Rising fuel prices, the increasing popularity of ride-sharing services, and a heightened awareness of environmental conservation have further fueled the market. These factors have led to the introduction of innovative modes of transportation. The growth in internet access and the widespread use of smartphones for booking rides further contribute to the market's expansion. Rising traffic congestion in Egypt has led many consumers to turn to car-sharing and carpool services. These options provide a convenient and comfortable travel experience at lower costs, making them particularly appealing to office workers.

Urbanization and low vehicle ownership rates in Egypt are anticipated to drive the demand. In 2023, the urban population in Egypt accounted for 43.1% of the total population, as reported by the World Bank's development indicators. Therefore, there is a demand for convenient, flexible transportation options. Furthermore, according to the Central Agency for Public Mobilization and Statistics (CAPMAS), the number of licensed vehicles in Egypt decreased by 8.9% to 9.9 million at the end of 2022, compared to 10.9 million in 2021. In addition, a report by AMIC revealed that car sales fell by 36.55%, with only 184,000 vehicles sold in 2022, down from 290,000 in 2021. These factors have increased the demand for other alternatives to transportation, including ride-hailing services.

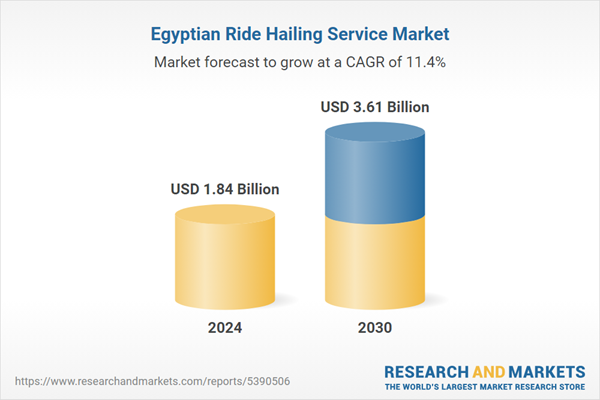

Egypt Ride Hailing Service Market Highlights

- Based on offering, the car sharing segment dominated the Egypt ride hailing service market with a revenue share of 44.7% in 2024.

- Growing environmental awareness among users, stricter CO2 emission regulations, lower prices, heightened traffic congestion, and various marketing strategies by industry players have contributed to the increased demand for the car-sharing segment.

- The e-hailing segment is expected to grow at the fastest CAGR of 14.1% over the forecast period.

- The convenience and user-friendliness of e-hailing services drive this growth. The rise of e-commerce and smartphone use in Egypt is fueling demand, as these services address the challenges of traditional taxis and reduce the need for private vehicles, making them a reliable public transport alternative.

- The rental segment held a substantial market share in 2024.

- Rental cars provide the freedom to travel at a personal pace, allowing stops to be made as desired and plans to be changed as needed. Dependence on public transport schedules or taxi availability is eliminated, offering greater flexibility.

- In April 2025, Egypt launched its electric taxi service in the New Administrative Capital, offering an eco-friendly transport solution. Known as "New Capital Cab," the service marks a step toward clean energy, according to George Michael, CEO of Caesar Clean Energy Transportation Solutions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The major companies featured in this Egypt Ride Hailing Service market report include:- Uber Technologies Inc.

- Avis Rent A Car System, LLC

- Sixt

- Halan

- FriendyCar

- Swvl Holdings Corp

- M Car Egypt

- Fyonka ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.84 Billion |

| Forecasted Market Value ( USD | $ 3.61 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Egypt |

| No. of Companies Mentioned | 9 |