The rising prevalence of respiratory diseases has significantly impacted the market growth. The adoption of long-term Home Mechanical Ventilation (HMV) in case of chronic respiratory failure due to diseases, such as thoracic disease, Chronic Obstructive Pulmonary Disorder (COPD), and neuromuscular disease, is expected to increase over the forecast period.

According to a study by the World Health Organization (WHO), moderate to severe COPD affects around 65 million individuals worldwide, making it the third leading cause of death. These estimates are expected to rise over the years owing to the growing geriatric population, increasing exposure to tobacco smoke, and indoor as well as outdoor pollution. These factors are anticipated to boost the overall market growth.

An increase in the number of government initiatives aimed at providing safe, affordable, and quality healthcare is driving the adoption of these devices. For example, the American Society of Anesthesiologists provides guidelines for the management of difficult airways and the use of different devices at various stages of respiratory diseases.

Manufacturers have increased their production capacity to meet an exponential demand during the pandemic. For instance, Vyaire, an Illinois-based respiratory equipment manufacturer, ramped up its production capacity by 50%. To provide a safer environment for the healthcare workers, Medtronic upgraded its existing PB980 (deployed in ICUs), which will allow the control of ventilators remotely away from the isolation room. These types of initiatives positively impacted the ventilators market growth in the U.S.

However, a boost in ventilator production due to coronavirus wave is expected to be normalized by 2022 due to the decreased infection rates, dependency of patients on life support equipment, and development of an effective COVID-19 vaccine and therapeutics.

U.S. Mechanical Ventilator Market Report Highlights

- Based on product, the ventilators segment held the largest revenue share of over 83.94% in 2024 and is anticipated to grow at a fastest growth rate over the forecast year

- The growth of the U.S. mechanical ventilator market across various end use segments, including hospitals, home care, and others, is driven by several key factors

- The home care segment is witnessing significant growth, fueled by the growing number of government initiatives heading for curbing healthcare expenditures by promoting home healthcare to support market growth

- The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants

- The market is experiencing high innovation, driven by portability, automation, and advancements in AI integration

Table of Contents

Companies Mentioned

- Getinge

- VYAIRE

- Medtronic

- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Koninklijke Philips N.V.

- Smiths Group plc

- Hamilton Medical

- ResMed

- Ventec Life Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | January 2025 |

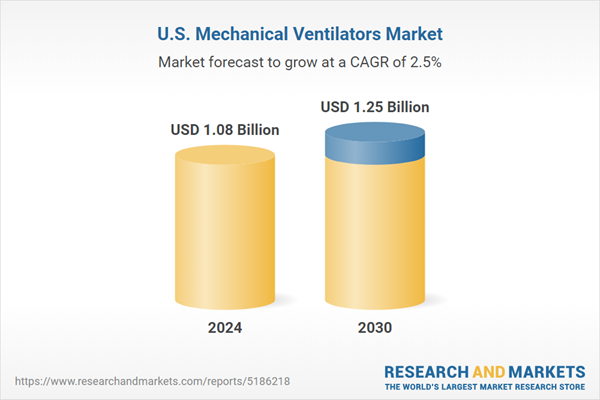

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.08 Billion |

| Forecasted Market Value ( USD | $ 1.25 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |