Over the long term, new model launches by major industry players and a rise in sales of electric and hybrid vehicles, as well as the adoption of strict vehicle emission norms and fuel efficiency standards, are creating demand in the electric vehicles industry with a surge in sales of mild hybrid vehicles. However, the dominance of strong hybrids and battery electric vehicles (BEVs) in European countries such as Germany, France, Sweden, Norway, and the Netherlands is likely to act as a major restraint for the growth of mild hybrid vehicles in the region. The penetration of all-electric vehicles in the European region showcased considerable growth in recent years, with sales of battery electric vehicles (BEVs) touching 54.7% in July 2023 compared to the same month in 2022. Therefore, the adoption of mild hybrid models, which integrate an internal combustion engine (ICE) in their powertrain, is likely to witness slower growth as compared to its counterparts.

Key players in the market are launching new models to cater to the increased demand for mild hybrid vehicles. For instance, in September 2022, Mitsubishi Motors Europe B.V. launched the new generation ASX SUV in Europe with a mild hybrid system. The vehicle will be made at Renault's Valladolid plant in Spain. In September 2022, Nissan Europe launched the fourth generation X Trail SUV in Europe, including a mild hybrid version of the same vehicle.

Spain is anticipated to showcase the fastest growth during the forecast period because the majority of car buyers in Spain cannot afford battery electric vehicles (BEVs). It is due to the low purchasing power compared to other countries like Germany, France, the United Kingdom, and Scandinavian countries. An increasing adoption is expected in other countries such as Germany, the United Kingdom, Italy, and France, owing to the growing consumer awareness about environmental hazards, and auto manufacturers are shifting focus on promoting electrification of vehicle fleets across the European region.

Europe Mild Hybrid Vehicles Market Trends

Passenger Car Segment is Anticipated to Dominate the Market

Consumers' shifting preference towards the adoption of low-emission vehicles is driving the growth of the passenger car segment of the mild hybrid vehicles market in Europe. Coupled with that, strict emissions norms, higher fuel efficiency standards, and the ambitious targets set by various European countries to ban ICE mobility by 2030 are also aiding the demand for mild hybrid passenger cars in the market. European Parliament set an ambitious goal to cut vehicle emissions by 40% between 2020 to 2025 from 2019 levels. Since mild hybrid vehicles are seen as the first step toward electrification of vehicles, they are experiencing a steady rise in sales in Europe.The significant benefits of the mild hybrid system are its smooth engine start-up, battery charging with kinetic energy, and short distances that can be covered on electric power, along with reduced overall fuel consumption. Further, due to the capability of mild hybrid vehicles offering better fuel efficiency compared to any conventional gasoline/diesel engine cars, it is becoming increasingly popular among consumers willing to purchase a low-emission passenger car. Also, the production of mild hybrid vehicles is placed at lower prices as they are less sophisticated than a full hybrid vehicle, becoming less expensive than its counterpart. Several leading auto manufacturing companies, such as Volkswagen, Audi, Renault, Nissan, and Toyota. are investing hefty sums to produce mild hybrid cars in the European region, which is further assisting its growth prospect.

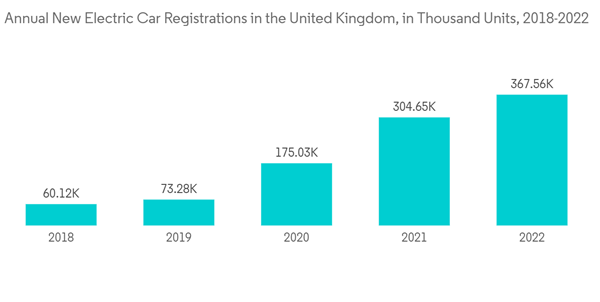

On the other hand, in recent years, various European countries such as the United Kingdom, Germany, and France, among others, witnessed an excessive surge in the sales of all-electric vehicle models as these vehicles are better suited to combat carbon emissions than mild hybrid vehicles. It acts as a major deterrent for the passenger car segment of the target market. For instance, new electric car registrations in the United Kingdom touched 367 thousand units in 2022, compared to 304 units in 2021, representing a Y-o-Y growth of 20.7%. Therefore, auto manufacturers in the market need to constantly offer advanced mild hybrid vehicle modes. It helps in combating carbon emissions with better efficiency of the vehicle to create demand among consumers.

Spain is Expected to Showcase Fastest Growth among other European Countries

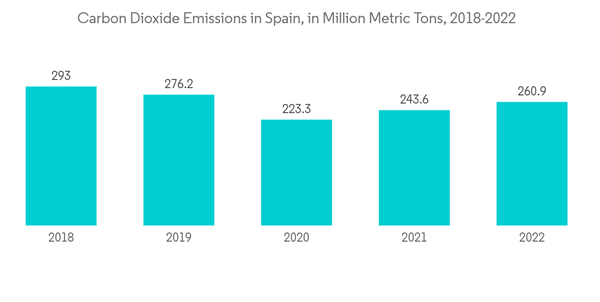

Spain is anticipated to become the fastest-growing market, followed by Italy, France, and Germany in the European region. The sales of mild hybrid vehicles in Spain are expected to showcase major growth, owing to the lower price of mild hybrid vehicles compared to battery-electric vehicles (BEVs) or plug-in hybrid electric vehicles (PHEVs). The purchasing power of people in Spain is lower compared to people living in other countries like Germany, France, the United Kingdom, and Scandinavian countries. These are major markets for strong hybrids and battery electric vehicles in Europe. The majority of EV buyers in Spain need help to afford to buy strong hybrids and battery electric vehicles. Therefore, mild hybrid vehicles are the most preferred type of low-emission vehicle in Spain.Italy, Germany, and France are also major markets due to the large presence of automotive OEMs and the rising electrification of vehicles because of the adoption of stringent automotive emission norms and fuel economy standards, which leads to high electric vehicle sales in these geographies.

Thus, with companies coming up with new launches in this segment and investments, the market for mild hybrid vehicles is expected to grow over the forecast period in the country. For instance,

- In September 2022, Mitsubishi Motors Europe BV announced the production of the ASX mild hybrid SUV at Renault's plant in Valladolid, Spain.

- In March 2022, Volkswagen Group and SEAT announced to invest EUR 7 billion (USD 7.38 billion) to produce a range of electric vehicles, including mild hybrids and batteries, at their plants in Martorell, Valen, CIA, and Pamplona.

Europe Mild Hybrid Vehicles Industry Overview

The European Mild Hybrid Vehicles market is highly consolidated and competitive. The market is characterized by the presence of considerably large players that long dominated the market. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.Some of the major players dominating the European market are Volkswagen AG, Toyota Motors, BMW Group, Nissan Motor Corp., Audi AG, BMW Group, and Mercedes-Benz, among others. Key players are launching new products to secure their market position and stay ahead of the market curve. For instance,

- In September 2022, Mazda Motor Europe announced the launch of their full-size SUV CX60 in Europe. It will be equipped with mild hybrid technology, among other variants such as gasoline, diesel, and hybrid.

- In May 2022, Solaris announced that they had received an order for 12 mild hybrid Urbino city buses to be supplied to Port of Bar, the chief seaport in Montenegro. The buses will be used to transport the citizens of the town from the city center to the port of the city.

- In March 2022, Nissan Motor Europe launched the new generation of Qashqai featuring e-POWER mild hybrid technology, an award-winning powertrain technology. This launch aims to support the long-term goal of the company to achieve 50% electrified sales in Europe by 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.