Key Highlights

- Over the long term, the demand from commercial dairy operators for alfalfa is anticipated to increase due to the increase in investment in huge-scale dairy operations during the forecast period. The major factors influencing the alfalfa market include the increasing demand for quality hay for livestock and cattle population, prices of alfalfa, and price trends in alternative feed and forage.

- The use of alfalfa has become critical to poultry feed, followed by animal feed in recent years due to its importance for crude protein content. Dependence on alfalfa for animal feed may continue to drive the alfalfa hay market over the forecast period. Alfalfa is known for its tolerance to drought, heat, and cold, with higher productivity.

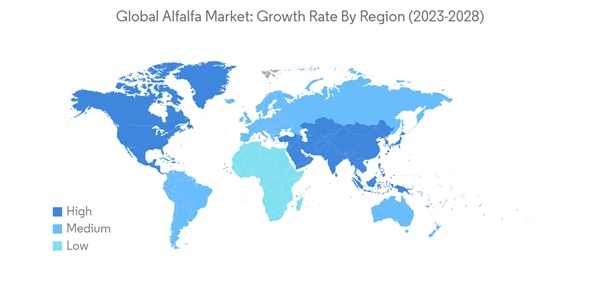

- North America is projected to be the largest market for alfalfa. China, the United Arab Emirates, and Saudi Arabia are the major importers of alfalfa hay from the United States. The United States and Spain are the major exporters of alfalfa globally. The increasing demand for dairy and animal products, shrinking of the land for grazing animals, and growth in high-yielding cattle, bred cattle demand for feed is driving the alfalfa market globally.

Alfalfa Market Trends

Increasing Demand from the Dairy and Meat Sector

- Livestock is a major factor responsible for the growth of the global alfalfa market. The annual growth of meat production in developing countries is projected to be 2.4%, and that of milk production at 2.5% by 2030. This is expected to increase the developing countries' share in the world's meat production to 66% (247 million metric tons) and in milk production to 55% (484 million metric tons). The livestock sector has been pressured to meet the increasing demand for high-value animal protein.

- The demand for alfalfa is increasing significantly in China and is driven because of changing production practices in the Chinese dairy industry. This is due to the increasing number of cows raised by modern dairy farmers who prefer using imported hay and commercial feeds.

- The Chinese government is focusing on boosting the domestic production of alfalfa to meet its high demand. The dairy sector is boosting the demand for alfalfa in China. According to Food and Agriculture Organization (FAO), the country had about 66.2 million milk animals in 2021, an increase of 9.2% since 2018. The continual increase in the number of cattle during 2018-2021 and the increasing demand for quality animal feed are expected to boost the demand for alfalfa over the forecast period.

Asia-Pacific Dominates the Market

- With the expansion of the dairy industry in recent years, demand for forages continues to increase. The demand for alfalfa hay in major markets like China and Japan is growing steadily.

- The government initiatives to boost alfalfa production are propelling the market's growth. For instance, China's Ministry of Agriculture issued the National Alfalfa Industry Development Plan (2016-2020) to boost production. This plan aimed to produce 5.4 million tons of alfalfa by 2020. The development plan increased the alfalfa acreage in the country by 6.3% in 2022 compared to 2016. In the region, livestock farming has been accelerated by the increased demand for dairy and meat among consumers.

- China, Japan, and South Korea are the most important destinations for alfalfa hays, which have been major export targets for the United States. In 2021, the Ministry of Agriculture, Forestry, and Fisheries (MAFF) estimated domestic production of forage products accounted for 77% of demand in Japan. Therefore, the country's imports have been growing. In 2018, Japan imported 25254 metric tons of alfalfa meal and pellets, which will increase to 28227 metric tons in 2021.

- The changing lifestyle of consumers, along with the shift to increased consumption of meat on account of its nutritional value, has improved the scope of livestock farming and thereby enabled the growth of the alfalfa market. Thus, the government initiatives, coupled with the demand from the livestock sector, are driving the growth of the market studied in the Asia-Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.