Heparin (C12H19NO20S3) is a widely used anticoagulant, a substance that inhibits blood clotting, making it essential in various medical applications. Sourced from animal tissues, this medication is administered to patients to prevent blood clots in veins, arteries, and lungs. Comprising mainly of sulfated polysaccharides, the properties of heparin include a rapid onset of action and the ability to form a complex with antithrombin III, which inactivates clotting enzymes. It's used in various medical situations such as during surgeries, dialysis, and in the treatment of deep vein thrombosis and pulmonary embolisms. Heparin works by enhancing the body's natural anticoagulant response, breaking down clots, and preventing the formation of new ones.

The global market is primarily driven by the increasing need for effective treatment options for cardiovascular diseases. In line with this, the widespread availability of varied and affordable heparin options is also providing an impetus to the market. Moreover, the considerable rise in the aging population, more susceptible to clotting disorders, is acting as a significant growth-inducing factor for the market. In addition to this, the growing number of surgeries and invasive procedures requiring anticoagulation therapy is resulting in higher product demand. The market is further driven by the implementation of organized healthcare systems that necessitate the proper management of blood-related conditions. Apart from this, the prevalence of lifestyle-related diseases that may lead to clotting disorders is propelling the market. Some of the other factors contributing to the market include rapid urbanization and modern lifestyles, the cultural shift towards more proactive health management, and extensive collaboration between healthcare providers, pharmaceutical companies, and research institutions.

Heparin Market Trends/Drivers:

Considerable rise in the number of chronic conditions

The global rise in chronic conditions such as heart disease, cancer, and diabetes has brought the use of anticoagulants, particularly heparin, into sharp focus. These chronic conditions often lead to secondary complications like blood clots and thrombosis, requiring the administration of anticoagulants to manage and prevent these potentially fatal occurrences. As lifestyles continue to evolve, sedentary habits, poor diet, and other factors are contributing to an increase in these chronic conditions, thereby pushing the demand for effective clot management treatments. Furthermore, healthcare practitioners and medical organizations are promoting preventive measures, including use in at-risk patients. This wide-ranging applications of this anticoagulant in managing complications from an increasingly prevalent group of diseases is serving as a cornerstone in the expansion of the market, shaping both current practices and future trends in healthcare.Continual technological advancements in drug delivery systems

Technological innovation has become a pivotal factor in the market. The advancement in drug delivery systems, such as infusion pumps, prefilled syringes, and targeted delivery, ensures that the anticoagulant can be administered more accurately and effectively. These innovations reduce the risk of overdosage and side effects, thereby enhancing patient safety and comfort. Additionally, as medical technology evolves, the integration of digital monitoring with heparin delivery allows for real-time monitoring of patient response, enabling personalized treatment plans and greater therapeutic efficacy. The continuous research and investment in this technology not only improve the overall usage experience of anticoagulants but also foster trust among healthcare providers and patients. The convergence of technology and medicine in this aspect is a significant driving force, steering the market towards a more dynamic and patient-centric direction.Growing regulatory support and approvals

The market expansion is significantly impacted by the regulatory landscape, encompassing various government bodies, international organizations, and healthcare authorities. The stringent regulatory environment ensures that heparin products meet quality, safety, and efficacy standards. This scrutiny extends to every stage, from the research and development phase to post-market surveillance. Rapid approval processes for new Heparin formulations and applications, alongside clear guidelines and supportive policies, help facilitate the drug's availability and proper usage. Furthermore, the regulatory support often extends to financial incentives for research, collaboration between governments and pharmaceutical companies, and public awareness campaigns about blood clot disorders. By cultivating an environment that balances safety with innovation, the regulatory support serves as a key pillar in the robust growth of the Heparin market, fostering trust, and ensuring that the best possible care reaches patients in need.Heparin Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global heparin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on the product, source, mode of administration, application, end-user, and distribution channel.Breakup by Product:

- Unfractionated Heparin

- Low Molecular Weight Heparin (LMWH)

- Ultra-Low Molecular Weight Heparin (ULMWH)

Low molecular weight heparin (LMWH) represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the product. This includes unfractionated heparin, low molecular weight heparin (LMWH), and ultra-low molecular weight heparin (ULMWH). According to the report, low molecular weight heparin (LMWH) represented the largest segment.The growing preference for low molecular weight heparin (LMWH) can be attributed to its enhanced bioavailability and prolonged action compared to the unfractionated variant. LMWH offers a more predictable dose-response relationship, reducing the need for frequent monitoring and dose adjustments. Its lower risk of causing heparin-induced thrombocytopenia (HIT) contributes to its favorability in both prophylactic and therapeutic settings. Additionally, LMWH's ease of subcutaneous administration and potential for outpatient care further promote its adoption, aligning with the trend towards patient-centric healthcare.

On the other hand, the unfractionated heparin and ultra-low molecular weight heparin (ULMWH) segments of the market are driven by several factors. These factors include their clinical efficacy in preventing and treating thrombotic conditions, their diverse applications in addressing deep vein thrombosis (DVT), pulmonary embolism (PE), and arterial thrombosis, and the influence of physician preferences based on patient profiles and medical history.

Breakup by Source:

- Bovine

- Porcine

Porcine accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the source. This includes bovine and porcine. According to the report, porcine represented the largest segment.The utilization of porcine mucosal tissues as the primary product source is driven by the high concentration of precursors in these tissues. Porcine source remains integral to the heparin production process due to its reliability, scalability, and cost-effectiveness. However, the industry's ongoing exploration of alternative sources, driven by concerns over availability and ethical considerations, underscores the importance of diversifying raw material options to ensure a stable supply chain for this critical anticoagulant.

On the other hand, the use of heparin sourced from bovine origins has been historically prominent in medical applications due to its availability and established track record. Also, continual advances in purification processes have addressed concerns related to potential contaminants and allergenic reactions associated with bovine-sourced anticoagulants, which is impelling the segment.

Breakup by Mode of Administration:

- Oral

- Parenteral

Oral represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the mode of administration. This includes oral and parenteral. According to the report, oral represented the largest segment.The development of oral formulations for anticoagulants marks a significant advancement in patient care. The shift from injectable to oral administration stems from the desire to enhance patient compliance, reduce the burden of injections, and facilitate long-term therapy. However, the challenge lies in achieving consistent bioavailability and maintaining predictable anticoagulation effects with oral formulations. Extensive research and clinical trials are being conducted to refine oral anticoagulant drugs, aiming to strike a balance between efficacy, safety, and convenience.

On the other hand, the parenteral mode of administration, involving injections, offers immediate effects that are particularly suitable for acute situations such as stroke and thrombotic events. This mode of administration ensures predictable dosing, which enhances patient safety and treatment efficacy.

Breakup by Application:

- Atrial Fibrillation & Heart Attack

- Stroke

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Others

Atrial fibrillation and heart attacks account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes atrial fibrillation & heart attack, stroke, deep vein thrombosis (DVT), pulmonary embolism (PE), and others. According to the report, atrial fibrillation and heart attacks represented the largest segment.Atrial fibrillation and heart attacks are pivotal drivers of the demand for various anticoagulants. The increased incidence of these conditions underscores the critical role of timely and effective anticoagulation in preventing thromboembolic events. Atrial fibrillation, characterized by irregular heart rhythms, necessitates ongoing anticoagulant therapy to prevent blood clot formation and potential stroke. Meanwhile, in the context of heart attacks, the product’s role as an adjunctive therapy complements other interventions to prevent further clotting and optimize patient outcomes.

On the other hand, the rising prevalence of stroke, deep vein thrombosis (DVT), and pulmonary embolism (PE) drives the demand for effective anticoagulation therapies. The aging global population contributes to a higher incidence of these conditions, emphasizing the need for suitable treatment options.

Breakup by End-User:

- Hospitals

- Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Others

Hospitals represent the largest market segment

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, clinics, homecare settings, ambulatory surgical centers, and others. According to the report, hospitals represented the largest segment.Hospitals serve as central hubs for patient care, where the use of heparin spans from surgical procedures to the treatment of thrombotic events for preventing blood clot formation. Hospitals' high patient throughput and critical nature of care emphasize the need for accessible and effective anticoagulation options. As healthcare facilities continue to evolve, optimizing product utilization and management within hospital protocols contributes to patient safety and overall quality of care.

On the other hand, the growing product applications across clinics, homecare settings, and ambulatory surgical centers reflects its versatility in catering to different patient care environments. This is especially convenient for patients, as it allows effective treatment in home-based or ambulatory settings.

Breakup by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Stores

- Others

Hospital pharmacies account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacies, retail pharmacies, drug stores, online stores, and others. According to the report, hospital pharmacies represented the largest segment.Hospital pharmacies play a pivotal role in the anticoagulant distribution and management within healthcare institutions. Their efficient procurement, storage, and dispensing of pharmaceuticals impact the product availability for clinicians. Additionally, hospital pharmacies facilitate communication between healthcare providers and manufacturers, ensuring timely restocking and adherence to quality standards. An effectively managed distribution channel contributes to seamless patient care and supports hospital staff in delivering appropriate therapies in a timely manner.

On the other hand, the easy product accessibility in retail pharmacies, drug stores, and online stores ensures wider patient access to necessary anticoagulant medications. This availability caters to diverse consumer preferences, allowing some patients to conveniently obtain anticoagulants from their preferred retail or online sources.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

North America exhibits a clear dominance, accounting for the largest heparin market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share.The market in the North America region is propelled by the region's high incidence of chronic diseases, notably cardiovascular disorders, deep vein thrombosis, and pulmonary embolism, fuels the demand for heparin as a vital anticoagulant and thromboprophylactic agent.

This demand is further magnified by the increasing proportion of the aging population, a demographic more prone to conditions necessitating anticoagulant treatment. The region's advanced healthcare infrastructure, coupled with the burgeoning number of surgical procedures, including cardiovascular surgeries and orthopedic interventions, fosters a significant need for heparin-based products to mitigate blood clot formation risks.

Improved awareness of thrombotic disorders and enhanced diagnostic techniques contribute to early detection and treatment, amplifying the necessity for product interventions. The stringent regulatory landscape in North America ensures the secure and effective utilization of anticoagulant drugs, including heparin, while ongoing research, collaborative endeavors, and innovations in the field continually refine product efficacy and safety profile. In summation, a dynamic interplay of demographic trends, healthcare infrastructure, medical awareness, regulatory standards, and research advancements collectively stimulate the rising demand for anticoagulant products across various medical domains.

Competitive Landscape:

The leading market players are investing significantly in R&D to develop improved formulations and delivery methods, enhancing the effectiveness and safety of heparin products. These efforts aim to address medical needs more efficiently and reduce potential side effects. To tap into new markets and diversify revenue streams, major manufacturers are expanding their geographic presence by establishing distribution networks, manufacturing facilities, and sales operations in emerging markets. Additionally, they are investing in advanced quality control measures, adherence to Good Manufacturing Practices (GMP), and transparency in their supply chains to maintain customer trust and regulatory approval. The key players are also forming strategic partnerships with research institutions, healthcare providers, and pharmaceutical companies to collectively advance heparin-based treatments.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- GlaxoSmithKline Plc

- Shenzhen Hepalink Pharmaceutical Co., Ltd

- Pfizer Inc.

- LEO Pharma A/S

- Sanofi S.A.

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Aspen Holdings

- Baxter International Inc.

- Hebei Changshan Biochemical Pharmaceutical Co. Ltd.

- Sandoz International GmbH

- Opocrin S.p.A.

- Sichuan Deebio Pharmaceutical Co., Ltd.

- Dongying Tiandong Pharmaceutical Co. Ltd.

Key Questions Answered in This Report

- How big is the heparin market?

- What is the future outlook of the heparin market?

- What are the key factors driving the heparin market?

- Which region accounts for the largest heparin market share?

- Which are the leading companies in the global heparin market?

Table of Contents

Companies Mentioned

- GlaxoSmithKline Plc

- Shenzhen Hepalink Pharmaceutical Co. Ltd

- Pfizer Inc.

- LEO Pharma A/S

- Sanofi S.A.

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Aspen Holdings

- Baxter International Inc.

- Hebei Changshan Biochemical Pharmaceutical Co. Ltd.

- Sandoz International GmbH

- Opocrin S.p.A.

- Sichuan Deebio Pharmaceutical Co. Ltd.

- Dongying Tiandong Pharmaceutical Co. Ltd.

Table Information

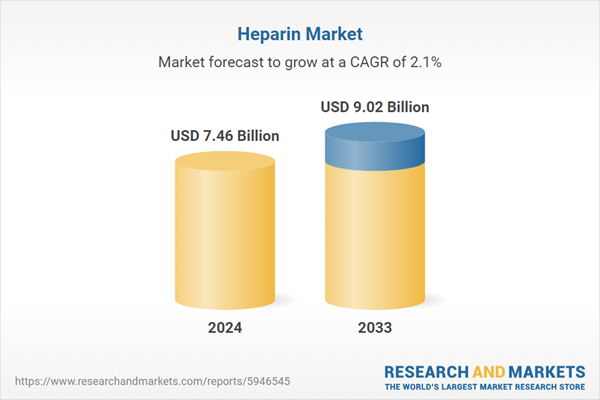

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.46 Billion |

| Forecasted Market Value ( USD | $ 9.02 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |