Penetration is the adoption of medical component manufacturing in various applications in the market. The penetration of medical component manufacturing is likely to be the highest in the 3D printing segment. The benefits of 3D printing such as improved productivity, cost-effectiveness, personalization, and customization of medical products, applications in complex operations, and rapid medical prototyping are projected to benefit the growth of the 3D printing market.

The plastic injection molding process segment accounted for the largest revenue share of over 65.0% in 2020. The segment is projected to grow due to the development of efficient products using better-engineered resins. Moreover, the process can help component manufacturers produce cost-effective products in various sizes and shapes. Some of the low-cost products include disposable gloves, syringes, plastic instruments, and different one-time products for healthcare facilities.

The rising geriatric population is projected to remain an indirect contributor to market growth. There has been a change in the pattern of the aging population across the globe in the recent past owing to the decreasing levels of fertility and rising life expectancy. This has led to a longer lifespan of people, wherein the share of old people or geriatric population is growing at a rapid pace. As per the United Nations, there are over 727 million people globally who are aged 65 or above as of 2020.

Emerging economies such as India and China are projected to offer numerous opportunities for market vendors. These countries have less penetration of medical devices but higher potential owing to their large population size. Moreover, the governments in these countries have undertaken different initiatives to improve public healthcare with a focus on rural health facilities and medical infrastructure. For instance, the Indian government has allowed 100% automatic FDI in this sector, wherein prior regulatory approvals are not required.

Medical Component Manufacturing Market Report Highlights

- The 3D printing process segment is anticipated to register the fastest CAGR of 20.8% from 2021 to 2030. Suitability to produce complex and customized products, along with cost efficiency in low volume production, is projected to drive the segment over the forecast period

- The plastic injection molding process segment held the largest revenue share of over 65.0% in 2020. Advantages such as durability, strength, ease of handling, and improved sterilization make the process comply with stringent regulations set by different government bodies

- North America accounted for the largest revenue share of over 40.0% in 2020. The Increasing geriatric population, along with a rise in lifestyle diseases, is projected to benefit the growth of the medical device industry in the region, thus benefiting the demand for various medical components

- Leading companies in the industry are focused on the development of advanced processes such as 3D printing and are likely to increase their R&D expenditure over the coming years. The merger & acquisition activities are anticipated to rise over the coming years as companies are focused on improving their market share

Table of Contents

Chapter 1. Methodology and Scope1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

Chapter 3. Medical Component Manufacturing Market Industry Outlook

3.1. Market segmentation

3.2. Market size and growth prospects, 2017 - 2030

3.3. Industry value chain analysis

3.3.1. Raw material trends

3.3.2. Manufacturing and processing trends

3.3.3. Sales channel analysis

3.4. Market dynamics

3.4.1. Market driver analysis

3.4.2. Market restraint analysis

3.4.3. Market opportunity analysis

3.4.4. Market challenge analysis

3.5. Porter’s analysis

3.6. PESTEL analysis

3.7. Market entry strategies

3.7.1. Case study

3.7.2. SWOT analysis

3.7.3. Key challenges

3.8. Major deals and strategic alliances

3.8.1. Joint ventures

3.8.2. Mergers & acquisitions

Chapter 4. Medical Component Manufacturing Market Process Outlook

4.1. Medical component manufacturing market share, by process, 2020 & 2030

4.2. Forging

4.2.1. Market estimates & forecasts, 2017 - 2030 (USD Billion)

4.3. Metal injection molding

4.3.1. Market estimates & forecasts, 2017 - 2030 (USD Billion)

4.4. 3D printing

4.4.1. Market estimates & forecasts, 2017 - 2030 (USD Billion)

4.5. Ceramic injection molding

4.5.1. Market estimates & forecasts, 2017 - 2030 (USD Billion)

4.6. Investment casting

4.6.1. Market estimates & forecasts, 2017 - 2030 (USD Billion)

4.7. Plastic injection molding

4.7.1. Market estimates & forecasts, 2017 - 2030 (USD Billion)

Chapter 5. Medical Component Manufacturing Market Regional Outlook

5.1. Medical component manufacturing market revenue, by region, 2020 & 2030

5.2. North America

5.2.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.2.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

5.2.3. U.S.

5.2.3.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.2.3.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

5.3. Europe

5.3.1. Market estimates and forecast, 2017 - 2030 (USD Billion)

5.3.2. Market estimates and forecast, by process, 2017 - 2030 (USD Billion)

5.3.3. Germany

5.3.3.1. Market estimates and forecast, 2017 - 2030 (USD Billion)

5.3.3.2. Market estimates and forecast, by process, 2017 - 2030 (USD Billion)

5.3.4. U.K.

5.3.4.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.3.4.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

5.3.5. France

5.3.5.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.3.5.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

5.3.6. Spain

5.3.6.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.3.6.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

5.4. Asia Pacific

5.4.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

5.4.3. China

5.4.3.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.3.2. Market estimates and forecast, by process, 2017 - 2030 (USD Billion)

5.4.4. India

5.4.4.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.4.2. Market estimates and forecast, by process, 2017 - 2030 (USD Billion)

5.4.5. Japan

5.4.5.1. Market estimates and forecasts, 2017 - 2030 (USD Billion)

5.4.5.2. Market estimates and forecasts, by process, 2017 - 2030 (USD Billion)

Chapter 6. Competitive Landscape

6.1. Key Players, recent development & their impact on the industry

6.2. Vendor Landscape

6.2.1. Company market ranking analysis

6.2.2. List of key manufacturers & suppliers

6.2.3. List of potential end-users

6.2.4. SWOT analysis, by key companies

Chapter 7. Company Profiles

7.1. Anchor Harvey

7.1.1. Company Overview

7.1.2. Financial performance

7.1.3. Product Benchmarking

7.1.4. Strategic Initiatives

7.2. Rejointsrl

7.2.1. Company Overview

7.2.2. Financial performance

7.2.3. Product Benchmarking

7.2.4. Strategic Initiatives

7.3. Nexxt Spine, LLC

7.3.1. Company Overview

7.3.2. Financial performance

7.3.3. Product Benchmarking

7.3.4. Strategic Initiatives

7.4. 3D Systems, Inc.

7.4.1. Company Overview

7.4.2. Financial performance

7.4.3. Product Benchmarking

7.4.4. Strategic Initiatives

7.5. Heraeus Holding

7.5.1. Company Overview

7.5.2. Financial performance

7.5.3. Product Benchmarking

7.5.4. Strategic Initiatives

7.6. Simalex

7.6.1. Company Overview

7.6.2. Financial performance

7.6.3. Product Benchmarking

7.6.4. Strategicinitiatives

7.7. American Casting Company

7.7.1. Company Overview

7.7.2. Financial performance

7.7.3. Product Benchmarking

7.7.4. Strategic Initiatives

7.8. Optimum Medical Limited

7.8.1. Company Overview

7.8.2. Financial performance

7.8.3. Product Benchmarking

7.8.4. Strategic Initiatives

7.9. MICRO

7.9.1. Company Overview

7.9.2. Financial performance

7.9.3. Product Benchmarking

7.9.4. Strategic Initiatives

7.10. Norwood Medical

7.10.1. Company Overview

7.10.2. Financial performance

7.10.3. Product Benchmarking

7.10.4. Strategic InitiativesList of Tables

1. Medical Component Manufacturing - Market snapshot

2. Medical component manufacturing market estimates and forecast, 2017 - 2030 (USD Billion)

3. Medical component manufacturing market revenue, by region, 2017 - 2030 (USD Billion)

4. Medical component manufacturing market revenue, by process, 2017 - 2030 (USD Billion)

5. Medical component manufacturing - Key market driver analysis

6. Medical component manufacturing - Key market restraint analysis

7. Medical component manufacturing market estimates & forecasts, by forging, 2017 - 2030 (USD Billion)

8. Medical component manufacturing market estimates & forecasts, by metal injection molding, 2017 - 2030 (USD Billion)

9. Medical component manufacturing market estimates & forecasts, by 3D printing, 2017 - 2030 (USD Billion)

10. Medical component manufacturing market estimates & forecasts, by ceramic injection molding, 2017 - 2030 (USD Billion)

11. Medical component manufacturing market estimates & forecasts, by investment casting, 2017 - 2030 (USD Billion)

12. Medical component manufacturing market estimates & forecasts, by plastic injection molding, 2017 - 2030 (USD Billion)

13. North America medical component manufacturing market estimates and forecast, 2017 - 2030, (USD Billion)

14. North America medical component manufacturing revenue, by process, 2017 - 2030, (USD Billion)

15. U.S medical component manufacturing market estimates and forecasts, 2017 - 2030 (USD Billion)

16. U.S. medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

17. Europe medical component manufacturing market estimates and forecast, 2017 - 2030 (USD Billion)

18. Europe medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

19. Germany medical component manufacturing market estimates and forecast, 2017 - 2030 (USD Billion)

20. Germany medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

21. France medical component manufacturing market estimates and forecast, 2017 - 2030 (USD Billion)

22. France medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

23. U.K. medical component manufacturing market estimates and forecasts, 2017 - 2030 (USD Billion)

24. U.K. medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

25. Spain medical component manufacturing market estimates and forecast, 2017 - 2030 (USD Billion)

26. Spain medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

27. Asia Pacific medical component manufacturing market estimates and forecasts, 2017 - 2030 (USD Billion)

28. Asia Pacific medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

29. China medical component manufacturing market estimates and forecasts, 2017 - 2030 (USD Billion)

30. China medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

31. India medical component manufacturing market estimates and forecasts, 2017 - 2030 (USD Billion)

32. India medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)

33. Japan medical component manufacturing market estimates and forecasts, 2017 - 2030 (USD Billion)

34. Japan medical component manufacturing revenue, by process, 2017 - 2030 (USD Billion)List of Figures

1. Medical component manufacturing market segmentation

2. Medical component manufacturing market revenue, 2017 - 2030 (USD Billion)

3. Medical component manufacturing value chain analysis

4. Medical component manufacturing market dynamics

5. Medical component manufacturing penetration & growth prospect mapping

6. Medical component manufacturing Porter’s analysis

7. Medical component manufacturing PESTEL analysis

8. Medical component manufacturing market share by process, 2020 & 2030

9. Medical component manufacturing market revenue by region, 2020 & 2030

Companies Mentioned

- Anchor Harvey

- Rejointsrl

- Nexxt Spine, LLC

- 3D Systems, Inc.

- Heraeus Holding

- Simalex

- American Casting Company

- Optimum Medical Limited

- MICRO

- Norwood Medical

Table Information

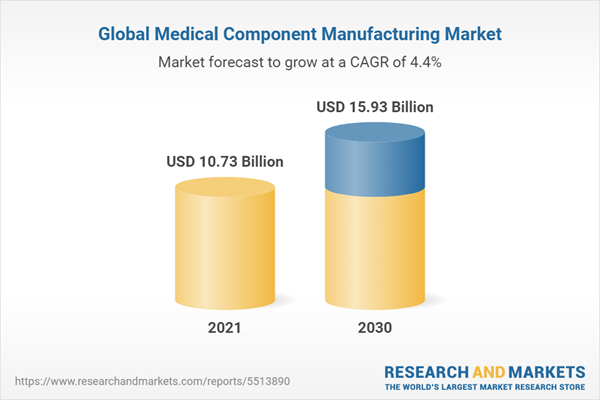

| Report Attribute | Details |

|---|---|

| No. of Pages | 92 |

| Published | December 2021 |

| Forecast Period | 2021 - 2030 |

| Estimated Market Value ( USD | $ 10.73 Billion |

| Forecasted Market Value ( USD | $ 15.93 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |