Facial care comprises a wide range of facial care products, such as moisturizers, anti-agers, face masks, cleansers, toners, scrubs or exfoliators, oils, face wash, and serums, that enhance the skin appearance. It is suitable for sensitive and allergy-prone skin and restores firmness and texture while reducing blemishes and scars. It offers nourished skin by providing vitamins and minerals, benefits in cleansing the face, and has increased shelf life. It also increases the amount of collagen and prevents loss of elasticity in the skin.

It assists in treating acne, rash, and pigmentation, maintaining healthy skin, preventing ultraviolet (UV) rays and sun burn, and decreasing the signs of aging, wrinkles, and dark spots. Besides this, it aids in protecting the skin from environmental damage like pollution. As it reduces visible pores and protects from bacteria and allergies, the demand for facial care is increasing in Australia.

Australia Facial Care Market Trends:

At present, the rising consumer consciousness towards physical appearance represents one of the key factors supporting the growth of the market in Australia. Besides this, the growing demand for facial care products among individuals due to the increasing social media influence is offering a positive market outlook in the country. Additionally, there is a rise in the demand for organic, natural, environmental-friendly, and sustainable facial care products among the masses. This, coupled with the increasing demand for chemical-free products that do not cause any side effects, is propelling the growth of the market in Australia.Apart from this, the rising demand for luxury and premium products due to the increasing concern about look and appearance is offering lucrative growth opportunities to industry investors. Moreover, the wide availability of facial products through various distribution channels, such as hypermarkets, supermarkets, convenience, pharmacies, and online stores, is positively influencing the market in the country.

In addition, the integration of advanced technologies, such as artificial intelligence (AI) and the internet of things (IoT), that provide personalized facial care solutions to individuals is contributing to the growth of the market. Furthermore, key manufacturers are introducing toxin-free and natural components in facial care products, such as aloe vera, rose, fruit extract, essential oils, and gelatin, which is strengthening the growth of the market in Australia.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the Australia facial care market report, along with forecasts at the regional levels from 2025-2033. Our report has categorized the market based on product type, ingredient, gender and distribution channel.Product Type Insights:

- Facial Cleansers

- Moisturizers

- Anti-Agers

- Skincare Sets

- Face Masks

- Others

Ingredient Insights:

- Chemical

- Natural

Gender Insights:

- Male

- Female

- Unisex

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Beauty Parlors and Salons

- Multi Branded Retail Stores

- Online

- Exclusive Retail Stores

- Others

Regional Insights:

- Western Australia

- New South Wales

- Queensland

- Victoria

- Rest of Australia

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Australia facial care market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Beiersdorf AG, Colgate-Palmolive Company, Johnson & Johnson, Kao Corporation, L'Oreal S.A., Procter & Gamble, Revlon Inc., The Estee Lauder Companies Inc, Unilever PLC, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report

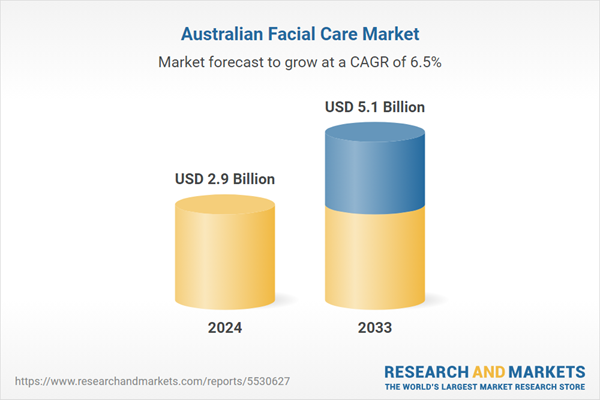

- What was the size of the Australia facial care market in 2024?

- What is the expected growth rate of the Australia facial care market during 2025-2033?

- What has been the impact of COVID-19 on the Australia facial care market?

- What are the key factors driving the Australia facial care market?

- What is the breakup of the Australia facial care market based on the product type?

- What is the breakup of the Australia facial care market based on the ingredient?

- What are the key regions in the Australia facial care market?

- Who are the key players/companies in the Australia facial care market?

Table of Contents

Companies Mentioned

- Beiersdorf AG

- Colgate-Palmolive Company

- Johnson & Johnson

- Kao Corporation

- L'Oreal S.A.

- Procter & Gamble

- Revlon Inc.

- The Estee Lauder Companies Inc

- Unilever PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 9 |