This Radio Advertising market report provides a comprehensive analysis of the market’s characteristics, size, and growth, including segmentation, regional and country-level breakdowns, competitive landscape, market shares, trends, and strategies. It also tracks historical and forecasted market growth across various geographies.

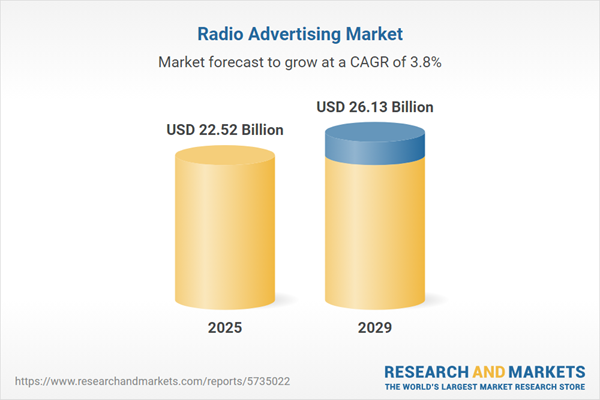

The radio advertising market size has grown steadily in recent years. It will grow from $21.58 billion in 2024 to $22.52 billion in 2025 at a compound annual growth rate (CAGR) of 4.4%. The growth in the historic period can be attributed to mass media dominance, local market targeting, cost-effective advertising, audio content consumption habits, brand recognition through jingles.

The radio advertising market size is expected to see steady growth in the next few years. It will grow to $26.13 billion in 2029 at a compound annual growth rate (CAGR) of 3.8%. The growth in the forecast period can be attributed to targeted advertising solutions, integration with digital platforms, podcast and on-demand audio opportunities, cross-platform advertising strategies, measurable ROI and analytics. Major trends in the forecast period include sponsorship and endorsements, adapting to changing consumer behavior, innovative ad formats, regulatory compliance, brand safety and contextual advertising.

The need for affordable advertising options for both large and small businesses is expected to boost demand in the radio advertising market. Despite the growing popularity of newer advertising platforms such as the internet and other digital media, radio continues to be a highly cost-effective advertising medium. In smaller markets, companies typically spend around $900 per week on a 30-second ad schedule, while in larger markets, such as Sydney, costs rise to approximately $8,000 per week. On average, advertisers pay about $20 to reach 1,000 listeners during peak times, and around $10 to $15 during off-peak hours. For example, in May 2024, the Out of Home Advertising Association of America (OAAA), a US-based trade association, reported that out-of-home (OOH) advertising revenue increased by 6.8% in the first quarter of 2024 compared to the previous year, reaching a total of $1.94 billion. Consequently, the affordability of radio advertising is expected to drive growth in the radio advertising market.

The surge in advertising spending across various industries is anticipated to boost the radio advertising market. Advertising spending refers to the financial resources dedicated by businesses or organizations to promotional activities aiming to reach their target audience and accomplish marketing objectives. Radio advertising, as a versatile marketing tool, is utilized by industries to engage a broad audience with compelling audio content, proving effective for the promotion of products, services, and events, especially in sectors such as retail, automotive, and entertainment. For instance, in April 2023, the Advertising Association and WARC Expenditure Report revealed an 8.8% growth in the UK's advertising market, reaching a total of $42.188 billion (£34.8 billion) in 2022. This rise in advertising spending contributes to the growth of the radio advertising market.

Leading companies in the radio advertising market are actively engaging in strategic partnerships as part of their business strategy to boost revenues. These collaborations within the radio advertising industry are designed to expand reach and revenue streams by teaming up with complementary media outlets or technology firms, providing access to broader audiences and innovative solutions for ad placement. A notable example is the partnership between Triton Digital LLC, a US-based digital audio technology and advertising company, and Basis Technologies, a US-based cloud-based software company. This collaboration, established in June 2023, enables marketers to purchase advertising across all audio segments, streamlining the process and offering agencies and brands an easier way to reach their target audiences while ensuring plagiarism-free content.

The introduction of digital radio is growing in popularity within the radio advertising market. Digital radio offers users improved spectral efficiency. For example, in February 2022, data from Radio Joint Audience Research Limited (RAJAR), a UK-based organization that monitors radio audiences, showed that digital listening in the United Kingdom rose to 64.4% of total radio listening. Meanwhile, AM/FM listening saw a slight increase, moving from 34.2% to 35.6%. Additionally, digital modulation methods, which involve more complex transmitters and receivers, allow for the transmission of more information compared to traditional analogue modulation schemes.

In June 2022, Rezolve Limited, a UK-based mobile commerce and engagement company, successfully acquired ANY Lifestyle Marketing GmbH for an undisclosed amount. This acquisition is anticipated to revolutionize the mobile engagement industry by transforming radio advertising and enhancing interactions between businesses and consumers through mobile devices. ANY Lifestyle Marketing GmbH, based in Germany, is a notable player in the radio advertising sector.

Radio advertising operates by enabling advertisers to acquire airtime on various radio stations for broadcasting commercials or spots that promote their products or services. This approach offers advertisers a cost-effective means to consistently broadcast their messages, leveraging the power to evoke emotions and stimulate demand. Additionally, radio advertising provides immediacy, encouraging listeners to visit a specific store, engage with a particular brand, or take predefined actions.

The primary categories of radio advertising encompass traditional radio advertising, terrestrial radio broadcast advertising, terrestrial radio online advertising, and satellite radio advertising. In traditional radio advertising, commercials are employed to showcase products or services, with advertisers securing airtime on commercial radio stations for broadcasting. This method is utilized across various industries, including BFSI, consumer goods and retail, government and public sector, IT and telecom, healthcare, and media. It caters to enterprises of different sizes, including large enterprises as well as small and medium-sized enterprises.

The radio advertising market research report is one of a series of new reports that provides radio advertising market statistics, including radio advertising industry global market size, regional shares, competitors with a radio advertising market share, detailed radio advertising market segments, market trends and opportunities, and any further data you may need to thrive in the radio advertising industry. This radio advertising market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the radio advertising market include Cox Media Group Inc., Citizen Group LLC, Sirius XM Radio Inc., iHeart Media Inc., Entercom Communications Corp., Cumulus Media Inc., Alpha Media LLC, Townsquare Media Inc., Neff Associates Inc., National Public Radio Inc., Bonneville International Corporation, Salem Media Group Inc., Beasley Broadcast Group Inc., Hubbard Broadcasting Inc., SidLee Inc., Commonwealth Broadcasting Corporation, Saga Communications Inc., Spire Agency, Pacifica Foundation, Cherry Creek Radio LLC, Daniel Brian Advertising, Strategic Media Inc., Midwest Family Broadcasting Inc., The Radio Agency Inc.

North America was the largest region in the radio advertising market in 2024. Western Europe was the second largest region in the global radio advertising market share. The regions covered in the radio advertising market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the radio advertising market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The radio advertising market consists of revenue earned by entities by providing services such as planning, developing, creating and managing advertisement and promotional activities in radio. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

The radio advertising market size has grown steadily in recent years. It will grow from $21.58 billion in 2024 to $22.52 billion in 2025 at a compound annual growth rate (CAGR) of 4.4%. The growth in the historic period can be attributed to mass media dominance, local market targeting, cost-effective advertising, audio content consumption habits, brand recognition through jingles.

The radio advertising market size is expected to see steady growth in the next few years. It will grow to $26.13 billion in 2029 at a compound annual growth rate (CAGR) of 3.8%. The growth in the forecast period can be attributed to targeted advertising solutions, integration with digital platforms, podcast and on-demand audio opportunities, cross-platform advertising strategies, measurable ROI and analytics. Major trends in the forecast period include sponsorship and endorsements, adapting to changing consumer behavior, innovative ad formats, regulatory compliance, brand safety and contextual advertising.

The need for affordable advertising options for both large and small businesses is expected to boost demand in the radio advertising market. Despite the growing popularity of newer advertising platforms such as the internet and other digital media, radio continues to be a highly cost-effective advertising medium. In smaller markets, companies typically spend around $900 per week on a 30-second ad schedule, while in larger markets, such as Sydney, costs rise to approximately $8,000 per week. On average, advertisers pay about $20 to reach 1,000 listeners during peak times, and around $10 to $15 during off-peak hours. For example, in May 2024, the Out of Home Advertising Association of America (OAAA), a US-based trade association, reported that out-of-home (OOH) advertising revenue increased by 6.8% in the first quarter of 2024 compared to the previous year, reaching a total of $1.94 billion. Consequently, the affordability of radio advertising is expected to drive growth in the radio advertising market.

The surge in advertising spending across various industries is anticipated to boost the radio advertising market. Advertising spending refers to the financial resources dedicated by businesses or organizations to promotional activities aiming to reach their target audience and accomplish marketing objectives. Radio advertising, as a versatile marketing tool, is utilized by industries to engage a broad audience with compelling audio content, proving effective for the promotion of products, services, and events, especially in sectors such as retail, automotive, and entertainment. For instance, in April 2023, the Advertising Association and WARC Expenditure Report revealed an 8.8% growth in the UK's advertising market, reaching a total of $42.188 billion (£34.8 billion) in 2022. This rise in advertising spending contributes to the growth of the radio advertising market.

Leading companies in the radio advertising market are actively engaging in strategic partnerships as part of their business strategy to boost revenues. These collaborations within the radio advertising industry are designed to expand reach and revenue streams by teaming up with complementary media outlets or technology firms, providing access to broader audiences and innovative solutions for ad placement. A notable example is the partnership between Triton Digital LLC, a US-based digital audio technology and advertising company, and Basis Technologies, a US-based cloud-based software company. This collaboration, established in June 2023, enables marketers to purchase advertising across all audio segments, streamlining the process and offering agencies and brands an easier way to reach their target audiences while ensuring plagiarism-free content.

The introduction of digital radio is growing in popularity within the radio advertising market. Digital radio offers users improved spectral efficiency. For example, in February 2022, data from Radio Joint Audience Research Limited (RAJAR), a UK-based organization that monitors radio audiences, showed that digital listening in the United Kingdom rose to 64.4% of total radio listening. Meanwhile, AM/FM listening saw a slight increase, moving from 34.2% to 35.6%. Additionally, digital modulation methods, which involve more complex transmitters and receivers, allow for the transmission of more information compared to traditional analogue modulation schemes.

In June 2022, Rezolve Limited, a UK-based mobile commerce and engagement company, successfully acquired ANY Lifestyle Marketing GmbH for an undisclosed amount. This acquisition is anticipated to revolutionize the mobile engagement industry by transforming radio advertising and enhancing interactions between businesses and consumers through mobile devices. ANY Lifestyle Marketing GmbH, based in Germany, is a notable player in the radio advertising sector.

Radio advertising operates by enabling advertisers to acquire airtime on various radio stations for broadcasting commercials or spots that promote their products or services. This approach offers advertisers a cost-effective means to consistently broadcast their messages, leveraging the power to evoke emotions and stimulate demand. Additionally, radio advertising provides immediacy, encouraging listeners to visit a specific store, engage with a particular brand, or take predefined actions.

The primary categories of radio advertising encompass traditional radio advertising, terrestrial radio broadcast advertising, terrestrial radio online advertising, and satellite radio advertising. In traditional radio advertising, commercials are employed to showcase products or services, with advertisers securing airtime on commercial radio stations for broadcasting. This method is utilized across various industries, including BFSI, consumer goods and retail, government and public sector, IT and telecom, healthcare, and media. It caters to enterprises of different sizes, including large enterprises as well as small and medium-sized enterprises.

The radio advertising market research report is one of a series of new reports that provides radio advertising market statistics, including radio advertising industry global market size, regional shares, competitors with a radio advertising market share, detailed radio advertising market segments, market trends and opportunities, and any further data you may need to thrive in the radio advertising industry. This radio advertising market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the radio advertising market include Cox Media Group Inc., Citizen Group LLC, Sirius XM Radio Inc., iHeart Media Inc., Entercom Communications Corp., Cumulus Media Inc., Alpha Media LLC, Townsquare Media Inc., Neff Associates Inc., National Public Radio Inc., Bonneville International Corporation, Salem Media Group Inc., Beasley Broadcast Group Inc., Hubbard Broadcasting Inc., SidLee Inc., Commonwealth Broadcasting Corporation, Saga Communications Inc., Spire Agency, Pacifica Foundation, Cherry Creek Radio LLC, Daniel Brian Advertising, Strategic Media Inc., Midwest Family Broadcasting Inc., The Radio Agency Inc.

North America was the largest region in the radio advertising market in 2024. Western Europe was the second largest region in the global radio advertising market share. The regions covered in the radio advertising market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the radio advertising market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The radio advertising market consists of revenue earned by entities by providing services such as planning, developing, creating and managing advertisement and promotional activities in radio. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

1. Executive Summary2. Radio Advertising Market Characteristics3. Radio Advertising Market Trends and Strategies4. Radio Advertising Market - Macro Economic Scenario Including the Impact of Interest Rates, Inflation, Geopolitics, and the Recovery from COVID-19 on the Market32. Global Radio Advertising Market Competitive Benchmarking and Dashboard33. Key Mergers and Acquisitions in the Radio Advertising Market34. Recent Developments in the Radio Advertising Market

5. Global Radio Advertising Growth Analysis and Strategic Analysis Framework

6. Radio Advertising Market Segmentation

7. Radio Advertising Market Regional and Country Analysis

8. Asia-Pacific Radio Advertising Market

9. China Radio Advertising Market

10. India Radio Advertising Market

11. Japan Radio Advertising Market

12. Australia Radio Advertising Market

13. Indonesia Radio Advertising Market

14. South Korea Radio Advertising Market

15. Western Europe Radio Advertising Market

16. UK Radio Advertising Market

17. Germany Radio Advertising Market

18. France Radio Advertising Market

19. Italy Radio Advertising Market

20. Spain Radio Advertising Market

21. Eastern Europe Radio Advertising Market

22. Russia Radio Advertising Market

23. North America Radio Advertising Market

24. USA Radio Advertising Market

25. Canada Radio Advertising Market

26. South America Radio Advertising Market

27. Brazil Radio Advertising Market

28. Middle East Radio Advertising Market

29. Africa Radio Advertising Market

30. Radio Advertising Market Competitive Landscape and Company Profiles

31. Radio Advertising Market Other Major and Innovative Companies

35. Radio Advertising Market High Potential Countries, Segments and Strategies

36. Appendix

Executive Summary

Radio Advertising Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on radio advertising market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for radio advertising ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The radio advertising market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Traditional Radio Advertising; Terrestrial Radio Broadcast Advertising; Terrestrial Radio Online Advertising; Satellite Radio Advertising2) By Enterprise Size: Large Enterprise; Small and Medium Enterprise

3) By Industry Application: BFSI; Consumer Goods and Retail; Government and Public Sector; IT and Telecom; Healthcare; Media and Entertainment

Subsegments:

1) By Traditional Radio Advertising: Spot Advertising; Sponsorships; Infomercials2) By Terrestrial Radio Broadcast Advertising: Local Ads; National Ads; Regional Ads

3) By Terrestrial Radio Online Advertising: Streaming Audio Ads; Digital Sponsorships; Podcast Ads

4) By Satellite Radio Advertising: National Spot Ads; Brand Integrations; Subscriber Promotions

Key Companies Mentioned: Cox Media Group Inc.; Citizen Group LLC; Sirius XM Radio Inc.; iHeart Media Inc.; Entercom Communications Corp.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Radio Advertising market report include:- Cox Media Group Inc.

- Citizen Group LLC

- Sirius XM Radio Inc.

- iHeart Media Inc.

- Entercom Communications Corp.

- Cumulus Media Inc.

- Alpha Media LLC

- Townsquare Media Inc.

- Neff Associates Inc.

- National Public Radio Inc.

- Bonneville International Corporation

- Salem Media Group Inc.

- Beasley Broadcast Group Inc.

- Hubbard Broadcasting Inc.

- SidLee Inc.

- Commonwealth Broadcasting Corporation

- Saga Communications Inc.

- Spire Agency

- Pacifica Foundation

- Cherry Creek Radio LLC

- Daniel Brian Advertising

- Strategic Media Inc.

- Midwest Family Broadcasting Inc.

- The Radio Agency Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 22.52 Billion |

| Forecasted Market Value ( USD | $ 26.13 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |