- Marco Rubber & Plastic Products, Inc.

- Polycomp Bv

- Precision Polymer Engineering

- Shanghai Fluoron Chemicals

- Solvay Sa

- The Chemours Company

- Zhonghao Chenguang Research Institute of Chemical Industry

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | July 2020 |

| Forecast Period | 2020 - 2025 |

| Estimated Market Value ( USD | $ 1.6 billion |

| Forecasted Market Value ( USD | $ 1.8 billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |