Biotech flavors are different flavors produced through biotechnology techniques involving various processes. One process involves fermentation with microorganisms like yeast or bacteria to produce natural or synthetic flavor compounds. Other processes, like using enzymes to break down certain compounds to produce specific flavors, are also involved.

There is a growing demand for biotech flavors among consumers as they are becoming more health-conscious and thus preferring natural ingredients in their food & beverages. Its demand is also growing due to the sustainability that these flavors provide over the traditional flavor production methods. The biotech flavor production method is more sustainable and environment-friendly as it is generally produced through fermentation, reducing resource consumption. Further, the price-effectiveness provided by biotech flavors increases both their competitiveness in the market and scalability, offering a competitive edge to biotech flavors in the flavor market. Additionally, since biotech flavors are designed and customized as per demand, they meet the stringent standards set by governments for regulations in the food, beverage, and pharmaceutical industries, increasing demand for biotech flavors.

Biotech Flavor Market Drivers

The increasing consumer demand for natural and sustainable products is increasing the biotech flavor market growth.Consumer preferences are shifting towards natural and sustainable products. They prefer flavors that are derived from natural processes. Biotech flavors are generally formed through natural fermentation, helping to cater to consumers' demand for naturally derived flavors. Biotech flavors reduce the need for a resource-intensive extraction process, offering a more sustainable method of flavor extraction, thus meeting the demand of customers who are increasingly becoming more environmentally conscious.

Biotech Flavor Market Geographical Outlook:

Asia-Pacific is anticipated to be the fastest-growing market of the biotech flavor market during the forecast period

In the forecast period, Asia-Pacific is anticipated to be the fastest-growing market for biotech flavors. Many reasons are influencing the Asia-Pacific's biotech flavor market expansion. This region is experiencing overall economic development, giving consumers more disposable income and propelling the demand for healthy products. At the same time, the huge consumer base and their increasing preferences for biotech flavors over synthetic chemical ingredients are leading the regional market growth of biotech flavors.Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Biotech Flavor Market is segmented and analyzed as follows:

By Form

- Liquid

- Paste

- Others

By Application

- Beverage

- Dairy

- Sweet-tasting food

- Salty

- Snacks

By End-User

- Food and Beverage

- Pharmaceutical

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Advanced Biotech

- Ambe Ns Agro Product Pvt Ltd

- Aromatech Group

- Biorigin (Zilor)

- Firmenich SA

- Jeneil

- MANE

- Scentium Flavours S.L.

- WEI TEH FLAVOUR & FRAGRANCE BIOTECHNOLOGY CORP

- International Flavors & Fragrances Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | December 2024 |

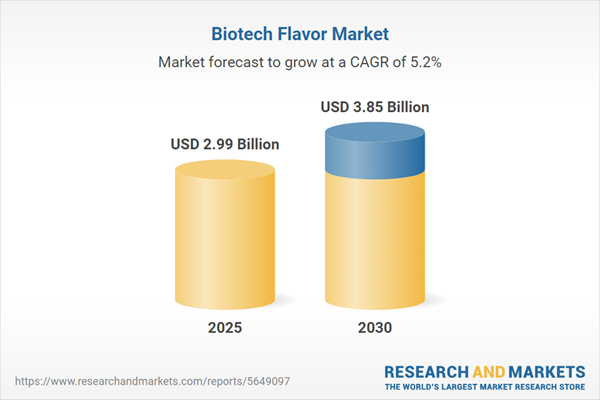

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 2.99 Billion |

| Forecasted Market Value ( USD | $ 3.85 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |