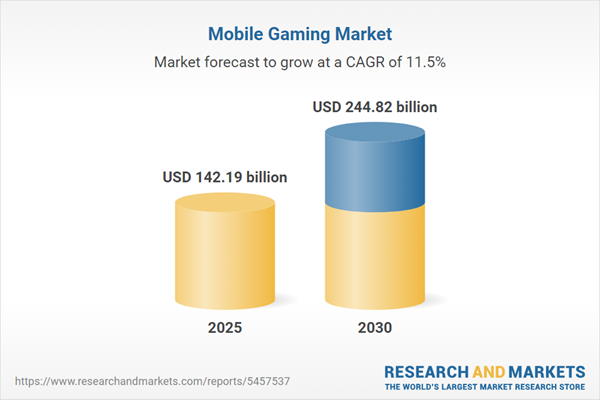

Mobile Gaming Market Size:

The Mobile Gaming Market is expected to grow from USD 142.190 billion in 2025 to USD 244.824 billion in 2030, at a CAGR of 11.48%.The mobile gaming industry has established itself as a dominant force in electronic entertainment, leveraging diverse platforms including computers, mobile devices, and consoles to reach global audiences. The sector's remarkable scalability stems from the ubiquity of mobile technology and the strategic integration of gaming into social media ecosystems.

Government Support and Infrastructure Development

Public sector commitment to gaming industry development has become increasingly evident through targeted funding initiatives. Government-backed support mechanisms, including dedicated gaming funds and educational infrastructure, demonstrate recognition of the sector's economic potential. Educational institutions now benefit from state-funded facilities that enable students to develop gaming content using professional-grade equipment and resources, fostering innovation and talent development within the industry.Major social platforms have recognized gaming's potential as a differentiation strategy, developing innovative mobile gaming solutions to enhance user engagement and expand promotional capabilities. This convergence of social media and gaming represents a significant evolution in how entertainment content is consumed and monetized.

Primary Growth Drivers

Smartphone and Internet Infrastructure Expansion

The proliferation of smartphone technology coupled with advancing internet penetration rates serves as the fundamental catalyst for mobile gaming growth. Technological improvements in mobile hardware and the integration of emerging technologies have accelerated industry development globally. Enhanced internet accessibility, particularly in developing markets, has made online gaming increasingly viable for broader demographics.The Indian market exemplifies this trend, with its Media & Entertainment sector valued at $24 billion, positioning gaming among the fastest-growing segments. India now ranks among the world's top five mobile gaming markets, illustrating the global expansion potential driven by improved connectivity and device accessibility.

Free-to-Play Revenue Models

The Free-to-Play (F2P) pricing model has emerged as the dominant monetization strategy, offering unlimited scalability potential through free initial downloads. This approach allows users to experience games without upfront commitment, subsequently driving revenue through in-app purchases and extended engagement. The model's effectiveness demonstrates the industry's evolution toward user acquisition strategies that prioritize accessibility over immediate monetization.Next-Generation Technology Integration

Advanced technologies including augmented reality and 5G connectivity are reshaping mobile gaming capabilities. The deployment of 5G infrastructure, with its enhanced download speeds and reduced latency, creates opportunities for cloud gaming services and more sophisticated mobile gaming experiences. These technological advances enable streaming of complex games and support for more immersive gameplay scenarios.Market Constraints and Challenges

Psychological and Social Concerns

Mobile gaming faces scrutiny regarding its psychological impact on users. Research indicates potential correlations between gaming engagement and behavioral changes, including increased aggression and reduced environmental awareness. These concerns create regulatory and public relations challenges that the industry must address through responsible gaming practices and content moderation.Premium Pricing Model Limitations

While Free-to-Play models dominate user preferences, paid gaming models present growth constraints. Both one-time purchase fees and subscription-based models encounter user resistance, despite their ability to generate predictable recurring revenue streams. Although subscription models offer financial stability for developers, consumer preference consistently favors accessible, free-entry gaming experiences.Strategic Implications

The mobile gaming market's trajectory indicates continued expansion driven by technological advancement and infrastructure development. However, sustainable growth requires addressing psychological impact concerns while optimizing monetization strategies that balance user accessibility with revenue generation. The industry's future success depends on leveraging emerging technologies while maintaining responsible gaming standards and adapting to evolving consumer preferences in an increasingly connected global marketplace.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Mobile Gaming Market Segmentation:

By Device Type

- Smartphone

- Tablet

- Smartwatch

- Others

By Genre

- Action and Adventure

- Arcade

- Role-Playing Games (RPG)

- Sports

- Puzzle

- Strategy

- Simulation

- Racing

- Casino

- Multiplayer Online Battle Arena (MOBA)

- Battle Royale

- Others

By Monetization Model

- Free-to-Play

- Freemium

- Pay-to-Play

- Subscription-Based

- Ad-Based

By Player Type

- Casual Gamers

- Hardcore Gamers

- Professional Players

By Distribution Platform

- iOS App Store

- Google Play Store

- Third-Party App Stores

- Web-Based Platforms

- Cloud Gaming Platforms

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Tencent Holdings Limited

- Scopely

- NetEase, Inc.

- Playrix

- Supercell Oy

- King

- Dream Games

- Roblox Corporation

- Century Games

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 142.19 billion |

| Forecasted Market Value ( USD | $ 244.82 billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |