Whiskey is a distilled alcoholic beverage that is renowned for its distinct flavor and complexity. It is typically made from fermented grains, such as barley, corn, rye, or wheat, and aged in wooden casks, often oak barrels, which contribute to its unique characteristics. The process of whiskey production involves mashing the grains, fermenting the mash, distilling the liquid to increase its alcohol content, and maturing it in the casks. The aging process imparts flavors and aromas to the whiskey, resulting in a wide range of styles and profiles. Additionally, whiskey is enjoyed worldwide and appreciated for its rich history, craftsmanship, and diverse expressions.

The market is primarily driven by the advancements in alcoholic beverage manufacturing. In addition, the rising disposable incomes, rapid urbanization, and the growing whiskey distilleries are contributing to the market growth. Besides, the market is propelled by the escalating demand for premium and super-premium whiskeys in developed and emerging countries. Additionally, changing consumer lifestyles and the popularity of socializing and mid-week/weekend parties among working professionals are positively influencing the market. Whiskey is often associated with showcasing elegance and sophistication, leading consumers to seek innovative and distinctive drinking experiences. Besides this, manufacturers are actively promoting their products and expanding distribution channels, including online retailing portals, to provide convenient shopping options. Furthermore, the introduction of organic whiskeys is gaining popularity among global consumers.

Whiskey Market Trends/Drivers:

The escalating demand for whiskey among individuals

The growing appreciation for the craftsmanship and heritage associated with whiskey production and the rising disposable income of consumers are contributing to the market growth. Additionally, the growing popularity of premiumization has influenced consumer preferences. Many individuals are willing to invest in high-quality and aged whiskeys, seeking unique and rare expressions that provide a distinct drinking experience. Moreover, the increasing trend of socializing culture, both in-person and online, has contributed to the demand for whiskey. Also, whiskey is often associated with social gatherings, celebrations, and moments of relaxation, making it a popular choice for individuals looking to enhance their social experiences. Furthermore, the expanding range of whiskey options, including flavored variants, craft distilleries, and innovative expressions, has attracted a broader consumer base, appealing to diverse tastes and preferences.Extensive promotional activities by manufacturers

At present, manufacturers are employing various strategies such as advertising campaigns, sponsorship of events, collaborations with influencers, and conducting whiskey-tasting events to showcase their products. These efforts help increase visibility, educate consumers about different whiskey offerings, and generate interest and demand. Moreover, the expanding online retailing portals and the increasing trend of establishing their online presence or partnering with e-commerce platforms are contributing to the market growth. Online retailing portals provide consumers with convenient access to a numerous selection of whiskey brands, detailed product information, customer reviews, and doorstep delivery. This hassle-free shopping experience appeals to busy consumers seeking convenience and allows them to explore and purchase whiskey products from the comfort of their homes. Furthermore, manufacturers have utilized digital marketing strategies to engage with consumers through social media platforms, websites, and email marketing. This enables them to reach a wider audience, communicate brand messages, and provide personalized recommendations based on consumer preferences.The introduction of innovative product variants

The introduction of flavored whiskeys, which infuse traditional whiskey with additional flavors such as honey, fruit, or spices is contributing to the market growth. This also appeals to consumers who enjoy experimenting with different taste profiles and offers numerous options for mixed drinks and cocktails. Moreover, the escalating demand for organic and sustainable options led to the introduction of whiskeys made from organically grown grains and produced using environmentally friendly practices which addresses the growing consumer interest in sustainability and aligns with their desire for products that are ethically sourced and produced. Additionally, whiskey producers are experimenting with different cask finishes, such as using barrels that previously held other types of spirits or wine. This process imparts unique flavors and aromas to the whiskey, creating an intriguing and diverse range of options for consumers seeking novel tasting experiences. These product innovations attract new consumers by expanding the market and appealing to a broader range of tastes and preferences. They provide consumers with more choices and opportunities to explore the world of whiskey, catering to their desire for variety, quality, and the opportunity to try something different.Whiskey Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on the product type, quality, and distribution channel.Breakup by Product Type:

- American Whiskey

- Irish Whiskey

- Scotch Whiskey

- Canadian Whiskey

- Others

Scotch whiskey dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes American, Irish, Scotch, Canadian, and others. According to the report, scotch whiskey represented the largest segment.Scotch whiskey is dominating the market growth as it has a rich heritage and reputation for excellence. It is known for its traditional production methods, stringent regulations, and strict quality control, which instill consumer confidence and trust in the product. The long-established reputation of Scotch whiskey as a high-quality spirit has contributed to its dominance in the market. Moreover, the distinct flavor profiles, ranging from smoky and peaty to fruity and floral, catering to diverse palates and preferences is also increasing its popularity.

Furthermore, scotch whiskey is often perceived as a symbol of luxury, sophistication, and craftsmanship, attracting consumers who seek prestigious and premium drinking experiences from single malts to blended whiskies, scotch provides options for different price points, allowing it to cater to a broad consumer base and adapt to varying market demands.

Breakup by Quality:

- Premium

- High-End Premium

- Super Premium

Premium whiskey holds the largest share in the market

A detailed breakup and analysis of the market based on the quality has also been provided in the report. This includes premium, high-end premium, and super premium. According to the report, premium whiskey accounted for the largest market share.Premium quality whiskey offers superior taste, craftsmanship, and an improved drinking experience. Additionally, consumers are willing to pay a higher price for whiskeys that exhibit exceptional flavors, complexity, and a higher level of refinement. Premium whiskeys often undergo longer aging periods, use high-quality ingredients, and employ meticulous production techniques, resulting in a product that is perceived as more luxurious and indulgent. Moreover, premium quality whiskeys are associated with status, prestige, and social recognition and are seen as symbols of sophistication and refinement, making them sought-after choices for special occasions, gifting, or displaying connoisseurship. Hence the aspirational value associated with premium whiskeys is driving their market dominance. Furthermore, the growth of premiumization in the beverage industry has influenced the market as well. Consumers are increasingly willing to spend more on premium products that offer enhanced quality, authenticity, and a memorable experience. This shift in consumer preferences has propelled the demand for premium quality whiskeys and contributed to their larger market share.

Breakup by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

Off-trade presently represents the largest distribution channel

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes off-trade (supermarkets and hypermarkets, discount stores, online stores, and others) and on-trade (restaurants and bars, liquor stores, and others). According to the report, off-trade accounted for the largest market share.The easy availability of whiskey in restaurants and bars serves as popular destination for consumers to enjoy whiskey in a social setting. These establishments offer several selection of whiskey brands and provide a platform for consumers to explore different expressions and experiences. The ambiance and expertise of bartenders and staff enhance the whiskey-drinking experience, attracting customers and driving sales. Furthermore, the off-trade distribution channel offers the advantage of convenience as consumers can purchase whiskey for consumption at home or for gifting purposes. Besides, consumers can browse and purchase whiskey online, benefiting from doorstep delivery and the convenience of comparing prices and product reviews globally.

Moreover, liquor stores offer several whiskey brands, including both mainstream and niche offerings, providing consumers with convenient access to numerous products. Moreover, liquor stores often have knowledgeable staff who can assist customers in making informed purchasing decisions based on their preferences thus propelling market growth.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

Europe exhibits a clear dominance, accounting for the largest whiskey market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, Europe was the largest market for whiskey.Europe has a longstanding history and cultural connection with whiskey consumption. For instance, countries such as Scotland and Ireland are renowned for their whiskey production, and their traditional distilleries have garnered global recognition and loyalty. Moreover, European consumers have a strong appreciation for quality and craftsmanship, which aligns with the characteristics of whiskey. Also, the European market is known for its discerning and sophisticated consumers who value premium spirits. This preference for high-quality products, coupled with a willingness to pay a premium for authenticity and heritage, has contributed to the dominance of the European whiskey market.

Competitive Landscape:

The competitive landscape of the market is dynamic and diverse, with numerous players competing for market share. Presently, it includes renowned multinational companies, and smaller craft distilleries, each offering its own unique expressions and styles. At present, key players are investing heavily in marketing and branding initiatives to increase brand awareness, loyalty, and perceived value. They are also expanding distribution networks, establishing local partnerships, and adapting their marketing strategies to resonate with the preferences and cultural nuances of specific markets. Furthermore, whiskey producers are experimenting with cask finishes, flavor infusions, and unique maturation techniques to capture consumer interest and stand out in a crowded market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Diageo plc

- Bacardi Limited

- Suntory Beverage & Food Limited

- Pernod Ricard

- The Brown-Forman Corporation

- Asahi Group Holdings Ltd

- William Grant & Sons Holdings Ltd

- The Edrington Group

- Allied Blenders and Distillers Pvt Ltd

- Constellation Brands

- La Martiniquaise

Key Questions Answered in This Report

- How big is the whiskey market?

- What is the expected growth rate of the global whiskey market during 2025-2033?

- What are the key factors driving the global whiskey market?

- What has been the impact of COVID-19 on the global whiskey market?

- What is the breakup of the global whiskey market based on the product type?

- What is the breakup of the global whiskey market based on the quality?

- What is the breakup of the global whiskey market based on the distribution channel?

- What are the key regions in the global whiskey market?

- Who are the key players/companies in the global whiskey market?

Table of Contents

Companies Mentioned

- Diageo plc

- Bacardi Limited

- Suntory Beverage & Food Limited

- Pernod Ricard

- The Brown–Forman Corporation

- Asahi Group Holdings Ltd

- William Grant & Sons Holdings Ltd

- The Edrington Group

- Allied Blenders and Distillers Pvt Ltd

- Constellation Brands

- La Martiniquaise

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | March 2025 |

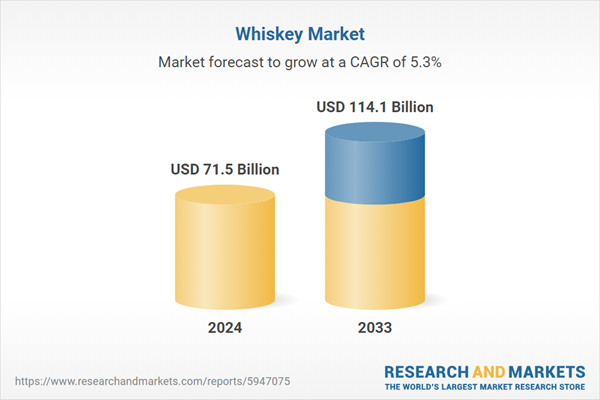

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 71.5 Billion |

| Forecasted Market Value ( USD | $ 114.1 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |