Global Non-Alcoholic Beverage Packaging Market - Key Trends & Drivers Summarized

What Is Non-Alcoholic Beverage Packaging and Why Is It Critical for the Beverage Industry?

Non-alcoholic beverage packaging refers to the containers and materials used to package drinks such as soft drinks, bottled water, juices, dairy products, sports drinks, and energy drinks. Packaging plays a vital role in protecting the beverage, preserving its quality and taste, and ensuring its safe transport from production to consumption. Non-alcoholic beverage packaging includes plastic bottles, glass bottles, aluminum cans, cartons, and flexible packaging materials, all designed to maintain product integrity, enhance shelf life, and appeal to consumers with convenient and eco-friendly options.The importance of non-alcoholic beverage packaging lies in its ability to safeguard the quality of beverages while addressing consumer preferences for sustainability and convenience. Packaging not only protects the beverage from contamination and spoilage but also serves as a marketing tool that influences consumer purchasing decisions. As the beverage industry continues to grow and diversify, with an increasing focus on health-conscious and eco-friendly products, innovative and sustainable packaging solutions are becoming essential.

How Is the Non-Alcoholic Beverage Packaging Market Evolving?

The non-alcoholic beverage packaging market is evolving rapidly in response to changing consumer preferences, particularly the demand for sustainable and eco-friendly packaging solutions. One of the key trends is the shift toward recyclable and biodegradable packaging materials. Consumers are increasingly looking for environmentally responsible packaging options, driving beverage companies to adopt recyclable plastics, plant-based materials, and lightweight packaging that reduces carbon emissions. Aluminum cans and glass bottles, which are easily recyclable, are gaining popularity as brands work to reduce their environmental footprint.Another significant trend is the growing use of lightweight, flexible packaging, such as pouches and cartons, which offer convenience and reduce material usage. Flexible packaging is becoming more popular for products like juices, dairy drinks, and sports beverages due to its portability, resealability, and reduced environmental impact. Additionally, advancements in digital printing and smart packaging technologies are allowing beverage companies to create personalized, eye-catching designs that engage consumers and provide product information through QR codes and other interactive features.

Which Types of Beverages Are Leading the Adoption of Advanced Packaging Solutions?

Bottled water and soft drinks are the largest segments driving the adoption of advanced packaging solutions in the non-alcoholic beverage market. Bottled water brands are increasingly adopting lightweight plastic bottles and recyclable packaging to address environmental concerns, while soft drink manufacturers are focusing on innovative packaging designs that improve portability and convenience. Sports drinks and energy drinks are also major adopters of flexible and eco-friendly packaging, catering to active consumers who seek convenient, portable beverage options.The dairy and juice segments are also contributing to the growth of the non-alcoholic beverage packaging market. In particular, plant-based dairy alternatives, such as almond milk and oat milk, are increasingly adopting sustainable packaging to appeal to health-conscious and environmentally aware consumers. Juice brands are exploring cartons and flexible packaging that offer longer shelf life while reducing packaging waste. Additionally, ready-to-drink coffee and tea products are adopting innovative packaging that preserves freshness and enhances the consumer experience.

What Are the Key Growth Drivers in the Non-Alcoholic Beverage Packaging Market?

The growth in the non-alcoholic beverage packaging market is driven by several key factors, with the increasing demand for sustainable packaging solutions being a primary driver. As consumers become more environmentally conscious, beverage companies are shifting toward recyclable, biodegradable, and lightweight packaging materials to meet sustainability goals and reduce plastic waste. Another important driver is the rising demand for convenience packaging, particularly among busy, on-the-go consumers who prefer portable, resealable packaging options like pouches and cartons.The expansion of the health-conscious beverage segment, including bottled water, plant-based dairy alternatives, and functional drinks like sports beverages, is also fueling demand for innovative packaging that aligns with consumer preferences for natural, sustainable products. Additionally, technological advancements in packaging design, such as smart packaging and digital printing, are enhancing the consumer experience by providing more personalized, interactive, and informative packaging. The growing emphasis on reducing food and beverage waste is further driving the adoption of packaging that extends shelf life and improves product safety.

Report Scope

The report analyzes the Non-Alcoholic Beverage Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Packaging Material (Plastic, Metal, Glass, Other Packaging Materials).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plastic Packaging Material segment, which is expected to reach US$95 Billion by 2030 with a CAGR of 5.9%. The Metal Packaging Material segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $38.7 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $47.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Non-Alcoholic Beverage Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Non-Alcoholic Beverage Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Non-Alcoholic Beverage Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allied Glass Containers Ltd., Amcor Ltd., Aptargroup, Inc., Ardagh Group SA, Ball Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Non-Alcoholic Beverage Packaging market report include:

- Allied Glass Containers Ltd.

- Amcor Ltd.

- Aptargroup, Inc.

- Ardagh Group SA

- Ball Corporation

- Bemis Co., Inc.

- Can-Pack SA

- CCL Industries, Inc.

- CKS Packaging Inc.

- Crown Holdings, Inc

- Evergreen Packaging LLC.

- Genpak LLC

- HUBER Packaging Group GmbH

- International Paper Company

- Kian Joo Group

- Mondi PLC

- Owens-Illinois, Inc. (O-I)

- Parksons Packaging Ltd.

- Silgan Holdings, Inc.

- Tetra Pak GmbH & Co. KG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allied Glass Containers Ltd.

- Amcor Ltd.

- Aptargroup, Inc.

- Ardagh Group SA

- Ball Corporation

- Bemis Co., Inc.

- Can-Pack SA

- CCL Industries, Inc.

- CKS Packaging Inc.

- Crown Holdings, Inc

- Evergreen Packaging LLC.

- Genpak LLC

- HUBER Packaging Group GmbH

- International Paper Company

- Kian Joo Group

- Mondi PLC

- Owens-Illinois, Inc. (O-I)

- Parksons Packaging Ltd.

- Silgan Holdings, Inc.

- Tetra Pak GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

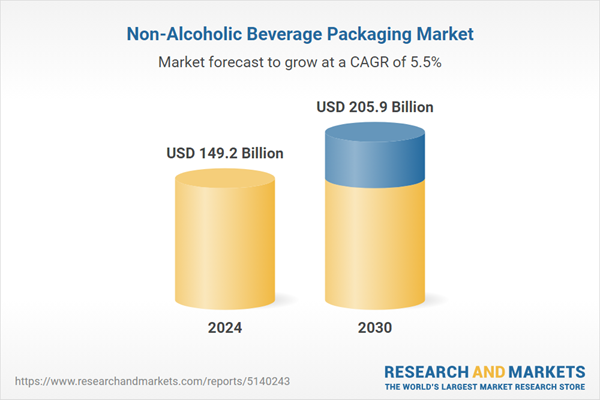

| Estimated Market Value ( USD | $ 149.2 Billion |

| Forecasted Market Value ( USD | $ 205.9 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |