The supply chain for backyard poultry feed witnessed a disruption as the supply of containers and vessels has also been affected, along with the transport of certain micro-ingredients, due to logistics issues. The government ordered the partial closure of its international ports, promoting further disruptions in the poultry feed supply chain. However, the backyard poultry feed market grew in the later phases due to exemptions from lockdown restrictions and government initiatives to dispel the rumors with respect to poultry as a source of COVID-19, which led to an increase in demand for poultry, thereby boosting the growth of the sector.

Over the medium term, the rapidly increasing demand for backyard poultry meat is an important factor driving the market. Poultry is considered one of the most economical sources of protein, owing to which poultry products, such as egg and meat, witness growing demand. With rising demand for backyard poultry meat and eggs across households and fast-food restaurants in Canada, poultry producers ramp up their production to meet the growing demand. In recent years, several households and small and medium farmers have taken up backyard poultry to meet consumption needs. Interest in backyard poultry in the country increased further during the COVID-19 pandemic, as people were hesitant to buy from stores. People in the country took up backyard poultry to meet their dietary needs of poultry meat and eggs, which increased the demand for backyard poultry feed as well. Chicken and turkey are two of the most consumed and produced meats in Canada, with chicken being the most preferred for backyard poultry. The quality and price of backyard feed products are the most prominent factors for the market growth. Hence, due to the aforementioned factors, the market is anticipated to grow during the forecast period.

Canada Backyard Poultry Feed Market Trends

Rising Demand for Poultry Products

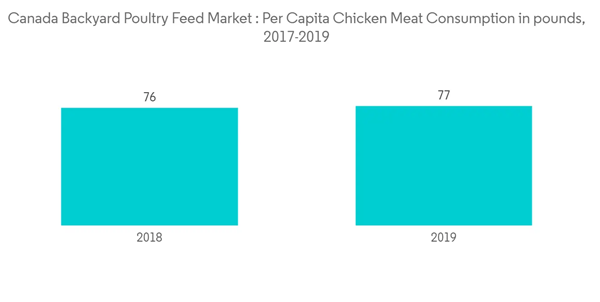

Poultry has been one of the fastest-growing segments of the agricultural sector in recent years. The poultry sector underwent major structural changes during the past two decades due to modern intensive production methods, genetic improvements, improved preventive disease control and biosecurity measures, increasing income and human population, and urbanization.Poultry is one of the most common livestock raising options for urban farmers and households in Canada. Turkeys and gamebirds are grown for meat, while chickens and ducks provide eggs, meat, or both. Canada saw an increase in poultry meat consumption in the past few years. Based on the data from Statistics Canada, the per capita consumption of chicken meat in the country was 73.21 pounds, which increased to 77.43 pounds in 2019. As a result of the rising demand for poultry meat and egg, the backyard poultry sector, including backyard poultry feed, witnessed growth in the country.

As backyard poultry does not require a lot of space, people set it up at an increasing rate. However, poultry requires the right nutrition for proper growth and production. As poultry requires 60% protein, 13% fat, and 3% calcium, the required nutrient content is met majorly by poultry by-products and fish meal. Thus, the demand for high-quality backyard poultry feed also increases simultaneously. Poultry production must increase to keep up with increasing consumer demand, which requires optimum use of high-quality feed to improve production efficiency and feed conversion ratios and enhance animal health. This is anticipated to boost the market during the forecast period.

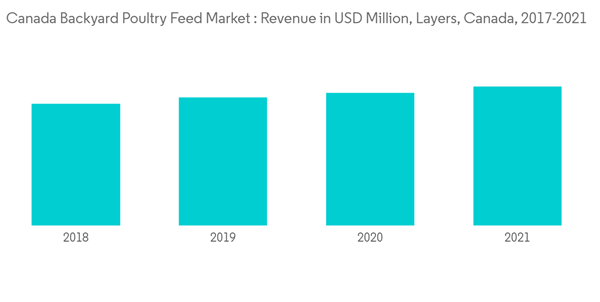

The Layers Segment is Dominating the Market

The trend of backyard chickens for a farm-to-table egg experience is growing in the country. This is anticipated to increase the demand for layer poultry and, in turn, the demand for poultry feed during the forecast period. Kingston, Newmarket, Niagara Falls, Brampton, Guelph, Edmonton, Montreal (some parts), Surrey, Vancouver, Kitchener, and Victoria are a few cities in Canada that allow backyard poultry, accounting for a major share of the market studied. The demand for novel products with a high nutritional base has aggravated the companies to introduce innovative products in different forms for the ease of consumption of layer poultry birds. Apart from the feed for layers, treats have also been introduced in the market to attract poultry owners. These feeds and treats are gaining popularity among the backyard layer poultry owners in the country. Thus, the market for layer feed is accelerated by the increasing demand for high protein products like farm-to-table eggs in consumers' diets and the adoption of new methods of feeding to improve efficiency during the forecast period.Canada Backyard Poultry Feed Industry Overview

The Canadian backyard poultry feed market is fragmented, where the prominent players occupy a minority of the market share and others account for the rest. Cargill Inc. was a prominent player in the market, followed by ADM Animal Nutrition, Country Junction Feeds, Floradale Feed Mill Limited, and Jones Feed Mills Ltd, in 2021.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill Inc.

- Hi Pro Feeds

- ADM Animal Nutrition

- New Rosedale Feed Mill

- Country Junction Feeds

- Floradale Feed Mill Limited

- Enterra Feed Corporation

- Jones Feed Mills Limited