As per the International Osteoporosis Foundation, around 52.0 million people suffered from osteoporosis or low bone mass in 2010 and are expected to reach 61.0 million by 2020 in the U.S. Besides, platelet rich plasma injections have been highlighted in numerous medical journals as a promising technique to heal damaged tissues. The studies have reported improved function and lesser pain after receiving these therapies than traditional standard care, thus driving its adoption rate.

Platelet rich plasma-based therapies continue to evolve as a popular treatment in the dermatology field. It is increasingly being preferred for skin rejuvenation, hair restoration, dermal augmentation, acne scars, and striae distensae. Moreover, the combination of platelet rich plasma with laser therapies, dermal fillers, micro-needling, and autologous fat grafting generates synergistic effects that lead to optimized aesthetic outcomes. The confluence of these factors boosts the penetration of these therapies in dermatology applications.

The emergence of platelet rich plasma products for point-of-care settings is another factor fostering market progression. Several POC systems are available in the market place that is specifically engineered and validated to deliver fast POC treatments within a few minutes. HEALEON HD PRP from HEALEON MEDICAL, INC., is one such FDA-approved Class II medical device that is designed for autologous platelet rich plasma preparation at the patient’s POC settings.

U.S. Platelet Rich Plasma Market Report Highlights

- The leukocyte-rich platelet rich plasma segment is expected to witness a significant increase in the commercial pool and number of experimental studies expanding its applications across orthopedic, general surgery, and sports medicine

- Numerous advancements in leukocyte PRP market space by manufacturers, mainly in protocol automation to maximize the standardization of plasma preparations are driving the segment

- The cosmetic surgery and dermatology application segment is expected to foresee the highest growth rate during the overcast period

- This is due to a rapid increase in preference among the consumers as injections based on this therapy help to achieve fuller facial features without opting for commercial fillers

- Platelet rich plasma systems are estimated to witness the fastest growth rate throughout the forecast period in the sports medicine application

- The advent of novel separation systems by key manufacturers that are specific to platelet rich plasma applications as well as functions vertically and are applicable across autologous cellular therapies boost the growth of these systems

- Numerous medical visits, high burden of orthopedic disorders particularly in geriatric population, and widespread application of this therapy for musculoskeletal injuries result in the dominant share of hospitals in 2019

- More than 300,000 old aged people, over 65 years, are hospitalized for hip fractures every year in the U.S.

- This high hospitalization rate surges the incorporation of platelet rich plasma as an adjunctive use in hip surgeries in hospital settings

- Key manufacturers are implementing business strategies such as broadening of product portfolio, widening of distribution network, and collaborations and mergers to reinforce their significant share in the market.

Table of Contents

Companies Mentioned

- Johnson & Johnson

- Arthrex, Inc.

- EmCyte Corporation

- DR. PRP America, Llc

- Juventix

- Terumo Corporation

- Zimmer Biomet

- Stryker

- Apex Biologix

- Celling Biosciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | May 2023 |

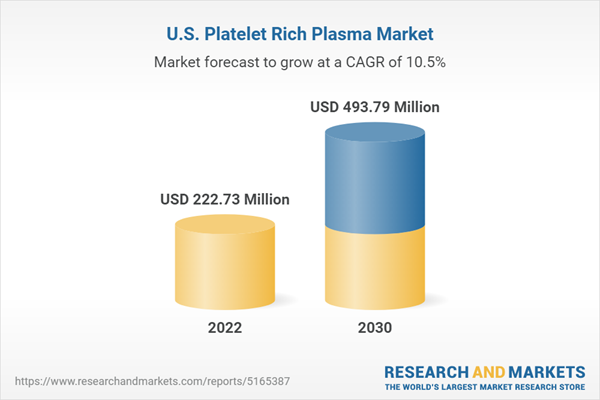

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 222.73 Million |

| Forecasted Market Value ( USD | $ 493.79 Million |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |