Aquaculture, also recognized as aqua farming, encompasses the controlled cultivation of aquatic organisms and plants. It involves carefully managing aquatic life, including breeding, rearing, and eventual harvest, within various water environments such as rivers, ponds, lakes, oceans, freshwater, and brackish waters. It is a crucial tool for conserving endangered species, enhancing productivity, and reducing the seafood trade deficit. Additionally, it contributes to waste reduction and offers a secure and sustainable breeding environment. Consequently, aquaculture enjoys widespread applications for commercial, recreational, and scientific objectives, making it a globally significant practice.

The global market is majorly driven by the increasing demand for seafood. With its ability to efficiently produce a wide range of aquatic species, aquaculture provides a sustainable solution to meet this escalating demand. Additionally, wild fisheries are often overexploited, making them an essential contributor to seafood supply and reducing pressure on natural aquatic ecosystems. Furthermore, the rising health consciousness and awareness of the nutritional benefits of seafood have boosted consumer preferences for fish and seafood products. Aquaculture ensures a controlled and healthy environment for aquatic organisms, producing seafood with fewer contaminants and a more predictable quality. Besides, advancements in aquaculture technologies, including recirculating aquaculture systems (RAS), automation, and genetic improvement programs, have enhanced production efficiency and reduced environmental impact, driving market growth. Moreover, aquaculture aligns with sustainability goals, as responsible practices promote efficient resource utilization and minimize habitat disruption. It also offers income generation and employment opportunities in developed and developing regions. The climate change and environmental concerns have prompted the exploration of alternative protein sources, further bolstering the demand for aquaculture as a reliable and eco-friendly protein production method.

Aquaculture Market Trends/Drivers:

Increasing adoption of new technologies

The increasing adoption of new technologies is offering numerous opportunities for the market. Technology is revolutionizing aquaculture operations by offering innovative solutions that enhance productivity, efficiency, and sustainability. Automated feeding systems, for example, ensure precise and timely feeding, reducing waste and improving fish health. Water quality monitoring tools enable real-time assessment and control, optimizing growing conditions. Genetic advancements in selective breeding and biotechnology lead to faster-growing and disease-resistant aquatic species. Moreover, the implementation of data analytics and artificial intelligence allows for predictive modeling and proactive decision-making, resulting in better resource management. Recirculating aquaculture systems (RAS) minimize water usage and waste, making land-based aquaculture more economically and environmentally viable. As aquaculture embraces these technologies, it becomes more competitive and adaptive, attracting investment and fostering innovation. Consequently, the sector not only meets the growing global demand for seafood but also aligns with sustainability goals, reinforcing its position as a critical contributor to the future of food production.Rising demand for seafood products

The rising demand for seafood products is favorably impacting the market. With the world's population continually expanding and evolving dietary preferences, the appetite for seafood has reached unprecedented levels. Aquaculture, as a sustainable and efficient means of seafood production, plays a pivotal role in meeting this soaring demand. Wild fisheries face overexploitation and depletion, making aquaculture indispensable in bridging the seafood supply gap. Consumers increasingly recognize the nutritional benefits of seafood, encouraging greater consumption. Moreover, as health-consciousness grows, seafood is preferred for its lean protein and omega-3 fatty acids. The rise of global middle-class populations, particularly in emerging economies, further propels seafood consumption as it becomes more affordable and accessible. As a result, aquaculture's ability to produce diverse aquatic species in controlled environments aligns perfectly with the need for a consistent and reliable seafood supply. This factor ensures that the market continues to expand, contributing significantly to global food security and economic growth.Growing consumption of organic seafood items

The growing consumption of organic seafood items is fueling the market growth. As consumers worldwide increasingly prioritize health and sustainability, organic seafood offers a compelling choice. Organic aquaculture practices adhere to stringent environmental and ethical standards, reducing the use of antibiotics and chemicals. This resonates with consumers seeking safer and more environmentally friendly food options. Organic seafood is particularly attractive to health-conscious consumers due to its reduced exposure to contaminants and antibiotics. The demand for organic certification in aquaculture reflects a broader shift toward organic and healthier dietary choices. Furthermore, the global trend toward sustainable and ethical consumption aligns with organic aquaculture's principles, promoting responsible fishing practices and conservation. This trend has prompted aquaculture producers to adopt organic farming methods, contributing to market growth.Aquaculture Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global aquaculture market, along with forecasts at the global, country, and regional levels for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.- Freshwater Fish

- Molluscs

- Crustaceans

- Others

Freshwater fish dominates the market

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others. According to the report, freshwater fish represented the largest segment.Freshwater fish, which include species like tilapia, catfish, and carp, are highly sought after due to their versatility and consumer appeal. Their relatively rapid growth rates, ease of cultivation, and ability to adapt to varying environmental conditions make them ideal candidates for aquaculture operations.

Additionally, they are known for their lean and nutritious meat, aligning with the growing consumer preference for healthier protein sources. As consumer demand for freshwater fish rises, aquaculture producers increasingly focus on cultivating these species. This strategic emphasis, combined with ongoing advancements in breeding techniques and sustainable farming practices, positions freshwater fish as a pivotal factor in propelling the market's growth, ensuring a consistent and reliable supply of these popular seafood choices.

Breakup by Environment:

- Fresh Water

- Marine Water

- Brackish Water

Fresh water dominates the market

The report has provided a detailed breakup and analysis of the market based on the environment. This includes fresh water, marine water, and brackish water. According to the report, fresh water represented the largest segment.Freshwater environments are pivotal in driving growth within the aquaculture market. These environments include rivers, lakes, and ponds and provide crucial habitats for various aquatic species that are commercially farmed. Freshwater aquaculture offers several advantages, including lower operating costs, ease of access, and reduced environmental impact compared to marine aquaculture. The availability of freshwater resources supports the cultivation of popular species like tilapia, catfish, and carp, contributing to market growth.

Moreover, freshwater environments enable controlled and sustainable aquaculture practices. Advanced recirculating aquaculture systems (RAS) and pond management techniques help maintain optimal water quality, promoting healthy fish growth. Additionally, freshwater sources often serve as natural breeding grounds for freshwater species, simplifying production.

The growth of freshwater aquaculture aligns with environmental sustainability goals, as it minimizes the need for overexploitation of natural fish stocks. By optimizing freshwater resources and adopting responsible practices, this segment plays a vital role in ensuring the industry's long-term viability and reducing pressure on fragile aquatic ecosystems.

Breakup by Distribution Channel:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

Traditional retail dominates the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others. According to the report, traditional retail represented the largest segment.Traditional retail distribution channels play a significant role in driving market growth within the aquaculture industry. These channels encompass brick-and-mortar stores, fish markets, and local seafood retailers that have long been the primary source for consumers to purchase seafood products. Several factors contribute to the importance of traditional retail in the aquaculture market. These outlets provide accessibility and convenience to consumers, offering a wide range of seafood choices, including fresh, frozen, and processed products. Shoppers can physically examine and select their preferred seafood items, fostering consumer confidence in product quality.

Furthermore, traditional retailers often establish direct relationships with local aquaculture producers, ensuring a fresh and consistent seafood supply. This enables consumers to access locally sourced and sustainably harvested seafood, aligning with their freshness and environmental responsibility preferences. Moreover, traditional retail channels are crucial in promoting aquaculture products, raising awareness about different seafood varieties, and educating consumers about responsible and healthy seafood choices.

Breakup by Region:

- Asia Pacific

- China

- Indonesia

- India

- Vietnam

- Philippines

- South Korea

- Japan

- Thailand

- Malaysia

- Australia

- Others

- Latin America

- Chile

- Brazil

- Ecuador

- Mexico

- Others

- Europe

- Norway

- Spain

- Russia

- United Kingdom

- France

- Italy

- Greece

- Netherlands

- Ireland

- Denmark

- Germany

- Others

- Middle East and Africa

- Egypt

- Turkey

- Saudi Arabia

- Others

- North America

- United States

- Canada

Asia Pacific exhibits a clear dominance, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific (China, Indonesia, India, Vietnam, Philippines, South Korea, Japan, Thailand, Malaysia, Australia, and others), Latin America (Brazil, Mexico, Ecuador, and others), Europe (Norway, Spain, Russia, United Kingdom, France, Italy, Greece, Netherlands, Ireland, Denmark, Germany, and others), Middle East and Africa (Egypt, Turkey, Saudi Arabia, and others), North America (United States and Canada). According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific's extensive coastlines, abundant freshwater resources, and favorable climate conditions provide an ideal environment for aquaculture operations. Countries like China, India, Vietnam, and Indonesia are major aquaculture producers, benefiting from these geographical advantages. The Asia Pacific nations have a long history of aquaculture practices, allowing for cultivating a wide range of species, including shrimp, tilapia, and carp. This diversity caters to both local and global demand for seafood products.

Furthermore, the region's expanding population and rising disposable income levels drive the demand for seafood, making aquaculture a critical contributor to food security and economic growth. Affordable labor in some countries also supports the expansion of aquaculture operations. Additionally, the region actively embraces technological advancements in aquaculture, implementing innovations such as recirculating aquaculture systems (RAS) and sustainable practices to enhance productivity and environmental sustainability.

Competitive Landscape:

Top companies are strengthening market growth through strategic initiatives and innovations. These industry leaders invest heavily in research and development, constantly innovating to improve aquaculture practices, enhance fish health, and minimize environmental impacts. They are at the forefront of developing advanced recirculating aquaculture systems (RAS), which reduce water usage and promote sustainability. Furthermore, these companies are actively exploring novel species for aquaculture, diversifying product offerings to cater to changing consumer preferences. This expansion beyond traditional species meets market demand and opens up new revenue streams. Besides, top aquaculture firms are committed to sustainable practices, aligning with global environmental concerns. They implement responsible aquaculture certifications, reduce antibiotic use, and employ efficient waste management techniques. Moreover, their global reach and distribution networks ensure a wide and reliable supply of seafood products. This consistency fosters consumer confidence and helps meet the growing demand for seafood. Additionally, these companies invest in education and collaboration with local communities, creating jobs and supporting the socio-economic development of their regions.The report has provided a comprehensive analysis of the competitive landscape in the aquaculture market. Detailed profiles of all major companies have also been provided.

- Aquaculture of Texas Inc.

- Aquaculture Systems Technologies, L.L.C.

- Aquafarm Equipment AS

- Cermaq

- Cooke Aquaculture Inc

- CPI Equipment Inc.

- Frea Aquaculture Solutions

- Farallon Aquaculture, SA

- Huon Aquaculture Group Ltd

- International Fish Farming Holding Co. -Asmak

- Leroy Seafood Group

- Nireus Aquaculture

- SELONDA Aquaculture SA

- Stehr Group

- Stolt-Nielsen Limited

- Tassal

- Thai Union Group

Key Questions Answered in This Report

1. What is aquaculture?2. How big is the global aquaculture market?

3. What is the expected growth rate of the global aquaculture market during 2025-2033?

4. What are the key factors driving the global aquaculture market?

5. What is the leading segment of the global aquaculture market based on the fish type?

6. What is the leading segment of the global aquaculture market based on environment?

7. What is the leading segment of the global aquaculture market based on distribution channel?

8. What are the key regions in the global aquaculture market?

9. Who are the key players/companies in the global aquaculture market?

Table of Contents

Companies Mentioned

- Aquaculture of Texas Inc.

- Aquaculture Systems Technologies L.L.C.

- Aquafarm Equipment AS

- Cermaq

- Cooke Aquaculture Inc.

- CPI Equipment Inc.

- Frea Aquaculture Solutions

- Farallon Aquaculture SA

- Huon Aquaculture Group Ltd

- International Fish Farming Holding Co. -Asmak

- Leroy Seafood Group

- Nireus Aquaculture

- SELONDA Aquaculture SA

- Stehr Group

- Stolt-Nielsen Limited

- Tassal

- Thai Union Group

Table Information

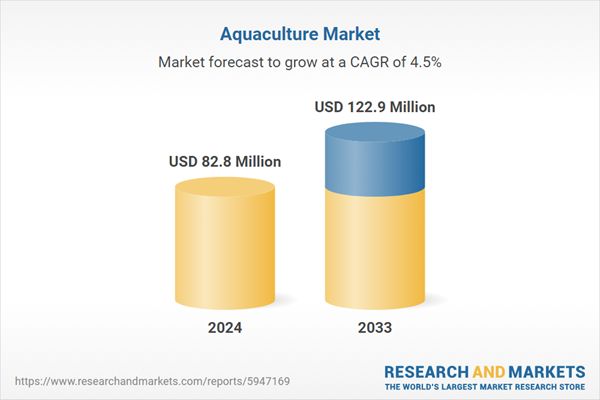

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 82.8 Million |

| Forecasted Market Value ( USD | $ 122.9 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |