Clinical Laboratory Services Market

The Clinical Laboratory Services Market is shifting from volume-driven test processing to outcome-linked, digitally orchestrated diagnostics that span prevention, acute care, chronic disease management, and population health. Services cover core chemistry, hematology, immunoassay, microbiology, anatomic pathology, molecular and genomic testing, and specialized esoteric assays. Demand is propelled by aging populations, chronic disease prevalence, oncology and rare-disease pathways, and the embedding of lab data into clinical decision support and care navigation. Trends include consolidated hub-and-spoke networks, rapid molecular platforms, syndromic panels, reflex algorithms, liquid biopsy, pharmacogenomics, and minimal-sample workflows. Interoperability with EHRs, remote phlebotomy, patient self-collection, and at-home logistics expand access while preserving traceability. Competitive dynamics blend national reference labs, hospital outreach programs, specialty genomics firms, and digital-first intermediaries. Differentiation centers on clinical accuracy, turnaround reliability, payer contracting, companion-diagnostic partnerships, and real-world data curation. As value-based care scales, labs evolve from “test vendors” to longitudinal data stewards and therapy-enabling partners - supporting risk stratification, earlier interventions, and closed-loop outcomes across integrated delivery networks and life-science ecosystems.Clinical Laboratory Services Market Key Insights

- Precision oncology and hereditary risk programs elevate molecular and genomic services from niche to standard pathways. Labs integrate tumor profiling, MRD monitoring, and germline testing with decision support, enabling targeted therapies, surveillance, and family cascade screening while aligning with multidisciplinary tumor boards and payer criteria.

- Infectious disease testing normalizes rapid, multiplex molecular platforms. Syndromic panels and reflex algorithms balance speed, stewardship, and cost by escalating from targeted assays to broader panels only when clinically warranted, reducing unnecessary antibiotics and length of stay while maintaining surge capacity for outbreaks.

- Chronic care models lean on lab-enabled risk stratification. Longitudinal biomarkers in cardiometabolic, renal, and autoimmune conditions feed care management and remote monitoring, guiding medication titration and preventing avoidable admissions. Labs that package analytics with provider workflows deepen payer partnerships.

- Liquid biopsy expands beyond tissue constraints. Circulating tumor DNA, methylation signatures, and exosome assays enable earlier detection, therapy selection, and recurrence surveillance. Pre-analytical rigor, bioinformatics pipelines, and orthogonal confirmation protocols differentiate clinical validity and utility.

- Pharmacogenomics enters routine prescribing. Actionable gene-drug pairs embedded in EHR alerts inform initial therapy choices and dosing, cutting trial-and-error cycles. Labs that deliver concise, clinician-friendly reports and education accelerate prescriber adoption and payer coverage confidence.

- Interoperability and data liquidity become strategic assets. FHIR-native interfaces, order/result normalization, and identity resolution enable cross-setting visibility. Labs monetize de-identified, consented datasets for outcomes research while maintaining rigorous privacy, security, and governance.

- At-home and decentralized collection widen access. Mobile phlebotomy, dried blood spots, saliva, and micro-sampling reduce barriers for rural and mobility-limited populations. Robust chain-of-custody, barcoding, and stability controls preserve quality as logistics networks expand.

- Operational excellence hinges on automation and analytics. Track-and-trace, robotic aliquoting, digital pathology, and AI-driven quality control raise throughput and reduce errors. Predictive maintenance and capacity modeling stabilize turnaround despite labor constraints and test-mix volatility.

- Reimbursement pressure reshapes portfolios. Prior auth, utilization management, and bundled payments push labs to evidence-backed menus, clinical pathways, and consultative services. Contracting strength depends on documented outcomes impact, site-of-care optimization, and denials management.

- Life-science partnerships create new revenue stacks. Companion diagnostics, trial testing, and real-world evidence programs turn labs into development and commercialization partners. Rapid assay launch, regulatory fluency, and scalable biobank governance secure durable collaborations.

Clinical Laboratory Services Market Reginal Analysis

North America

An integrated payer-provider landscape drives consolidation of reference networks and hospital outreach programs. Emphasis is on interoperability, prior-authorization automation, and evidence-backed test utilization. Molecular oncology, PGx, and digital pathology scale within IDNs, while at-home collection and retail clinics extend reach. Competitive advantage comes from turnaround reliability, payer contracting, and outcomes-linked analytics for value-based arrangements.Europe

National health systems emphasize quality standards, accreditation, and equitable access. Centralized procurement fosters large regional labs with advanced automation and digital pathology. Precision medicine initiatives expand germline and tumor profiling within structured pathways, while data protection rules shape cloud and cross-border data flows. Collaboration with academic centers supports translational assays and population screening pilots.Asia-Pacific

Rapid urbanization and private healthcare growth fuel demand for high-throughput core labs and advanced molecular services. Leading markets scale oncology, NIPT, and infectious disease genomics, with strong investment in automation and LIS modernization. Price sensitivity encourages tiered menus and decentralized collection. Local manufacturing of reagents and instruments shortens lead times; public-private programs broaden access in emerging economies.Middle East & Africa

Infrastructure build-out prioritizes centralized reference hubs with spoke sites for sample intake and rapid tests. Investments target molecular capabilities, digital pathology, and robust cold-chain logistics. Government initiatives seek screening for endemic conditions and maternal-child health, while private providers develop premium oncology and wellness panels. Training, accreditation, and quality systems are central to reliability and trust.South & Central America

Private labs and public programs expand core and specialized testing amid budget constraints and uneven access. Focus areas include infectious disease, maternal-fetal screening, and oncology. Partnerships with global vendors bring automation and reagent security; regional logistics and at-home sampling improve coverage beyond major cities. Reimbursement stability and regulatory clarity drive sustainable growth and technology refresh cycles.Clinical Laboratory Services Market Segmentation

By Test Type

- Genetic Testing

- Clinical Chemistry

- Medical Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Drug of Abuser Testing

- Others

By Laboratory

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

By Application Outlook

- Bioanalytical & Lab Chemistry Services

- Toxicology

- Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Others

Key Market players

Labcorp, Quest Diagnostics, Sonic Healthcare, Eurofins Scientific, SYNLAB, Cerba HealthCare, Unilabs, ARUP Laboratories, Mayo Clinic Laboratories, BioReference Laboratories, KingMed Diagnostics, Dian Diagnostics, ADICON Holdings, Dr. Lal PathLabs, SRL DiagnosticsClinical Laboratory Services Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Clinical Laboratory Services Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Clinical Laboratory Services market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Clinical Laboratory Services market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Clinical Laboratory Services market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Clinical Laboratory Services market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Clinical Laboratory Services market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Clinical Laboratory Services value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Clinical Laboratory Services industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Clinical Laboratory Services Market Report

- Global Clinical Laboratory Services market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Clinical Laboratory Services trade, costs, and supply chains

- Clinical Laboratory Services market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Clinical Laboratory Services market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Clinical Laboratory Services market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Clinical Laboratory Services supply chain analysis

- Clinical Laboratory Services trade analysis, Clinical Laboratory Services market price analysis, and Clinical Laboratory Services supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Clinical Laboratory Services market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Labcorp

- Quest Diagnostics

- Sonic Healthcare

- Eurofins Scientific

- SYNLAB

- Cerba HealthCare

- Unilabs

- ARUP Laboratories

- Mayo Clinic Laboratories

- BioReference Laboratories

- KingMed Diagnostics

- Dian Diagnostics

- ADICON Holdings

- Dr. Lal PathLabs

- SRL Diagnostics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

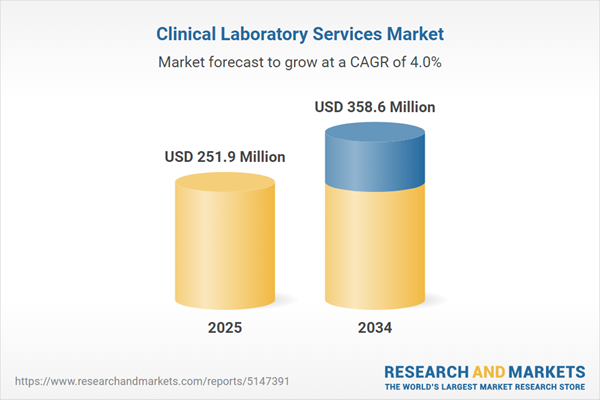

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 251.9 Million |

| Forecasted Market Value ( USD | $ 358.6 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |