The rapid growth of quick-service restaurants (QSRs), such as McDonald’s with over 41,000 outlets globally, is largely influencing the frozen potato products market outlook. These chains rely heavily on frozen fries, wedges, and hash browns to maintain consistent quality, taste, and portion control across locations. In April 2025, Lamb Weston unveiled Frenzy Fries, a three-sided, skin-on fry created to elevate sensory dining experiences in the United Kingdom and European foodservice markets. Frozen formats also minimize food waste and streamline kitchen operations, making them ideal for high-volume service environments.

Consumers are largely drawn to artisanal and exotic flavours, such as truffle fries, curry wedges, garlic parmesan bites, while premium frozen potato products gain popularity in North America and Europe. In January 2024, Tesco expanded its Plant Chef line by adding frozen meatballs and Sweet Potato Katsu Curry for boosting plant-based options. These products offer a gourmet twist on traditional potato snacks, appealing to foodies and health-conscious buyers. This trend reflects a broader move toward indulgent, restaurant-style foods that can be enjoyed at home.

Increased investments in refrigerated logistics are further shaping the frozen potato products market trends. Advanced refrigerated transportation and storage systems help maintain product quality and safety from production to retail. In October 2024, leading Romanian agri-food firm Grup Șerban Holding invested EUR 62.5 million to enhance its potato processing and storage capabilities including the expansion of cold storage facilities. Enhanced logistics also enable faster delivery and wider distribution, allowing brands to reach more consumers, including in remote or hot climates.

Key Trends and Recent Developments

May 2025

Falcon Agrifriz Foods launched India’s largest automated frozen potato manufacturing plant in Gujarat. The facility features a 350-meter French fries production line with 15 metric tons per hour capacity and a specialty line producing 3.5 metric tons per hour. This ₹1,050 crore investment is likely to make the region a global frozen potato hub.January 2025

Allana Consumer Products Ltd. invested ₹300 crore to establish manufacturing facilities for French fries and frozen potato products in Gujarat and North India by 2027. This strategic expansion reflects the firm’s commitment to diversifying its portfolio and meeting the growing global demand for convenient and ready-to-eat foods.January 2025

HyFun Foods expanded its presence in over 1,000 Woolworths stores in Australia by introducing premium frozen potato products including Hash Browns and Tots under the "Your Spud Co" brand. With a ₹25 crore collaboration, HyFun aims to capture a double-digit market share, backed by a ₹1,100 crore investment to grow production and global reach.October 2024

Mart Frozen Foods inaugurated a USD 65 million high-tech facility in Idaho's Magic Valley in the United States. The plant produces and packages frozen, fully baked Idaho potatoes branded as OH!Tatoes. This expansion is expected to create 80 full-time jobs and generate an estimated annual economic impact of USD 11.15 million.Convenience & Urban Lifestyles

Busy lives and urbanization are fuelling the demand for ready-to-cook products, adding to the frozen potato products market revenue. As per the United Nations, 68% of the global population is estimated to live in urban areas by 2050. With preparation time slashed and consistent taste guaranteed, consumers are increasingly choosing frozen options. Ready-to-cook frozen potato products offer convenience, longer shelf life, and easy preparation, making them a popular choice for both households and foodservice outlets.Adoption of E‑commerce Channels

E‑commerce platforms, meal‑kit services, and online grocery delivery are accelerating the frozen potato sales by offering convenience and broader access. These digital channels offer unmatched convenience, allowing shoppers to browse, compare, and order from home. In January 2025, Blue Tribe Foods introduced its sweet potato fries, available on Zepto, Swiggy Instamart, and Blinkit for health-conscious consumers. This shift toward online shopping has expanded market reach, boosted sales volumes, and enabled brands to connect directly with digitally savvy consumers.Health‑Oriented Product Innovations

The shift towards health-conscious eating is driving the frozen potato products industry, helping the launch of low-fat, air-fried, reduced-sodium, gluten-free, and vegan products. In December 2022, Godrej Yummiez launched its Crispy Potato Starz, made with high quality potatoes and no added preservatives to expand its vegetarian portfolio. These innovations cater to demand for guilt-free indulgence without sacrificing taste or convenience. This trend is broadening the consumer base and assisting brands to differentiate themselves in a competitive market, contributing to strong market growth.Sustainability in Sourcing & Packaging

Major brands in the frozen potato products market are increasingly using eco-friendly farming methods and recyclable materials. The adoption of eco-friendly farming techniques is helping to promote soil health and biodiversity. In March 2025, McCain Foods launched Regen Fries made from potatoes grown with regenerative agriculture, strengthening its commitment to sustainable farming. Additionally, companies are shifting to recyclable, biodegradable, and compostable packaging materials to minimize plastic waste. Such efforts lower carbon footprints and meet the growing consumer demand for environmentally responsible products.Advanced Processing Technologies

Technological innovations to improve quality, minimize waste, and enhance cold-chain efficiency, adding to the frozen potato products industry growth. In March 2025, HyFun Foods, partnered with United Kingodm-based HarvestEye to revolutionize India's potato industry through artificial intelligence. This collaboration aimed to enhance farming efficiency, crop quality, and supply chain transparency. Such innovations optimize production, reduce losses, and enhance cold-chain management, enabling companies to meet growing demand sustainably and cost-effectively, driving overall market growth.Frozen Potato Products Industry Segmentation

The report titled “Frozen Potato Products Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- French Fries

- Hash Brown

- Sweet Potatoes/Yam

- Potato Wedges

- Potato Bites

- Mashed

- Smileys

- Others

Market Breakup by End Use

- Food Service

- Retail

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Distributors

- Convenience Stores

- Online

- Direct Purchase and Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frozen Potato Products Market Share

Hash Browns & Sweet Potatoes/Yam to Record Significant Consumption

Hash browns are gaining preference in the frozen potato products market with strong popularity as a breakfast item especially in the United States, the United Kingdom, and Australia. Brands including HyFun Foods and Agristo supply frozen hash browns in various formats such as patties and shredded styles. The segment benefits from rising consumer demand for quick, ready-to-eat meals. Innovations like seasoned and health-conscious versions are gaining traction. Hash browns further appeal to retail and foodservice channels, maintaining steady growth due to breakfast and snacking trends.Frozen sweet potatoes or yams are witnessing growing interest due to their nutritional benefits and rising health awareness. Several companies are expanding their offerings to include sweet potato fries for catering to retail and foodservice sectors. In November 2024, International Food & Consumable Goods Egypt unveiled new sweet potato wedges, available in both skin-on and skin-off variations. This segment is growing steadily, especially in Western markets, driven by vegan, gluten-free, and clean-label trends. Moreover, sweet potatoes also represent an important niche with promising future potential.

Retail Channels to Drive Frozen Potato Products Sales

The retail segment of the frozen potato products industry involves products sold directly to consumers via supermarkets, hypermarkets, and online grocery platforms. This segment is growing steadily as consumers are seeking convenient, ready-to-cook snacks and meal accompaniments for home use. Brands are focusing on retail innovation and packaging to attract consumers. In March 2025, Lamb Weston introduced an industry-first retail bag for frozen potatoes made from used cooking oil to cater to eco-conscious consumers. Retail channels are also expanding with trends, such as frozen food meal kits, health-conscious options, and increasing online grocery penetration.Convenience Stores & Online Channels to Boost Frozen Potato Products Demand

Convenience stores represent a growing segment in the frozen potato products market, especially in urban and suburban areas where quick meals and snacks are in demand. Major chains are stocking single-serve frozen fries, hash browns, and potato bites designed for immediate consumption or quick home preparation. Convenience stores also feature smaller packaging sizes for catering to impulsive purchases and limited storage space. The increasing consumer preference for on-the-go snacks fuels growth in this segment.Online sales of frozen potato products are surging, driven by the rise of e-commerce and changing consumer habits. In September 2024, HyFun Foods expanded rapidly with online availability in all top Indian metros, marking major retail growth a year since its launch. Online platforms are offering a wide range of frozen potato items with home delivery and curbside pickup options. The convenience of online shopping, combined with detailed product information and customer reviews, encourages trial and repeat purchases. Subscription services and frozen food meal kits further boost online demand.

Frozen Potato Products Market Regional Analysis

Europe & Asia Pacific to Witness Wide Frozen Potato Products Adoption

Europe, including the United Kingdom, Germany, and France, is adding to the frozen potato products demand forecast. The region benefits from increasing demand for convenience meals and growing vegetarian and vegan trends. According to Finder, the vegan population of the United Kingdom surged by 1.1 million between 2023 and 2024. Retailers are introducing new frozen potato ranges, including plant-based and gourmet options. The stringent food safety standards encourage quality and innovation while catering to evolving European tastes while promoting sustainable sourcing and packaging practices.The Asia Pacific market is rapidly expanding in the frozen potato products market, fuelled by rising urbanization and changing lifestyles in India, China, and Australia. The frozen potato sector is gaining traction, supported by domestic processors, such as HyFun Foods expanding production capabilities. Online retail channels and modern supermarkets are increasingly offering frozen potato products, meeting rising consumer interest in convenience foods. The region’s potential for innovation and untapped demand is positioning it as a key growth market.

Competitive Landscape

Key players in the frozen potato products market are adopting various strategies to maintain competitiveness and capture market share. Product innovation is allowing players to develop diverse offerings, such as seasoned fries, curly fries, wedges, and value-added options to cater to evolving consumer preferences. Geographic expansion is pursued by entering emerging markets where demand for convenient and ready-to-cook foods is growing rapidly. Strategic partnerships and collaborations with foodservice providers, retailers, and distributors are helping companies to broaden their reach and ensure consistent supply chains.Many firms are focusing on sustainability initiatives, including reducing carbon footprints, using eco-friendly packaging, and sourcing potatoes from sustainable farms, which appeal to environmentally conscious consumers. Investment in advanced processing technologies improves product quality, shelf life, and operational efficiency. Furthermore, companies emphasize marketing and branding efforts to build loyalty and enhance product visibility.

Lastly, the adoption of digital platforms for e-commerce and direct-to-consumer sales is important to meet changing buying behaviours and expand market presence globally.

McCain Foods Limited

McCain Foods Limited, founded in 1957 and headquartered in Florenceville-Bristol, Canada, is a global leader in frozen potato products. The company offers a wide variety of fries, appetizers, and specialty potato items for serving retail, foodservice, and industrial customers worldwide.Agrarfrost GmbH

Agrarfrost GmbH, established in 1978 and headquartered in Germany, specializes in producing frozen potato products. Agrarfrost’s range includes fries, potato specialties, and convenience products for catering mainly to European retail and foodservice markets with a focus on quality and sustainability.Agristo N.V.

Agristo N.V., founded in 1984 and located in Belgium, Germany produces a diverse range of frozen potato products. The firm supplies fries, wedges, and other potato snacks primarily to foodservice providers and retailers across Europe, emphasizing innovation and customer-oriented solutions.

Farm Frites International B.V.

Farm Frites International B.V., launched in 1971 and headquartered in The Netherlands, manufactures frozen potato products including fries, snacks, and specialty items. The company serves global retail and foodservice sectors, focusing on quality, innovation, and sustainable agricultural practices.

Other players in the frozen potato products market include J.R. Simplot Company, Iscon Balaji Food Private Limited, Lamb Weston Holdings, Inc., Pizzoli S.p.A, Landun Xumei Food Co., Ltd., and Ajino Chinuya Co., Ltd among others.

Key Features of the Frozen Potato Products Market Report

- Comprehensive quantitative analysis of market size, share, and growth projections.

- In-depth segmentation by product type, end use, distribution channel, and geography.

- Competitive landscape with detailed profiles of leading market players.

- Insights into emerging trends and technological advancements impacting the market.

- Assessment of market drivers, restraints, opportunities, and challenges.

- Forecasts up to 2034 based on historical and current market data.

- Trusted global insights backed by rigorous data collection and analysis.

- Customized reports tailored to specific business needs and industries.

- Experienced analysts providing actionable recommendations and market forecasts.

- Timely delivery with ongoing support and updated market intelligence.

Table of Contents

Companies Mentioned

The key companies featured in this Frozen Potato Products market report include:- McCain Foods Limited

- Agrarfrost GmbH

- Agristo N.V.

- Farm Frites International B.V.

- Iscon Balaji Food Private Limited

- J.R. Simplot Company

- Lamb Weston Holdings, Inc.

- Pizzoli S.p.A

- Landun Xumei Food Co., Ltd.

- Ajino Chinuya Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 156 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

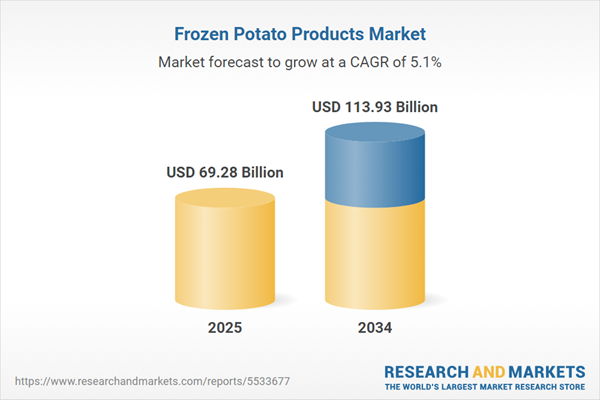

| Estimated Market Value ( USD | $ 69.28 Billion |

| Forecasted Market Value ( USD | $ 113.93 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |