COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, factors such as upcoming oil and gas exploration projects and increased oil and gas production are expected to boost the demand in the Libya Oil and Gas Upstream Market during the forecast period.

- On the other hand, the ongoing civil war in the country has severely impacted the growth in the sector, and political instability is likely to hurt the Libya Oil and Gas Upstream Market during the forecast period.

- Nevertheless, the exploration and development of its offshore acreage for discovering prospective gas fields in the Mediterranean Sea are expected to provide a significant growth opportunity for the market beyond the forecast period.

Libya Oil and Gas Upstream Market Trends

Onshore to Dominate the Market

- Libya held an estimated 48.4 thousand million barrels of proved crude oil reserves at the beginning of 2020. Most of the country's proven oil reserves are held onshore. There are also some offshore oil fields off the coast of Libya, near the capital Tripoli.

- One of the most essential of Libya's crude oil blends is the Amna, with an API gravity of 37.0, high quality, and low sulfur 0.17% crude oil. The oil grade is of excellent quality and requires low refining maintenance and equipment.

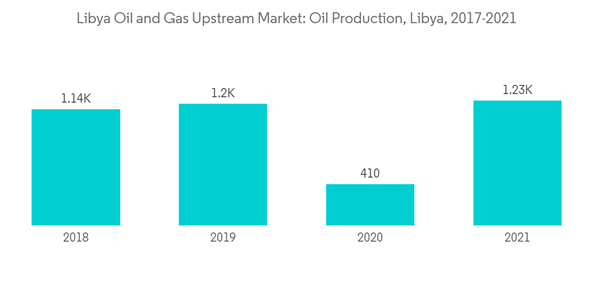

- The oil production increased in the country by nearly three times in 2021, from 410 thousand barrels/day in 2020 to 1230 thousand barrels/day in 2021, as the market recovered from the Covid-19 pandemic.

- However, production is still well below the production levels in pre-war Libya, demonstrating the conflict's impact and the opportunity for increasing production. The increase in oil production in the country is expected to provide some growth in the sector.

- In November 2022, TotalEnergies, in partnership with ConocoPhillips, completed the acquisition of an 8.16% stake held by Hess in the Waha project, increasing its interest in the concession from 16.33% to 20.41%. The Waha concessions in Libya's Sirte Basin are some of the most prolific in the region, producing around 300,000 barrels per day (BPD) and feeding into Libya's Es Sider grade, and are estimated to contain more than 500 million barrels of oil equivalent and exploration potential spanning over 53,000 km².

- Hence, onshore oil and gas fields are expected to dominate the market due to the location of the oil and gas reservoir in the country.

Political turmoil to restrain growth

- As the war progresses, it is expected that the production may remain volatile, in the short term, because of the belligerent factions vying for control of the oil fields. The oilfields have also suffered significant infrastructural damage in the process.

- Libya's crude oil production has continually fluctuated because of armed conflict and political instability since Libya's first civil war, which began in 2011. For instance, in April 2022, protesters across the country started to blockade several major ports and oil fields in Libya, causing production to fall to around 0.5 million b/d by July 2022.

- Similarly, in December 2021, armed militants shut in an estimated 0.4 million b/d of crude oil production. According to the Oil Ministry, due to production losses in April 2022, Libya lost nearly USD 60 million in revenues daily.

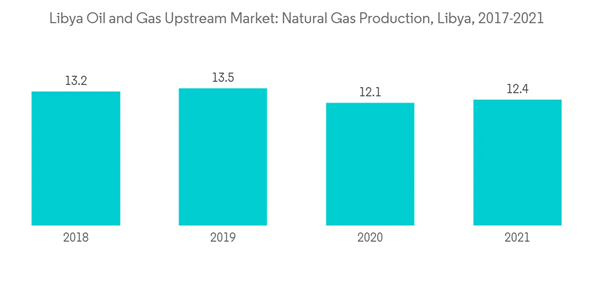

- Natural gas production in Libya has fluctuated wildly since the start of the war in 2011. In 2010, Libya's gas production stood at 16.7 billion cubic meters, falling to 7.5 billion cubic meters in 2011 and still lagging at 12.4 billion cubic meters during 2021.

- Hence, the lack of political stability, combined with damage to oil and gas infrastructure caused by militants and protests, reduces the economic attractiveness to potential investors, which is expected to restrain the market during the forecast period.

Libya Oil and Gas Upstream Industry Overview

The Libyan Oil and Gas Upstream Market is moderately consolidated. The major companies include (not in particular order) BP PLC, Eni SpA, National Oil Corporation, PJSC Gazprom, and Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Eni SpA

- National Oil Corporation

- PJSC Gazprom

- BP PLC

- Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA