The molecular sieves market is being propelled by the increasing product demand from industries for efficient gas separation and purification processes. Molecular sieves are widely used in adsorption applications due to their superior adsorption capabilities coupled with selectivity including natural gas dehydration and oxygen generation, among others. This trend is further supported by clean energy utilization, stringent environmental regulations, and expansion of industrial sectors across the globe. Furthermore, advancements in molecular sieve technologies bring an improvement in their efficiencies, making them indispensable for making quality industrial outputs with cheaper and less environmental impacts to running costs. For instance, in 2024, Honeywell's Ecofining technology enables St1's Gothenburg biorefinery to produce 200,000 tons of SAF and renewable fuels annually, reducing CO₂ emissions by 500,000 tons using flexible feedstocks like cooking oil and animal fats. This technology relies on advanced molecular sieve systems to enhance the production of sustainable aviation fuel (SAF) and other renewable fuels.

The United States plays a pivotal role in the molecular sieves market, driven by its advanced industrial infrastructure and significant focus on innovation. As a leading producer and consumer, the US supports market growth through extensive applications in petrochemicals, natural gas processing, and air separation technologies. Investments in research and development enhance the efficiency and performance of molecular sieves, catering to stringent environmental regulations and energy optimization demands. For instance, in 2024, Honeywell will provide adsorption-based technology for Mozambique's Rovuma LNG project, enabling water, CO2, and hydrocarbon removal, supporting ExxonMobil's 18 Mtpa production via modular trains and enhancing global energy accessibility. Furthermore, the country’s robust manufacturing base and export capabilities ensure a steady supply of high-quality molecular sieves to global markets, reinforcing its position as a key contributor to the industry's expansion.

Molecular Sieves Market Trends:

Increasing Demand in the Petrochemical Industry

The primary driver for the global market is the growing demand in the petrochemical industry. Molecular sieves are critical to refining processes, where they are used for drying and purifying various hydrocarbon streams and gases. Their high selectivity and efficiency in separating molecules based on size make them indispensable for ensuring the purity of final products. With the growth of the petrochemical sector, in particular in developing economies, the demand for molecular sieves is on the rise. This is because countries like India are attracting investment in the petrochemical industry. For instance, according to the Ministry of Petroleum & Natural Gas, the Indian Government, the petrochemical sector in India is projected to attract investments exceeding USD 87 Billion in the next decade, representing over 10% of global petrochemical growth. Under the new PCPIR Policy 2020-35, a combined investment of INR 10 lakh crore (approximately USD 142 Billion) is targeted by 2025, underscoring the government's long-term vision for the industry. This trend is further fueled by advancements in refining technologies and the growing need for cleaner, more efficient fuel processing methods. As such, the market is steadily growing as a result of the continuous quest for operational efficiency and regulatory compliance within the petrochemical industry.Advancements in Water Treatment Technologies

The other major driving factor behind the market is their rising applications in water treatment technologies. With the growing demand for clean and safe water globally, molecular sieves are increasingly becoming a favorite choice for purifying and decontaminating water. They have a very high adsorption capacity and are known to target particular molecular sizes, which makes them highly effective in the treatment of water for a wide range of industrial and municipal applications. According to an industrial report, the gap between global water supply and demand is projected to reach 40% by 2030. Moreover, water management practices that are termed to be sustainable and the various norms regarding water quality are, on the other hand, generating much demand for molecular sieves in water treatment plants. It is not only across the developed regions, but it also dominates the developing countries facing problems of water scarcity and environmental pollution.Expansion of Green and Sustainable Practices

Another key reason driving the market is that the world is shifting more towards sustainability and green practices. Molecular sieves hold a crucial position in numerous eco-friendly processes, including carbon capture and green chemistry applications. Through selective adsorption of gases and organic compounds, they help reduce emissions as well as increase energy efficiency in various industrial processes, which aligns with the increasing pressure from regulations and corporate commitments for environmental sustainability. Further, new, more efficient types of molecular sieves, which are environmentally friendly, also catalyze market growth. This trend is more pronounced in automotive and renewable energy industries where molecular sieves are used to reduce pollution in fuel evaporation control systems and assist in the storage and purification processes in renewable energy, respectively. For instance, in 2024, Honeywell's UOP eFining™ technology was selected by Jiutai Group to produce 100,000 tons of sustainable aviation fuel annually from eMethanol, reducing greenhouse gas emissions by 88% versus conventional jet fuel.Molecular Sieves Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global molecular sieves market, along with forecast at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, material type, application, shape, size, and end-use industry.Analysis by Type:

- Type 3A

- Type 4A

- Type 5A

- Type 13X

- Type Y

- Pentacil

- Others

Analysis by Material Type:

- Carbon

- Clay

- Porous Glass

- Silica Gel

- Zeolite

- Others

Analysis by Application:

- Catalyst

- Adsorbent

- Desiccants

The adsorbent segment is another key area in the market, which is characterized by the use of these materials in separation and purification processes. They are highly efficient at adsorbing specific molecules from liquid or gas mixtures, making them essential in applications such as gas purification, water treatment, and air separation. This growth is due to the flexibility and high efficiency of molecular sieves as adsorbents for capturing a wide range of molecular species. The use of these materials in environmental applications, like pollutant removal and carbon capture, contributes significantly to the expansion of this market segment.

The desiccants involve a type of application of moisture control and drying. This kind of material is efficient in absorbing water vapor in the air and gases; these applications are essential to ensure the protection of products and processes against moisture damage. Pharmaceutical, electronics, and food industries utilize desiccants based on molecular sieves since they require maintaining very low humidity. This demand is driven by the requirement for good moisture control solutions in industries and superior performance as to other desiccating materials.

Analysis by Shape:

- Pelleted

- Beaded

- Powdered

Analysis by Size:

- Microporous

- Mesoporous

- Macroporous

The pores of mesoporous molecular sieves range from 2 to 50 nanometers. These are primarily used in applications where bigger molecules have to be adsorbed. They have significant values in the chemical industry, especially in catalysis and separation processes. In the pharmaceutical industry, they have been used to design drug delivery systems. The large pore size will allow the adsorption and catalysis of bigger organic and inorganic molecules, thus making them quite ideal for industrial applications. The growth in this segment is because of their unique properties that are ideal for specialized applications that microporous sieves cannot fulfill.

The macroporous segment has the pore size more than 50 nanometers. These sieves are used in applications requiring a large amount of adsorbable particle and molecules' size, for example, filtration in water treatment to remove heavy metals and other sizeable contaminants and in food companies for filtration purposes. Their macro-porous size makes the sieves less selective for microporous and mesoporous sieves but for applications involving large molecules or large particles. The utility of macroporous molecular sieves in industries, where large-scale filtration and adsorption is required, supports the market.

Analysis by End-Use Industry:

- Oil and Gas Industry

- Agricultural Industry

- Chemical Industry

- Pharmaceutical Industry

- Water Treatment Industry

- Construction Industry

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Molecular Sieves Market Analysis

US accounts for 89.5% share of the market in North America. The United States' thriving industrial landscape makes it a significant market for molecular sieves. A major factor in the need for molecular sieves for gas separation and drying operations is the petrochemical industry. In hydrogen purification and CO₂ capture technologies, molecular sieves are essential as the United States moves towards cleaner energy practices. Additionally, the rise in shale gas has increased demand, especially for natural gas processing applications including dehydration. The use of molecular sieves in drug formulation and packaging to regulate humidity is expanding in the pharmaceutical and healthcare industries. According to an industrial report, in 2021, the pharmaceutical sector in the United States brought in USD 550 Billion and Americans spent a whopping USD 576.9 Billion on medications. The United States is projected to spend between USD 605 and USD 635 Billion on healthcare. This makes the application significant. Furthermore, growing molecular sieve uses in environmental settings, such as wastewater treatment, are consistent with sustainability and federal environmental requirements. Opportunities are constantly being created by advancements in zeolite-based molecular sieves, particularly in catalysis. Strong R&D expenditures, an emphasis on high-performance materials, and cooperation between businesses and academic institutions all help the U.S. market. The market for molecular sieves in the United States is expected to increase steadily due to rising demand from a variety of industries, government initiatives to promote industrial efficiency and technical advancements.Europe Molecular Sieves Market Analysis

The market for molecular sieves in Europe is fuelled by strict environmental laws and a strong emphasis on sustainability. Molecular sieves are widely used for drying, purification, and catalysis applications in important sectors like petrochemicals, pharmaceuticals, and environmental services. Molecular sieves are essential to CO₂ capture technologies, which are in high demand due to the EU's Green Deal, which places a strong emphasis on lowering emissions. The market is further boosted by the expansion of the pharmaceutical industry, especially in Germany and Switzerland. Germany is one of the top countries in the world for pharmaceutical manufacture, according to data from Germany Trade and Invest. The volume of pharmaceutical production reached EUR 34.6 billion (USD 36.4 billion) in 2021, representing a 6.9 percent increase from the previous year. Germany is one of the largest pharmaceutical production hubs in the European Union, along with Belgium and Italy. Molecular sieves are crucial for preserving product stability during the production and storage of drugs. The use of molecular sieves in the field of renewable energy, such as hydrogen purification and biogas upgrading, is also growing in Europe. European producers are creating sophisticated zeolite sieves with a significant emphasis on research and innovation to increase productivity and broaden applications. The region's commitment to environmental sustainability and technological leadership positions it as a significant contributor to the global molecular sieves market.Asia Pacific Molecular Sieves Market Analysis

The market for molecular sieves is expanding at the quickest rate in Asia-Pacific due to the region's rising urbanisation and industrialisation. Molecular sieves for gas drying and separation are widely used by the region's leading chemical and petrochemical industries, especially in China and India. The need for these materials has increased because of increased energy demand driving natural gas processing activities. Molecular sieves are utilized for product stability and moisture control in the pharmaceutical and food packaging industries in Asia-Pacific, which also make substantial contributions. There are further potential prospects due to the increasing use of renewable energy sources like hydrogen and biogas in nations like South Korea and Japan. Approximately 9% of South Korea's electricity generation came from renewable sources in 2022, according to the Renewable Energy Institute. By 2030, this percentage is expected to rise to 21.6%, and by 2036, it will reach 30.6%. This is expected to bolster the market growth in the country. Asia-Pacific is a desirable market for producers of molecular sieves due to its low manufacturing costs and supportive government policies for industrial expansion. APAC is also expected to maintain strong growth due to its expanding industrial base and focus on sustainable practices.Latin America Molecular Sieves Market Analysis

The thriving oil and gas sector in Latin America, especially in Brazil and Mexico, is driving growth in the market for molecular sieves. According to IEA data, Latin America, and the Caribbean (LAC) is well-placed to produce low-emissions hydrogen and its derivatives, building on its abundant natural and renewable energy resources and largely decarbonised electricity mix (of which 60% comes from renewables). In 2023, hydrogen demand in the region reached 4 Mt, mostly for use in oil refining and chemical manufacturing. Almost 90% is produced using natural gas, which contributes to the region’s reliance on imports. In keeping with the region's emphasis on boosting energy exports, molecular sieves are essential for the dehydration and separation operations of natural gas. Driven by expanding consumer markets and advancing industrial infrastructure, the food packaging and pharmaceutical industries are likewise becoming more significant providers. The use of molecular sieves in air purification and wastewater treatment applications is being encouraged by environmental legislation. Opportunities for the adoption of molecular sieves are presented by the economic growth and government initiatives to modernise industry in Latin America. Despite being smaller than in other areas, the market is growing steadily because of growing industrialization and environmental consciousness.Middle East and Africa Molecular Sieves Market Analysis

The oil and gas sector is the main driver of the market for molecular sieves in the Middle East and Africa. According to an industrial report, energy investment in the Middle East is expected to reach approximately USD 175 Billion in 2024, with clean energy accounting for around 15% of the total investment. Molecular sieves are widely used in the petrochemical and natural gas processing industries in nations like Saudi Arabia and the United Arab Emirates. The region's water shortage has raised the demand for molecular sieves in water treatment and desalination systems. Furthermore, the expansion of South Africa's pharmaceutical sector is increasing demand for molecular sieves for drug packaging and storage. The market for molecular sieves is anticipated to rise steadily as the area makes investments in sustainable practices and industrial modernization.Competitive Landscape:

Key players in the market are actively engaged in research and development to innovate and enhance the efficiency of their products. These efforts are particularly focused on increasing adsorption capacity, improving selectivity for specific molecules, and developing environmentally sustainable solutions. Many companies are expanding their global presence through strategic partnerships, mergers, and acquisitions, aiming to enhance their market reach and capitalize on emerging market opportunities, especially in regions such as Asia Pacific and the Middle East. Additionally, these players are investing in production capacity expansion to meet the growing demand from various industries such as oil and gas, pharmaceuticals, and water treatment. This focus on innovation, expansion, and sustainability is pivotal to maintaining their competitive edge in the changing molecular sieves market. For instance, in October 2024, Axens, IFPEN, and JEPLAN announced the commercialization of Rewind PET, enabling global licensing of PET glycolysis-based depolymerization technology. This process involves the continuous breakdown of PET into BHET (Bis(2-Hydroxyethyl) terephthalate), followed by its purification. Molecular sieves play a critical role in this stage, ensuring the removal of water and impurities to achieve high-purity BHET.The report provides a comprehensive analysis of the competitive landscape in the molecular sieves market with detailed profiles of all major companies, including:

- Axens

- BASF SE

- Bear River Zeolite Company (USAC)

- Caledon Laboratories Limited

- CECA (Arkema)

- Clariant Produkte (Schweiz AG)

- Honeywell UOP

- Interra Global Corporation

- KNT Group

- Merck & Co.

- Sorbead India

- Tosoh Corporation

- Zeochem AG (Cph Chemie & Papier)

Key Questions Answered in This Report

1. How big is the molecular sieves market?2. What is the future outlook of molecular sieves market?

3. What are the key factors driving the molecular sieves market?

4. Which region accounts for the largest molecular sieves market share?

5. Which are the leading companies in the global molecular sieves market?

Table of Contents

Companies Mentioned

- Axens

- BASF SE

- Bear River Zeolite Company (USAC)

- Caledon Laboratories Limited

- CECA (Arkema)

- Clariant Produkte (Schweiz AG)

- Honeywell UOP

- Interra Global Corporation

- KNT Group

- Merck & Co.

- Sorbead India

- Tosoh Corporation

- Zeochem AG (Cph Chemie & Papier)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

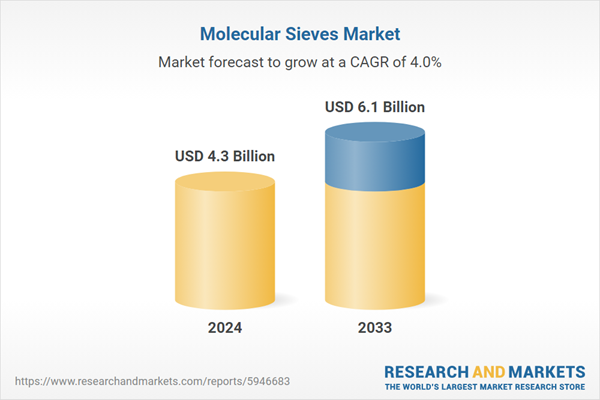

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.3 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |