Factors like the development of new small and medium-sized airports in the region, modernization of the existing fleet, acquisition of new turboprop aircraft by airlines, such as TAROM, and new shorter routes are significantly driving the growth of the turboprop aircraft market in Europe. Many flight routes in Europe are below 1,000 km, which provides opportunities for using turboprop aircraft instead of narrow-body turbofan aircraft for short-haul operations, propelling the market growth in the region.

Furthermore, the presence of international aircraft engine manufacturers and collaborations with local manufacturers focusing on reducing aircraft emissions in European skies is also propelling the market's growth. Turboprop aircraft generate less emission compared to a turbofan engine on shorter routes. However, with the advent of fuel-efficient small jets with faster speeds and longer ranges, the demand for turboprops might be affected in the forecast years.

Europe Turboprop Aircraft Market Trends

Commercial Segment Will Showcase Remarkable Growth During the Forecast Period

The Commercial segment is anticipated to show significant growth in the market during the forecast period. The growth is attributed to the increasing airport projects, rise in disposable income of people, and introduction of new routes across cities. With the growing emphasis on smart airports, the operators are highly investing in new and improved infrastructure. The evolution of technology has enabled the authorities to incorporate various advanced technologies that enhance the passenger experience at airports.Europe region made one of the highest investments in the world in airport construction and expansion activities in 2022. For instance, the Son Sant Joan Mallorca Airport Redevelopment project involves the redevelopment of the Son Sant Joan Mallorca Airport in the Balearic Islands, Spain. Construction began in the beginning of 2023 and is expected to be completed in three years.. The project aims to increase the airport's operational capacity, reduce delays and traffic congestion, and improve user safety. Besides these, introducing new routes across European cities will add to the market growth. For instance, in August 2023, Aeroitalia announced that it would open three new routes from Milan, Naples, and Rome to Marche Airport, connecting the city of Ancona and the Marche province with Italy's main cities. Aeroitalia is set to increase its regional connectivity by employing its turboprop ATR 72-600 fleet. Such developments will boost the commercial segment of the market.

United Kingdom to Exhibit the Highest Growth Rate

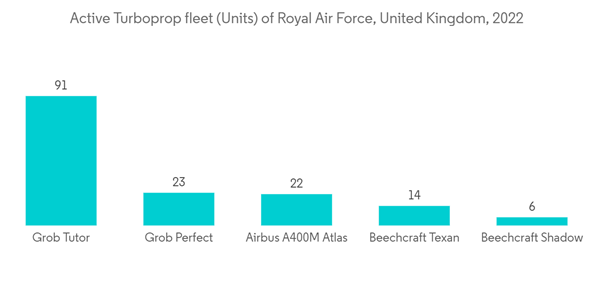

While many prominent European nations are reluctant to buy more turboprop aircraft for various applications, the United Kingdom is investing in upgrading the existing turboprop fleet and procuring new aircraft. Manufacturers are setting up new facilities for the development of aircraft turboprop systems.In addition, the rise in aircraft orders and deliveries is also adding to the market growth. In May 2023, the Royal Air Force took the delivery of the 22nd Atlas C1 (A400M) transport aircraft and completed the delivery development & production phase. Simultaneously, its tactical capability will expand, including the full range of support to UK airborne forces. Recently, the United Kingdom's Maritime and Coastguard Agency (MCA) incorporated two new advanced Beechcraft King Air B200 planes equipped with advanced sensors, emergency locator beacons, electro-optical infrared cameras, and other devices capable of spotting minute dangers from as far as 40 miles away. Such developments will drive the demand for turboprops in the United Kingdom.

Europe Turboprop Aircraft Industry Overview

The turboprop aircraft market in Europe is consolidated in nature, with prominent local and global players holding significant shares in the market. Some of the key players in the market are Textron Inc., DAHER, ATR, Lockheed Martin Corporation, and PILATUS AIRCRAFT LTD. ATR dominates a significant market share, catering to several low-cost carriers. The development of light turboprop business aircraft is growing in the region, owing to business growth. The players see turboprop aircraft as a potential solution, to a certain extent, for the reduction of Europe's aviation pollution. Thus, players are launching the latest turboprop aircraft models with advanced technologies that might effectively reduce aviation's carbon footprint. For instance, in April 2023, Daher’s efficient and fast single-engine turboprop aircraft TBM 960 made its first public European appearance at the AERO Friedrichshafen, Europe’s largest general aviation exhibition.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus SE

- Piaggio Aerospace

- Lockheed Martin Corporation

- Embraer SA

- Textron Inc.

- Pilatus Aircraft Ltd

- ATR

- Thrush Aircraft Inc.

- Viking Air Limited

- Piper Aircraft Inc.

- DAHER

- Air Tractor Inc.